Is Car Insurance A Choice Or A Requirement In Texas

Is Car Insurance A Choice Or A Requirement In Texas?

Car Insurance Requirements in Texas

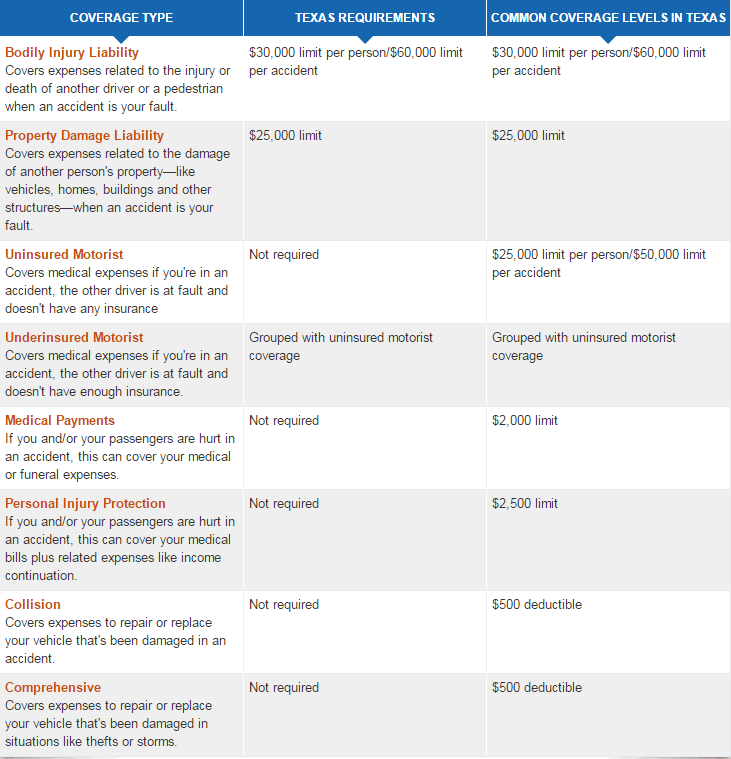

Texas is one of several states that requires its drivers to carry car insurance. The minimum coverage required is bodily injury liability coverage of at least $30,000 per person, up to a total of $60,000 for any accident, and $25,000 in property damage liability. This coverage pays for medical and property damage costs if you are responsible for an accident that injures someone else. While this is the minimum coverage required, most auto insurance companies suggest that you carry higher levels of coverage.

Optional Coverage for Texas Drivers

In addition to the required coverage, Texas drivers are able to select from several optional coverages. Collision coverage pays for damage to your vehicle due to a collision with another vehicle or object. Comprehensive coverage pays for losses caused by events other than collisions, such as theft, fire, vandalism, or weather-related damage. Uninsured motorist coverage pays for medical expenses, lost wages, or pain and suffering if you get in an accident with an uninsured driver. Personal injury protection pays for medical bills, lost wages, and other related expenses regardless of who is at fault in an accident.

Do You Need Insurance to Register a Car in Texas?

Yes, you must have insurance to register a car in Texas. When you register your vehicle, you must provide proof of insurance to the Texas Department of Motor Vehicles. The insurance policy must meet the minimum coverage requirements of the state. If you do not have insurance, you cannot register your car. It is also important to note that you must carry proof of insurance at all times when you are driving.

Consequences for Driving without Insurance in Texas

Driving without insurance in Texas is a serious offense. If you are caught driving without insurance, you could face a fine of up to $350 and/or up to three days in jail. In addition, your driver’s license could be suspended for up to one year. If you are convicted of driving without insurance more than once, you could face a fine of up to $1,000 and/or up to one year in jail. You may also be required to file an SR-22 form with the state, which is a special form that proves you have adequate insurance coverage.

Do You Need to Carry Insurance If You Don’t Own a Car?

Yes, you must carry insurance if you drive in Texas, even if you don’t own a car. If you are borrowing a car from a friend or relative, you must have proof of insurance. If you are renting a car, the rental company will provide the necessary insurance coverage. If you are driving a borrowed car without insurance, you could face the same penalties as if you were driving without insurance in your own car.

Conclusion

In conclusion, it is important to note that car insurance is a requirement in the state of Texas. Drivers must carry the minimum coverage required by the state, and are also able to select from several optional coverages. It is also important to remember that you must have insurance in order to register your car, and that driving without insurance can lead to serious consequences. Finally, it is important to remember that even if you don’t own a car, you must still carry insurance if you plan to drive.

Texas Auto Insurance Plan - Save Money On Your Auto Insurance Money

texas car insurance

PPT - Texas Cheapest Car Insurance PowerPoint Presentation, free

Cheap Car Insurance Rates in Austin

Insurance Coverage On New Car - How Does Car Insurance Work : The car