Icici Lombard Car Insurance Policy Download

Download ICICI Lombard Car Insurance Policy

Introduction

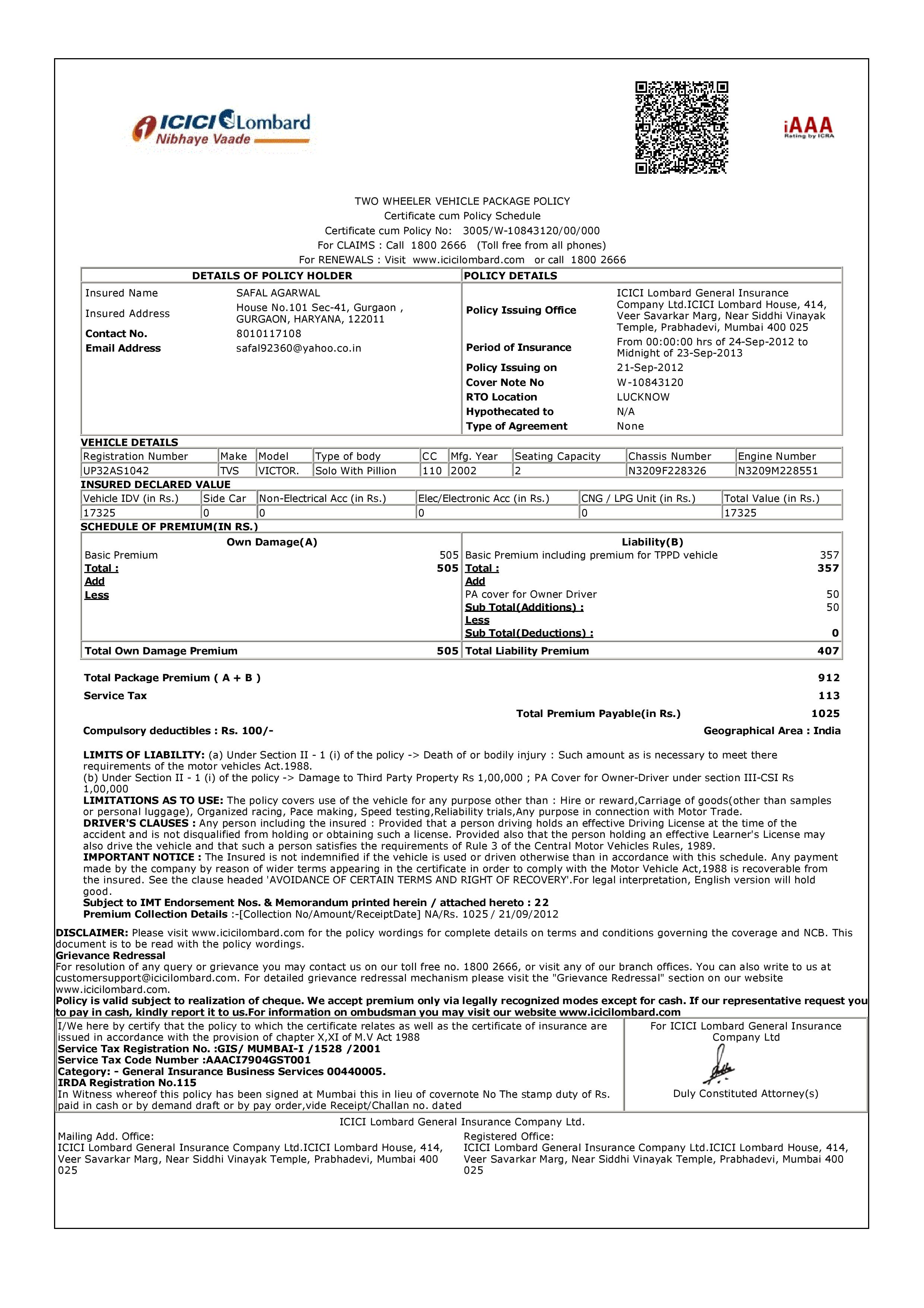

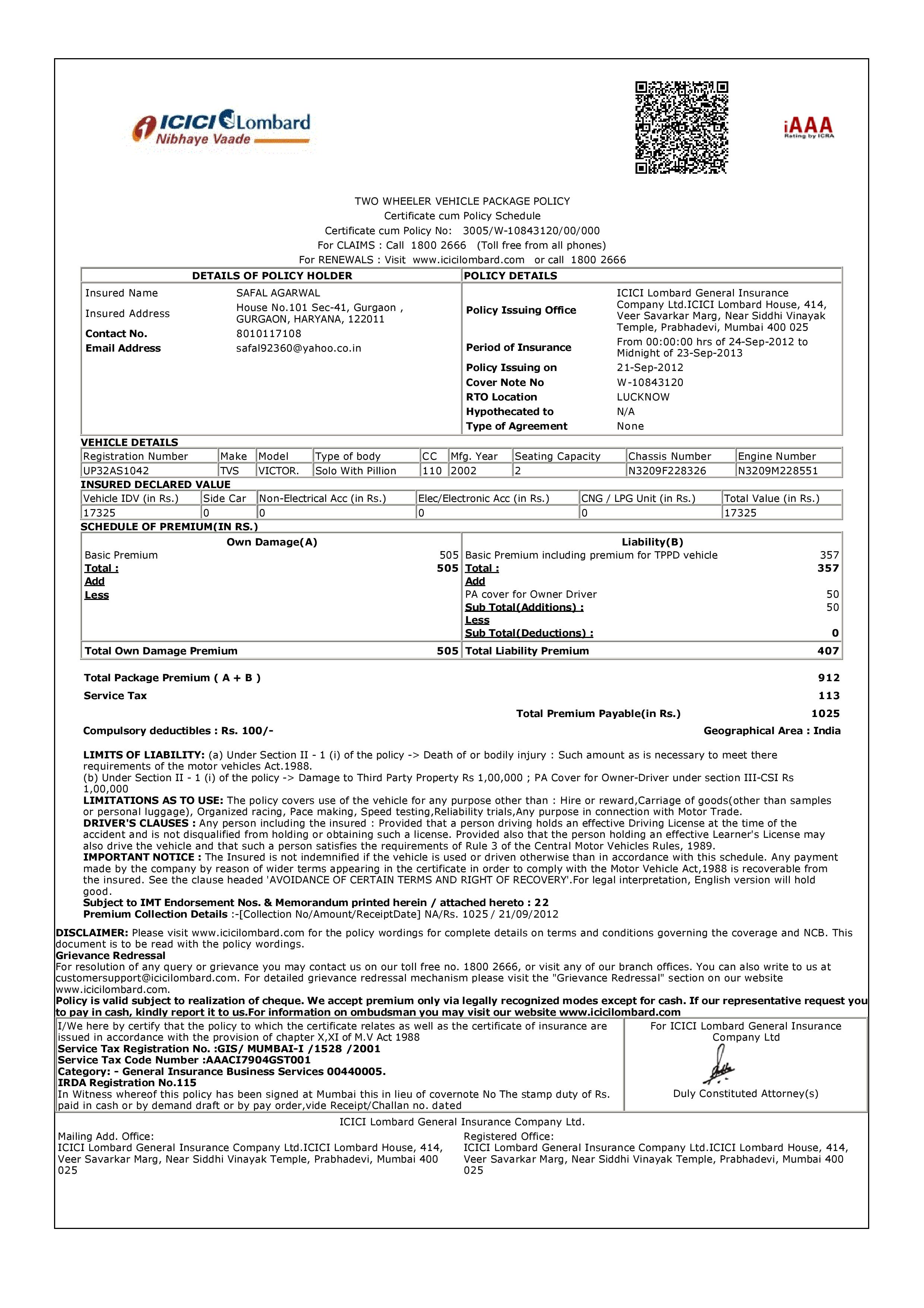

ICICI Lombard is a leading general insurance company in India that provides various types of insurance coverage to individuals and corporate organizations. The company offers an array of products, ranging from car insurance to health insurance. One of the most popular services offered by ICICI Lombard is its car insurance policy. The company provides a comprehensive car insurance policy that covers a wide range of risks, including financial losses due to accident, theft, and natural disasters.

The company also offers a convenient online facility to download the car insurance policy. This facility allows customers to access the policy details and make the necessary changes without having to contact the customer service team. The policy document is available in PDF format, which can be easily downloaded from the website.

Benefits of ICICI Lombard Car Insurance Policy

ICICI Lombard’s car insurance policy comes with a range of benefits. The policy covers the insured vehicle’s repair and replacement costs in the event of an accident, theft, or natural disaster. The policy also covers the cost of third-party liability in case of an accident. The policy also provides coverage for personal effects, such as a laptop or mobile phone, that are damaged during an accident. Additionally, the policy provides coverage for medical expenses incurred by the insured due to an accident.

The policy also provides coverage for towing charges in case the insured vehicle needs to be towed due to a breakdown or an accident. The policy also provides a No Claim Bonus (NCB) of up to 50% on renewal of the policy. This NCB can be used to reduce the premium amount for the next policy period.

Download Process

