Car Insurance For A New Driver

Car Insurance For A New Driver

Welcome to the world of driving!

Driving is an exciting experience and a privilege that not everyone has. It’s important to remember though, that with a privilege comes responsibility. As a new driver, you need to make sure you’re following the rules of the road and taking all necessary precautions to stay safe. This includes getting the right car insurance. Finding the right car insurance for a new driver can be challenging, but it’s essential to keep you and your car protected. Here are some tips to help you find the best car insurance for a new driver.

Shop Around

When shopping for car insurance for a new driver, it’s important to shop around and compare quotes from different insurers. Doing this will help you find the best coverage for the best price. Make sure you’re comparing apples to apples – meaning you’re looking at the same type of coverage from each insurer. Don’t be afraid to ask questions to make sure you’re getting the coverage you need.

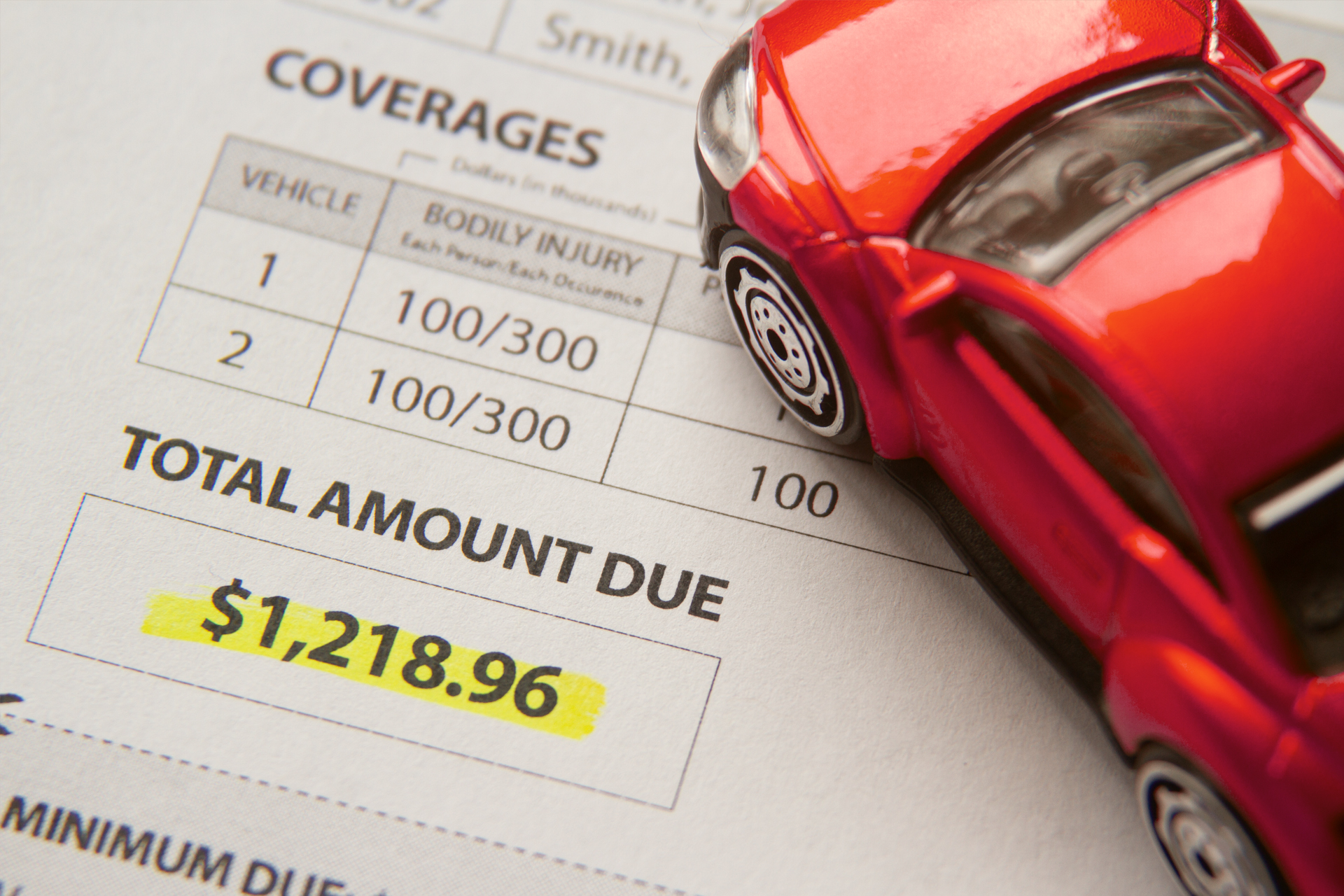

Understand Your Coverage

It’s important to understand what types of coverage you need and what types of coverage you don’t need. There are several types of car insurance coverage available, including liability, collision, comprehensive, and uninsured/underinsured motorist. Liability insurance is the most basic type of coverage and is required in most states. It covers damages to the other party if you’re at fault in an accident. Collision coverage is helpful if you’re in an accident and need to repair your own vehicle. Comprehensive coverage is helpful in covering damages from theft, vandalism, and other non-accident related damages. Uninsured/underinsured motorist coverage helps protect you if you’re in an accident with an uninsured or underinsured driver. Depending on your situation, some of these coverages may not be necessary for you.

Know What Discounts You’re Eligible For

It’s important to know what discounts you’re eligible for when shopping for car insurance for a new driver. Many insurers offer discounts for good drivers, safe drivers, students, and drivers over a certain age. Be sure to ask your insurer about any discounts you may qualify for. You’ll be surprised at how much money you can save.

Choose a Higher Deductible

Choosing a higher deductible is another way to save money on car insurance for a new driver. A deductible is the amount of money you pay out of pocket before your insurance kicks in. The higher your deductible, the lower your premium. Just make sure you can afford to pay the deductible in the event of an accident.

Look for a Low Mileage Discount

If you don’t drive often, you may be eligible for a low mileage discount. Most insurers offer discounts for drivers who drive fewer miles than the average driver. Ask your insurer if they offer a low mileage discount and if you’re eligible. This could save you a lot of money.

Conclusion

Shopping for car insurance for a new driver can be daunting, but it doesn’t have to be. By following these tips, you can find the best coverage for the best price. Remember to shop around and compare quotes, understand your coverage, know what discounts you’re eligible for, choose a higher deductible, and look for a low mileage discount. Taking these steps can help you find the perfect car insurance for a new driver.

How To Save On Car Insurance: Smart Ways To Lower Your Rate - PointsPanda

PPT - Cheapest New Driver Insurance-Find Cheap Car Insurance For New

Insurance Tips For New Drivers - YouTube

Best Free Auto Insurance Images and Photos

Regal Insurance Brokers – New Driver Insurance