How Much To Add A Named Driver To Insurance

Monday, November 25, 2024

Edit

How Much To Add A Named Driver To Insurance?

What Is Named Driver Insurance?

Named driver insurance is a type of car insurance policy that covers a driver who is specifically named on the policy. This means that the driver is only covered to drive the vehicle with the agreement of the policyholder. This type of insurance is usually cheaper than a fully comprehensive policy, as it does not include the full range of cover that is available with a fully comprehensive policy.

Named driver insurance is typically used by parents who want to add their children onto their policy as a named driver. This allows for the parent to maintain control over the car and to ensure that their child is safe when driving. It is also a good option for those who have a partner that does not have their own car insurance policy and they need to be added onto their partner’s policy.

How Much Does It Cost To Add A Named Driver To Insurance?

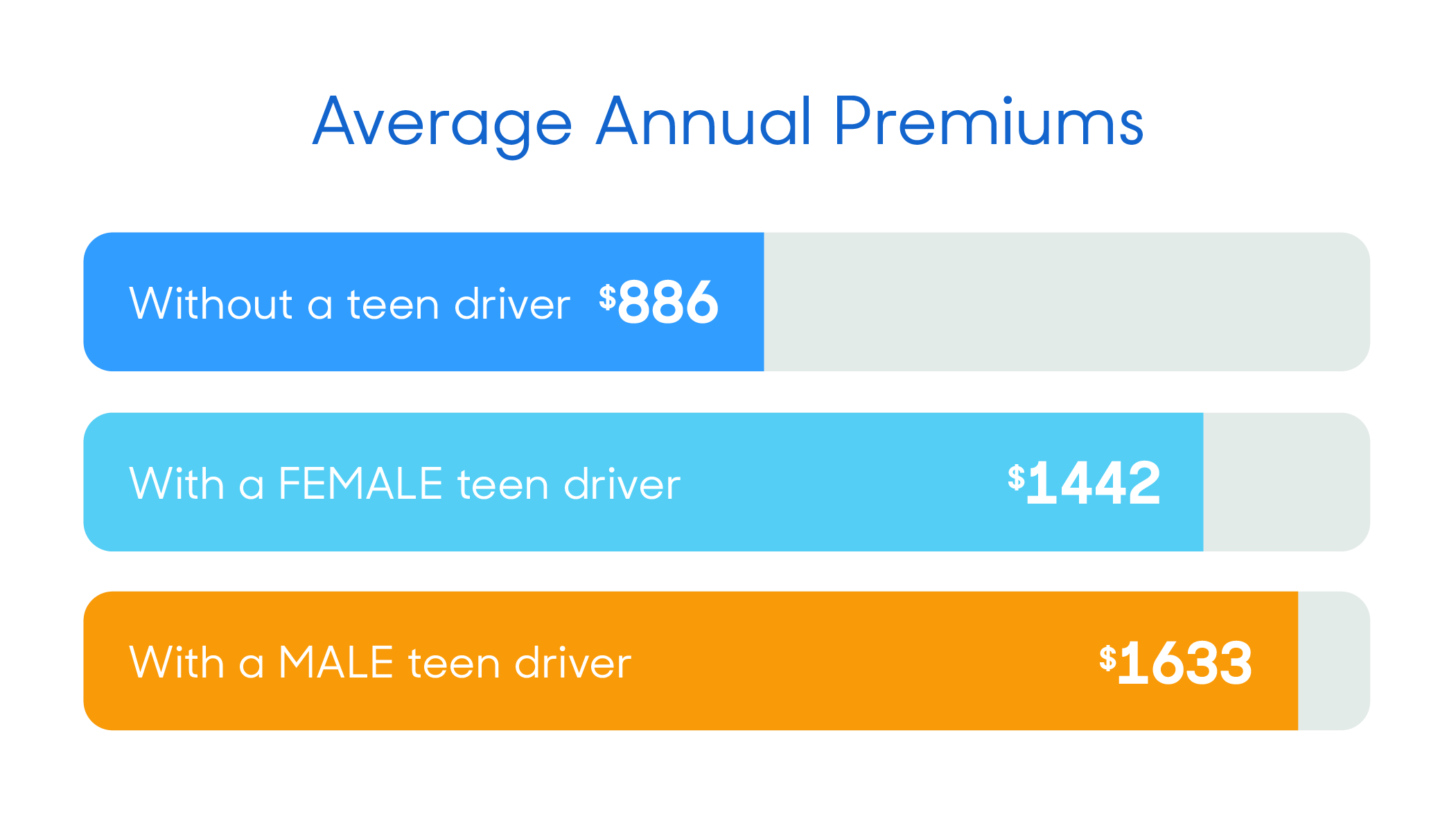

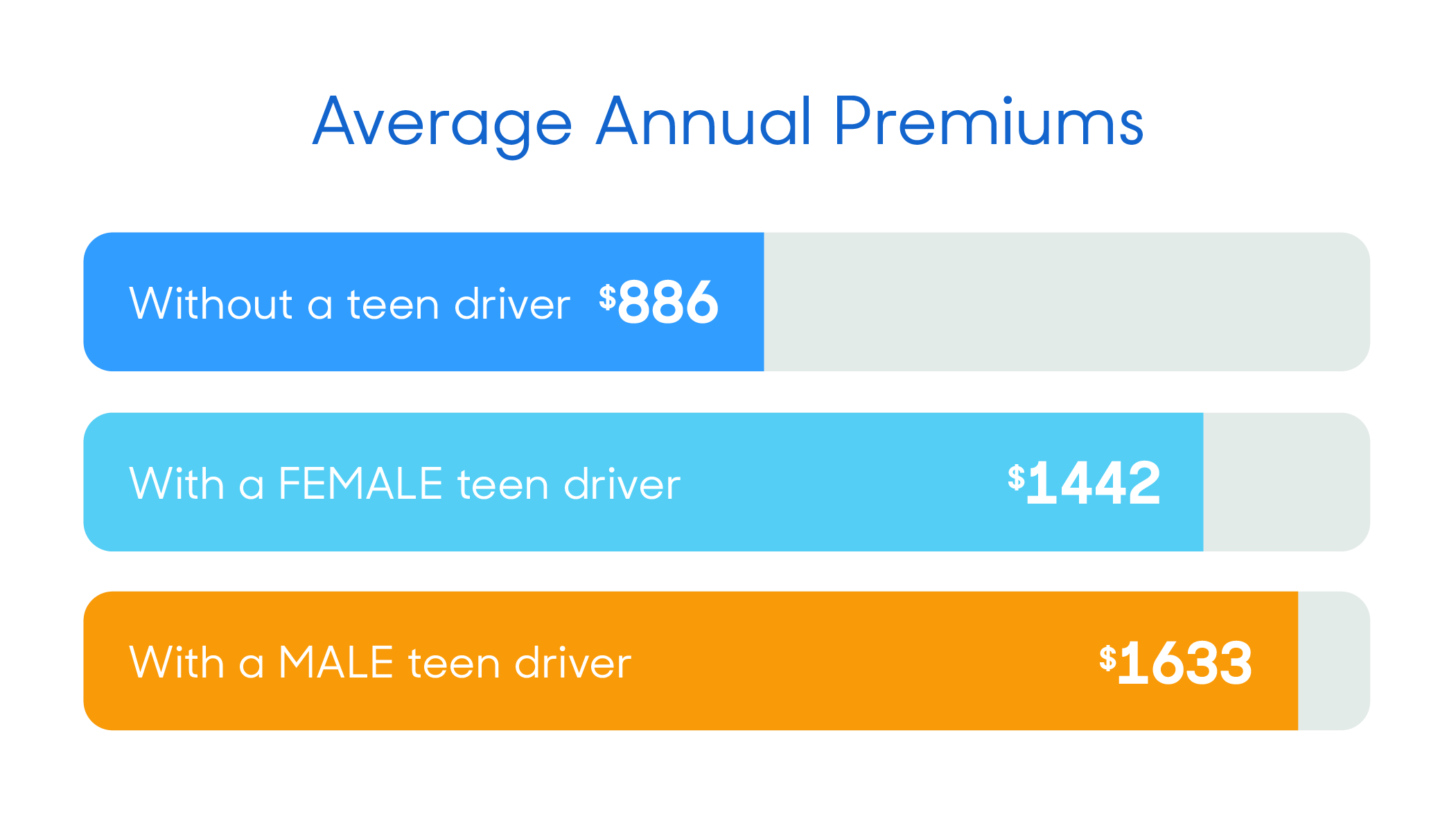

The cost of adding a named driver to insurance can vary significantly depending on the type of policy you have and the individual driver. Generally speaking, the cost of adding a named driver to an insurance policy is typically less than the cost of adding a fully comprehensive policy.

For example, if you are adding a young driver to your policy, then you can expect to pay more than if you were adding an experienced driver. Similarly, if you are adding a driver with a history of accidents or convictions, then you can expect to pay more for their insurance.

The best way to get an accurate quote for adding a named driver to insurance is to use an online comparison website. This will allow you to compare quotes from a range of different insurers and get an accurate quote for adding a named driver to your policy.

What Are The Benefits Of Adding A Named Driver?

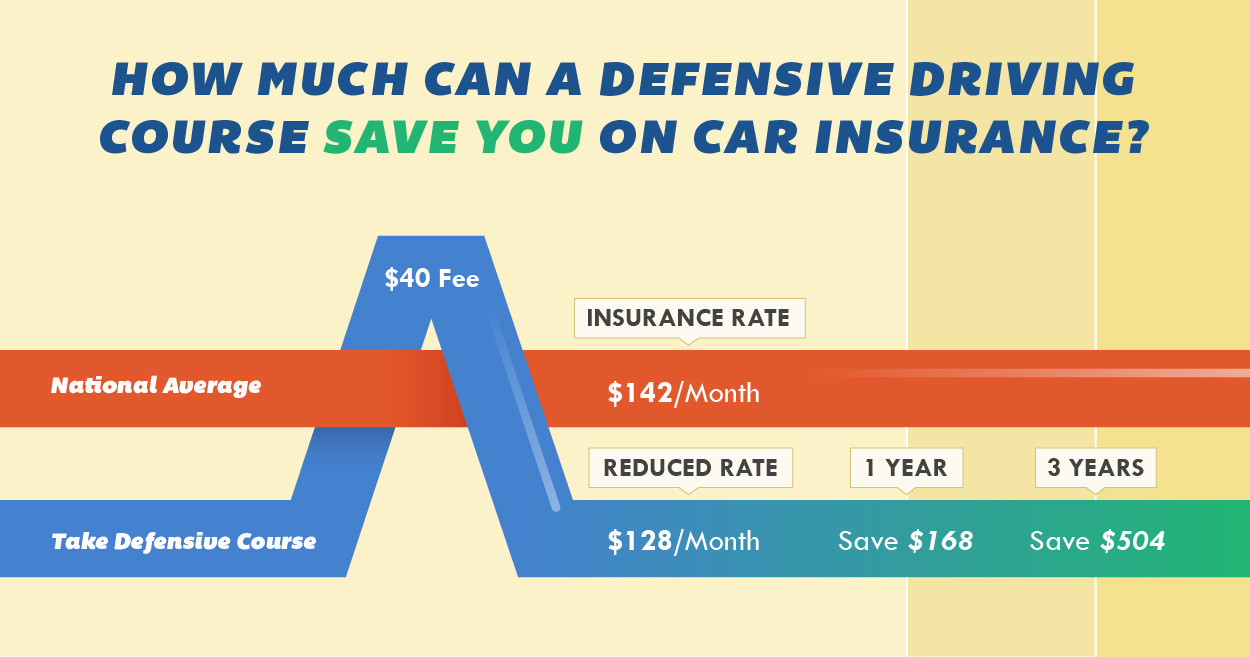

There are a number of benefits to adding a named driver to your insurance policy. The most obvious benefit is that it can reduce the cost of your insurance premium. As mentioned above, the cost of adding a named driver to a policy is typically less than the cost of adding a fully comprehensive policy.

Adding a named driver to your policy also allows you to maintain control over who is driving the vehicle. This means that you can be sure that your car is being driven safely and that the driver is not engaging in any risky behaviour.

Finally, adding a named driver to your policy can also help to build up a No Claims Discount for the named driver. This can be beneficial for the named driver as it can help to reduce the cost of their insurance in the future.

Are There Any Downsides To Adding A Named Driver?

As with most things, there are some potential downsides to adding a named driver to your insurance policy. The most obvious downside is that you may be liable for any damage caused by the named driver. If the named driver is at fault in an accident, then the policyholder may be liable for any costs associated with the damage.

It is also important to note that adding a named driver to your policy can affect your No Claims Discount. If the named driver has an accident, then your No Claims Discount may be affected, even if the accident was not your fault.

Finally, it is also worth noting that adding a named driver to your policy can affect the cost of your insurance premiums. The cost of adding a named driver to a policy is typically less than the cost of adding a fully comprehensive policy, but it can still add to the overall cost of your premiums.

Conclusion

Adding a named driver to your insurance policy can be a great way to reduce the cost of your premiums and to maintain control over who is driving your vehicle. However, it is important to be aware of the potential downsides of adding a named driver to your policy, such as being liable for any damage caused by the named driver, and the potential impact on your No Claims Discount. Ultimately, it is important to weigh up the pros and cons of adding a named driver to your policy before making a decision.

How to Add A Teen Driver to Your Car Insurance and How Much it Costs

Named driver car insurance in Singapore

How Much Does It Cost to Add a Driver to Car Insurance Policy - Cost to

Are Defensive Driving Courses Worth the Money? | QuoteWizard

Adding Drivers - TCI Insurance