Is Nj A No Fault State For Auto Insurance

Is New Jersey a No-Fault State for Auto Insurance?

New Jersey is a no-fault state that requires drivers to carry a certain level of automobile insurance in order to legally drive. This means that all drivers are responsible for their own medical bills, as well as any property damage that they may cause. This is regardless of who is at fault in the event of an accident. While no-fault states have their advantages, it’s important to understand all the aspects of this type of insurance, so that you can make sure you are adequately protected.

What is No-Fault Insurance?

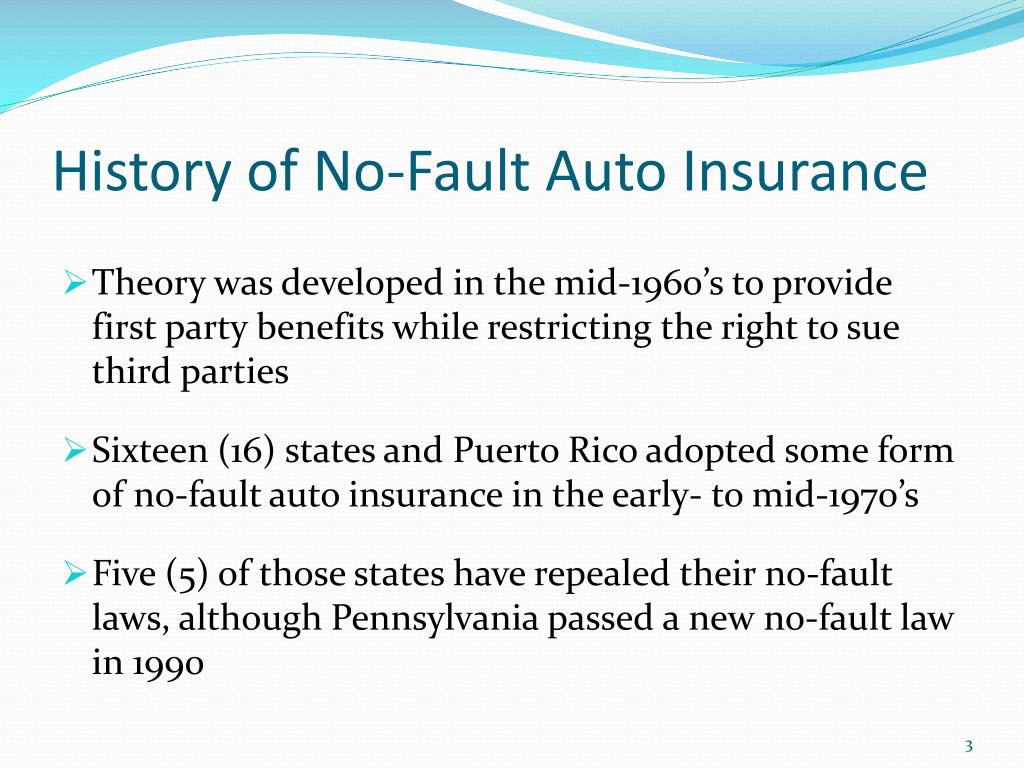

No-fault insurance is a type of insurance that is required in certain states, including New Jersey. With no-fault insurance, each driver is responsible for their own medical bills and property damage, regardless of who is at fault. This type of insurance is designed to minimize the need for costly legal battles, as each driver is responsible for their own costs. It also eliminates the need to prove fault in an accident, as each driver's insurance policy will cover their costs.

What Does No-Fault Insurance Cover?

No-fault insurance covers medical bills, lost wages, and property damage. It also covers funeral expenses, if necessary. Each driver is responsible for their own medical bills, as well as any property damage they may cause. This means that if you are involved in an accident, your insurance will cover your medical bills and property damage, regardless of who is at fault.

What is the Minimum Level of Coverage in New Jersey?

In New Jersey, drivers are required to carry at least $15,000 in coverage for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage per accident. This is the minimum level of coverage that must be carried, and it is important to ensure that you have adequate coverage in the event of an accident.

What Are the Advantages of No-Fault Insurance?

The biggest advantage of no-fault insurance is that it eliminates the need to prove fault in an accident. This means that each driver is responsible for their own medical bills and property damage, regardless of who is at fault. This helps to minimize the cost of legal battles, as each driver is responsible for their own costs. Additionally, it also helps to reduce the cost of premiums, as each driver is responsible for their own costs.

Conclusion

No-fault insurance is a type of insurance that is required in certain states, including New Jersey. With no-fault insurance, each driver is responsible for their own medical bills and property damage, regardless of who is at fault. This type of insurance is designed to minimize the need for costly legal battles, as each driver is responsible for their own costs. It is important to understand all the aspects of this type of insurance, so that you can make sure you are adequately protected. Additionally, it’s important to carry the minimum level of coverage as required by the state.

Ultimate Guide to No-Fault Auto Insurance

Cheap No Fault Auto Insurance Quotes - Which States and What it Means

Trenton Car Accident Attorneys discuss NJ No-Fault auto insurance laws

PPT - Reserving for Unlimited Long-Term No-Fault (PIP) Claims

New Jersey is a No-Fault Insurance State. What Does That Mean?