Best Full Coverage Auto Insurance

What is Full Coverage Auto Insurance?

Full Coverage Auto Insurance is a combination of liability, comprehensive, and collision coverages. It is the most comprehensive type of insurance coverage that you can purchase for your vehicle. Liability coverage pays for the medical expenses and property damage incurred by another person if you are responsible for an accident. Comprehensive coverage pays for damage to your car caused by something other than a collision, such as fire, theft, or hail. Collision coverage pays for damage to your car caused by a collision with another vehicle or object.

What Does Full Coverage Auto Insurance Cover?

Full Coverage Auto Insurance covers a wide range of potential damages. It includes liability, comprehensive, and collision coverage. Liability coverage pays for the medical expenses and property damage incurred by another person if you are responsible for an accident. Comprehensive coverage pays for damage to your car caused by something other than a collision, such as fire, theft, or hail. Collision coverage pays for damage to your car caused by a collision with another vehicle or object.

Do I Need Full Coverage Auto Insurance?

Whether or not you need full coverage auto insurance depends on your personal circumstances. If you are financing a car, the lender may require you to have full coverage. If you own your vehicle outright and are not worried about the potential for a financial loss, you may opt for just the minimum coverage required by your state. On the other hand, if you want the peace of mind knowing that you are covered for a wide range of potential damages, full coverage auto insurance may be a wise decision.

How Much Does Full Coverage Auto Insurance Cost?

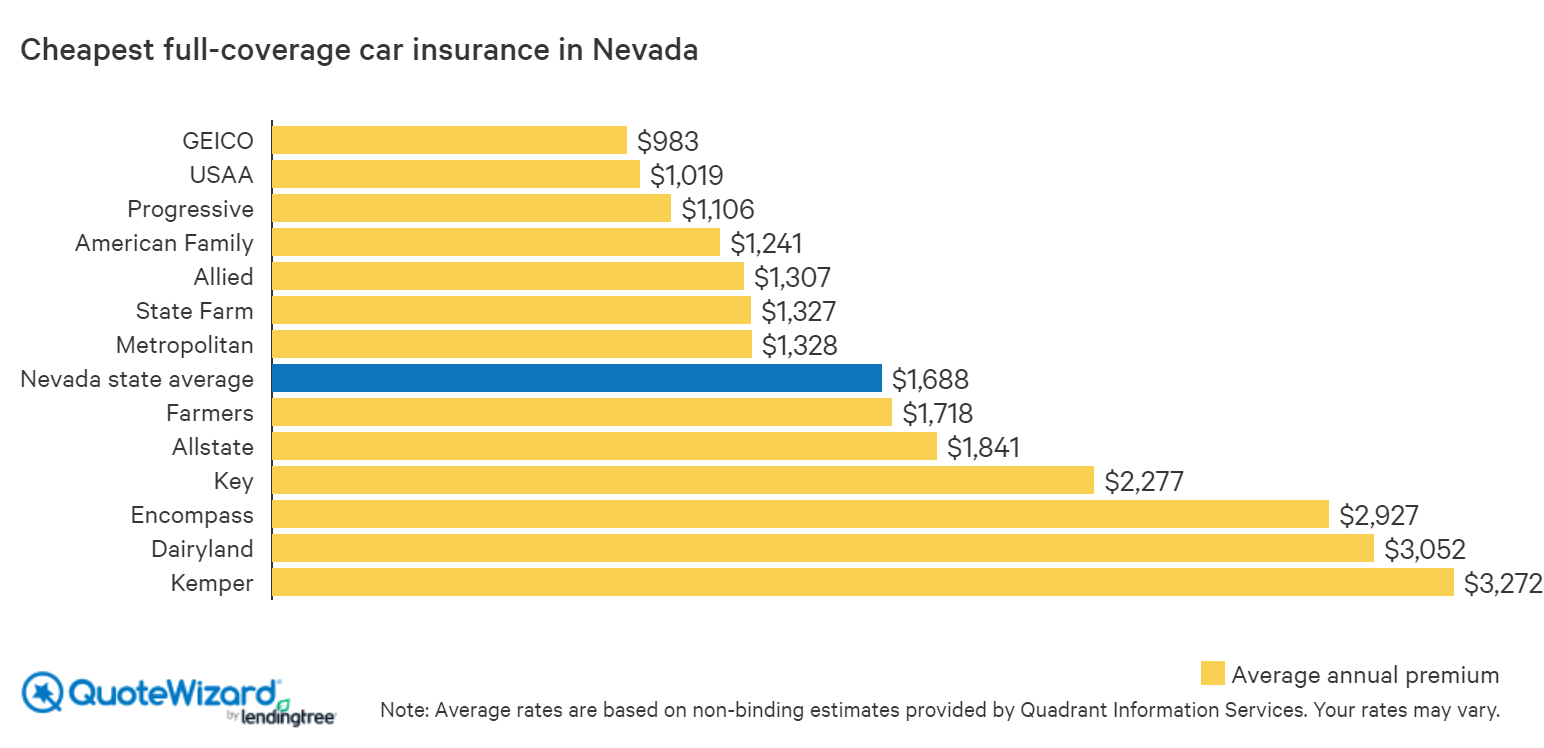

The cost of full coverage auto insurance varies depending on a number of factors, including your location, driving record, and the type of vehicle you are insuring. Generally speaking, full coverage auto insurance is more expensive than minimum liability coverage. However, the added protection may be worth the additional cost in the long run.

How Do I Find the Best Full Coverage Auto Insurance?

When shopping for full coverage auto insurance, it is important to compare quotes from multiple companies. This will help you find the best coverage at the most affordable rate. It is also important to look for discounts, such as good driver discounts, that can help you save even more money on your policy. Additionally, it is important to read the policy carefully to make sure you understand what is and is not covered.

Conclusion

Full Coverage Auto Insurance is the most comprehensive type of insurance you can purchase for your vehicle. It includes liability, comprehensive, and collision coverage, and can provide peace of mind in the event of an accident. The cost of full coverage auto insurance varies depending on a number of factors, including your location, driving record, and the type of vehicle you are insuring. It is important to compare quotes from multiple companies and look for discounts in order to find the best coverage at the most affordable rate.

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

List of the Best Car Insurance

Find The Best Full Coverage Car Insurance - Forbes

Where to Buy Cheap Nevada Car Insurance | QuoteWizard

Cheap full coverage car insurance will cover you in the best way.