Downloading the car insurance policy from the ICICI Lombard website is a simple process. Customers need to log in to their ICICI Lombard account using their registered credentials. Once logged in, they need to navigate to the ‘Policies’ section and select the ‘Car Insurance’ option. They will then be directed to a page where they can view their policy details and download the policy document in PDF format.

The policy document can be easily opened and viewed using a PDF reader. Customers can also use the document to make changes to the policy, such as adding or removing riders, or increasing or decreasing the coverage amount. The document can also be used to renew or cancel the policy.

Conclusion

The ICICI Lombard car insurance policy is an ideal solution for customers looking for comprehensive coverage for their vehicles. The policy provides coverage for a wide range of risks, including financial losses due to accident, theft, and natural disasters. The policy also provides coverage for personal effects, towing charges, and medical expenses. The policy document can be easily downloaded from the ICICI Lombard website.

The policy document can be used to make changes to the policy, such as adding or removing riders, or increasing or decreasing the coverage amount. It can also be used to renew or cancel the policy. Customers can easily download the policy document and make the necessary changes without having to contact the customer service team.

Icici Lombard Motor Claim Form

151929835-Icici-Lombard.pdf | Deductible | Liability Insurance

[Resolved] ICICI Lombard Insurance — Want Justice for cheating and

![Icici Lombard Car Insurance Policy Download [Resolved] ICICI Lombard Insurance — Want Justice for cheating and](https://www.consumercomplaints.in/thumb.php?complaints=861872&src=Cheated_policy_2.png&wmax=900&hmax=900&quality=85&nocrop=1)

Claim Form: Icici Lombard Motor Claim Form

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO