Car Insurance Quotes Lower Credit Score

Thursday, November 14, 2024

Edit

Car Insurance Quotes with Lower Credit Score

The Impact of Credit Score on Car Insurance Quotes

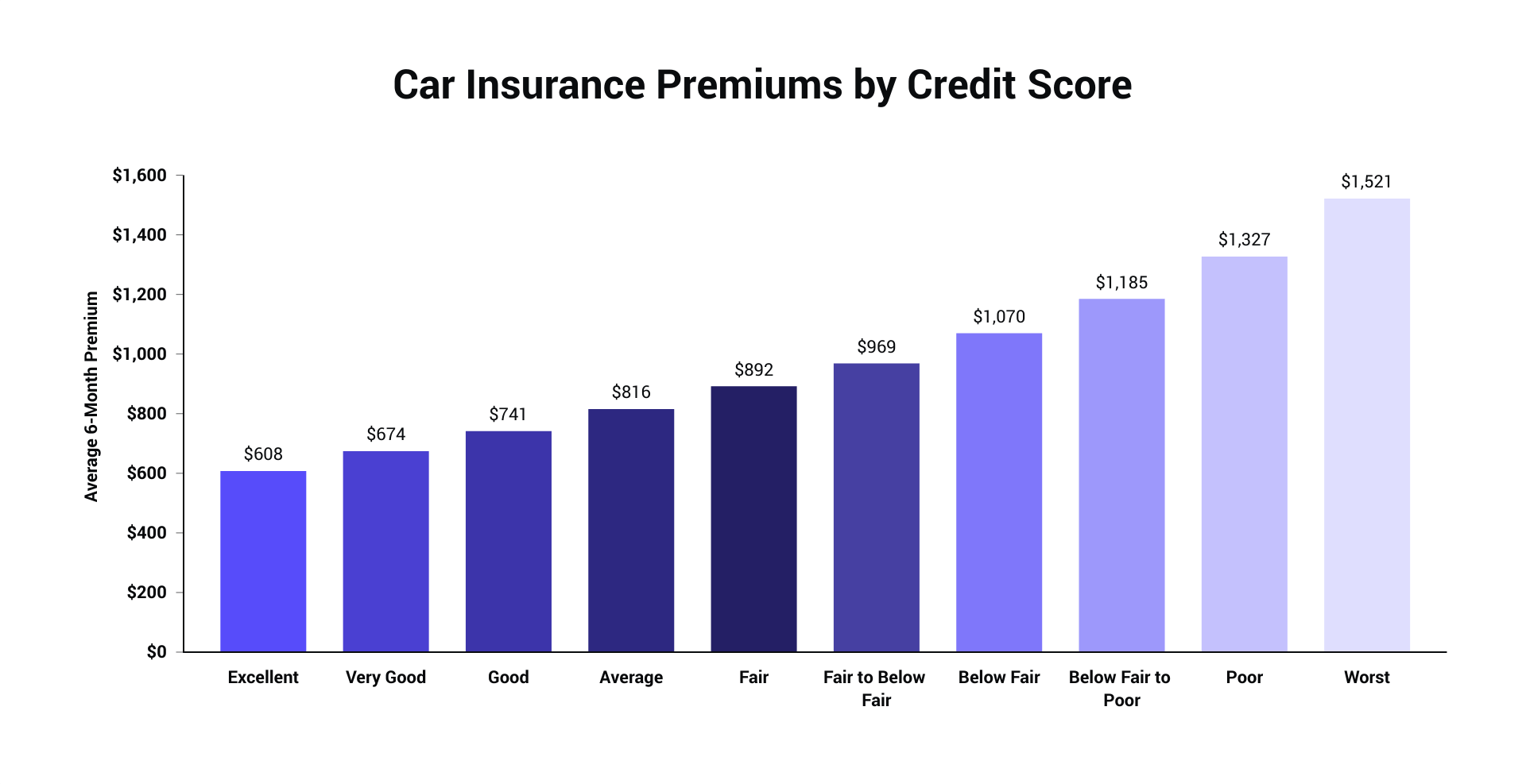

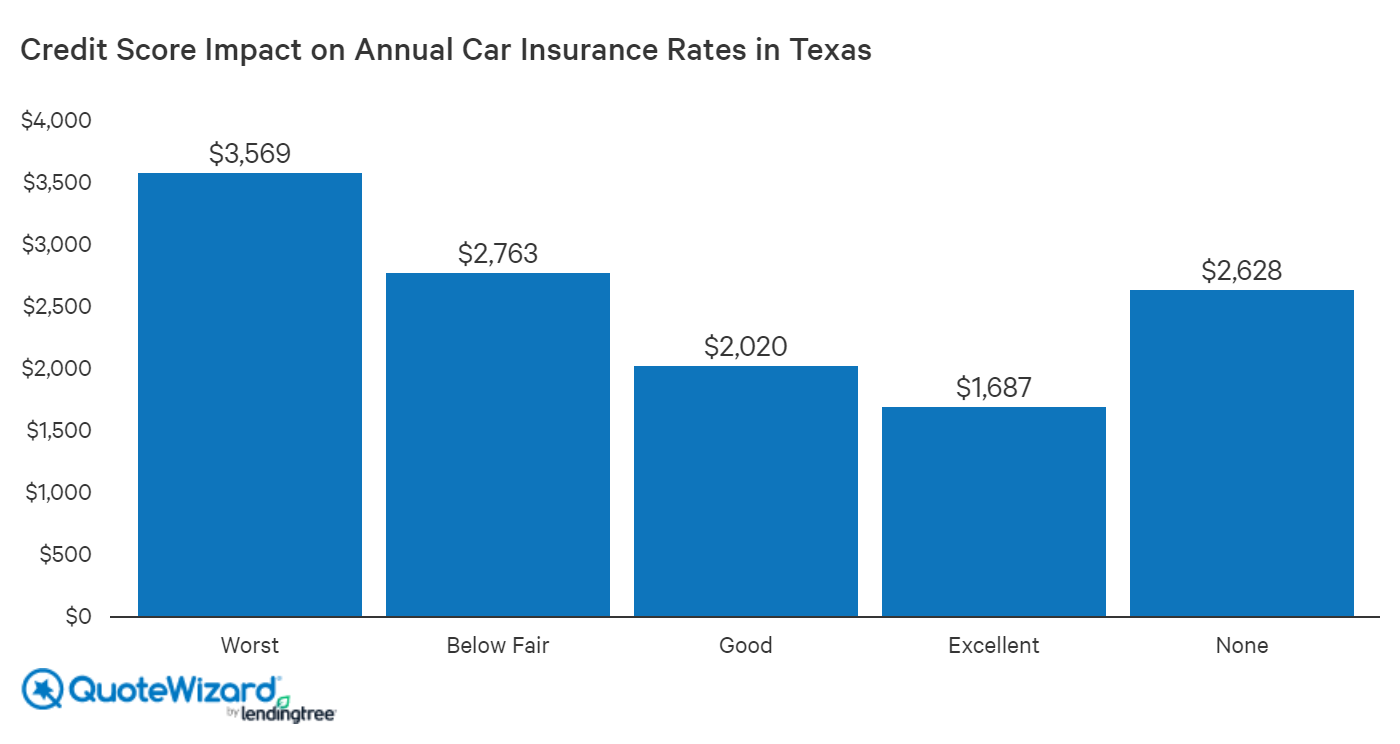

Do you have a lower credit score? You may be wondering how this will affect the cost of car insurance. Unfortunately, the answer is not a simple one. It’s true that a lower credit score can mean higher premiums, but it’s not the only factor. A variety of other factors, such as your driving record, age, and even the type of car you drive can play a role in the cost of your car insurance quotes.

Insurance companies look at your credit score to determine how likely you are to file a claim. A lower credit score could indicate that you’re more likely to file a claim due to financial difficulties. The insurance company could then charge higher premiums in order to offset the risk.

Tips to Get Cheaper Car Insurance Quotes with Lower Credit Score

If you have a lower credit score and are worried about the cost of car insurance, there are a few things you can do to get cheaper quotes. The first is to shop around. Different insurance companies have different ways of assessing risk, and you may be able to find one that is more forgiving of your credit score.

It’s also important to compare the coverage that each insurance company offers, as well as the cost. Make sure you understand all the coverage options and choose the one that best fits your needs. Don’t be afraid to ask questions and make sure you understand the terms and conditions of the policy.

Another way to get cheaper car insurance quotes with a lower credit score is to raise your deductible. A higher deductible means that you’ll have to pay more out-of-pocket if you do file a claim, but it could also lead to lower premiums. Just make sure you have enough money saved up to cover the deductible if you do file a claim.

Other Ways to Get Cheaper Car Insurance Quotes

In addition to shopping around and raising your deductible, there are a few other ways to get cheaper car insurance quotes. One is to bundle your auto insurance with other types of insurance, such as homeowners or renters insurance. Many insurers offer discounts for bundling, so it’s worth looking into.

You may also be able to get a discount if you have a clean driving record. If you don’t have any traffic violations or accidents in the past three years, you may qualify for a discount. Some insurers also offer discounts for certain safety features, such as anti-lock brakes, airbags, and automatic seatbelts.

Finally, you may be able to get cheaper car insurance quotes if you’re willing to pay in full or in installments. Paying in full can often result in a discount, and some insurers offer lower rates for those who pay in installments.

Conclusion

A lower credit score doesn’t have to mean higher premiums for car insurance. By shopping around, raising your deductible, bundling your policies, and taking advantage of discounts, you can get cheaper quotes even with a lower credit score. It’s important to understand all the coverage options and terms and conditions of the policy, so make sure you ask questions and read the fine print before signing any contracts.

Credit Scores and Auto Insurance | QuoteWizard

Fresh blog with the latest info and secrets on car buying and financing

Is Your Credit Score Affecting Your Insurance Premiums?

Example Car Insurance Quotes Progressive. QuotesGram

Free Car Insurance Quotes (from 100+ Companies) | The Zebra