Average Cost Of High Risk Auto Insurance

The Average Cost Of High Risk Auto Insurance

What is High Risk Auto Insurance?

High risk auto insurance is the type of insurance that people who have a higher probability of filing a claim are required to have. This might be due to a variety of factors, such as having a bad driving record, a DUI or DWI conviction, or a history of traffic violations. It can also be because of the type of vehicle being insured, such as a sports car or luxury vehicle. High risk auto insurance is a way for insurance companies to protect themselves against the possibility of a high rate of claims. The insurance company will assess the risk of the driver and then determine the rate of insurance that is needed to cover that risk.

Why Is High Risk Auto Insurance More Expensive?

The higher cost of high risk auto insurance is due to the increased risk that the insurance company has to take on when offering coverage to certain drivers. The insurance company must charge a higher premium in order to cover the increased risk. It is important to remember that all insurance companies base their rates on the risk that they take on when issuing policies. High risk drivers are more likely to get into an accident and therefore need to pay more for their coverage.

How Much Does High Risk Auto Insurance Cost?

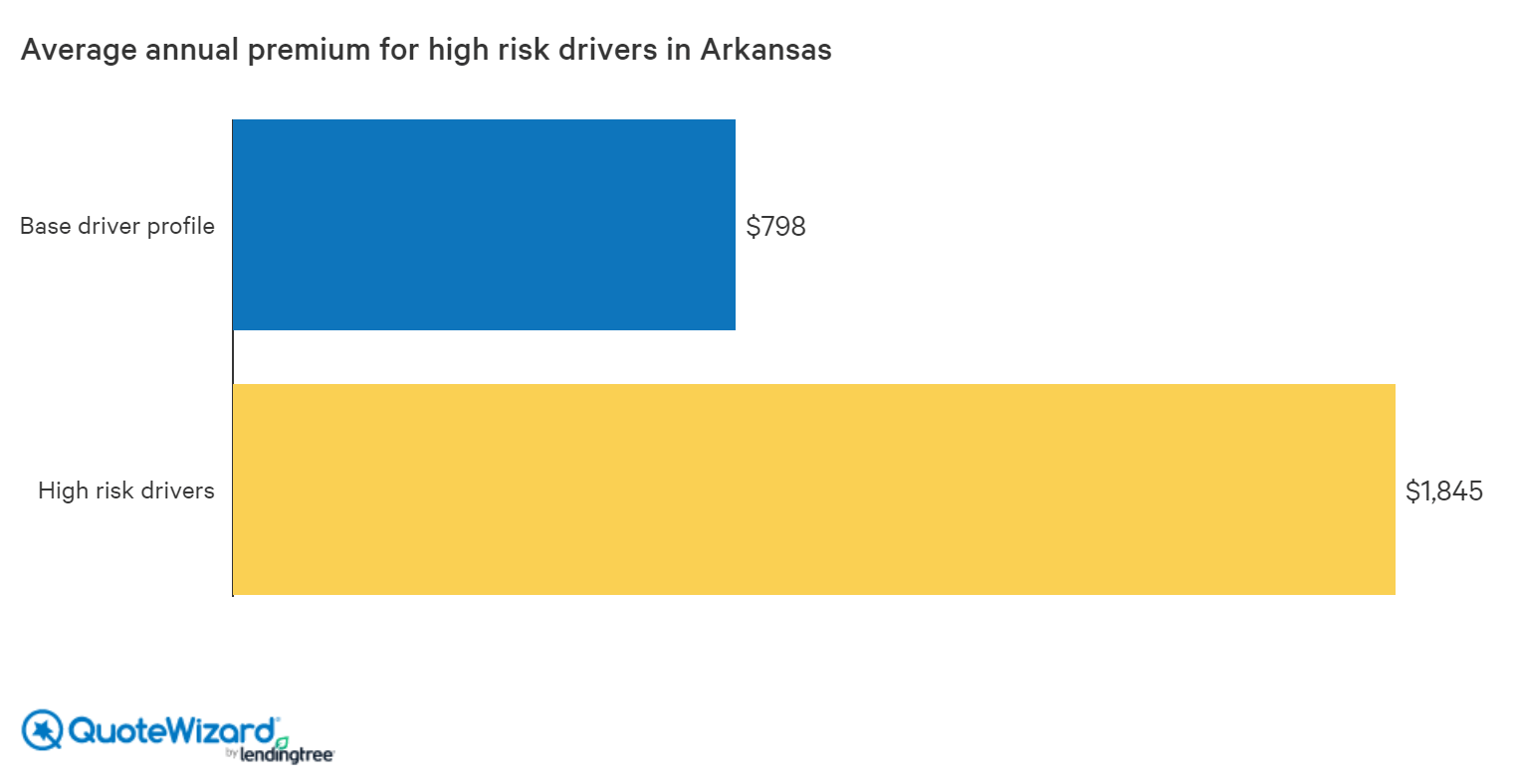

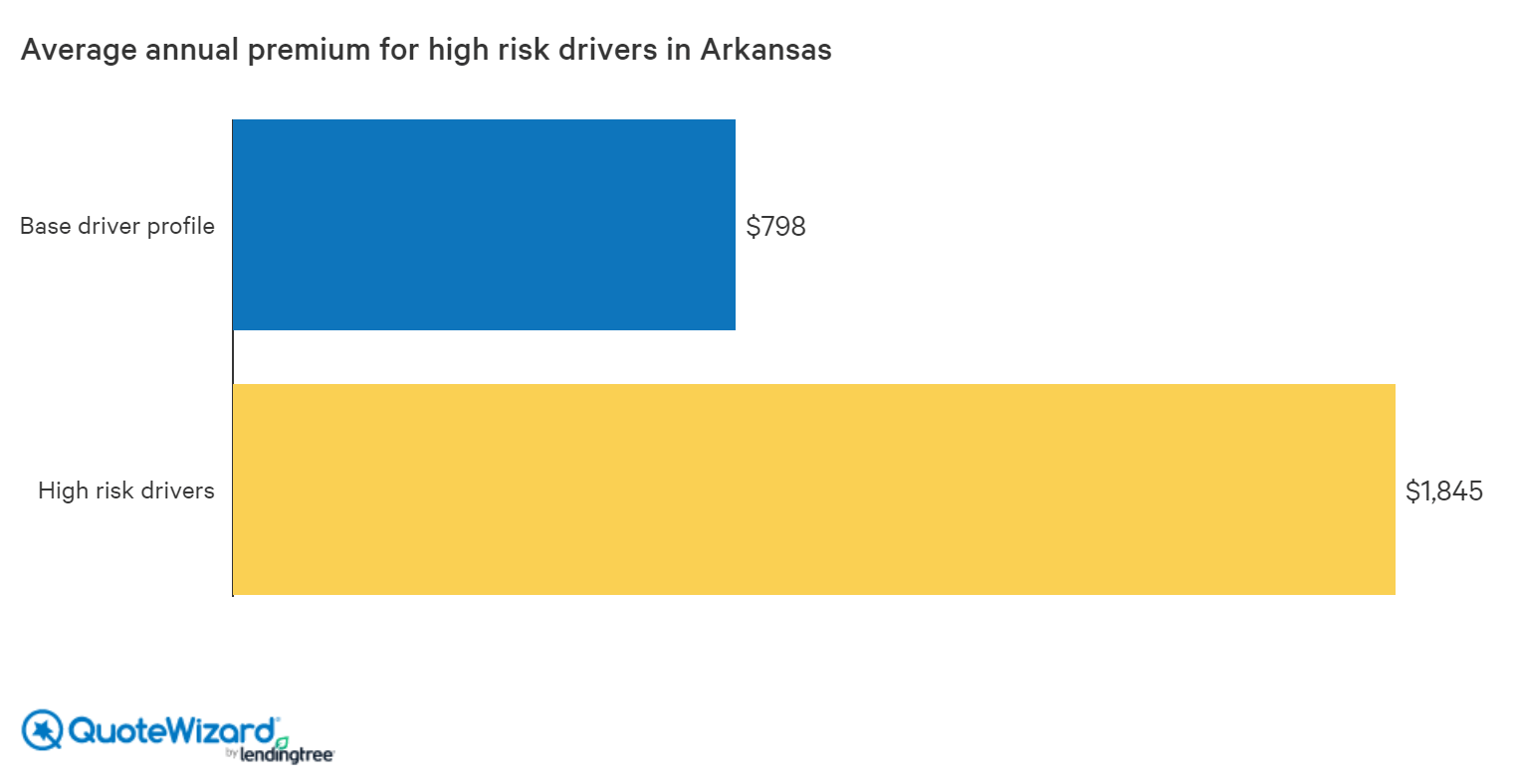

The cost of high risk auto insurance varies depending on the risk factors of the driver and the type of vehicle being insured. Generally, the cost of high risk auto insurance is higher than the cost of standard auto insurance. This is due to the increased risk that the insurance company is taking on. The average cost of high risk auto insurance is usually around $1,000 to $2,000 per year. The cost of coverage can vary greatly depending on the specific risk factors of the driver and the type of vehicle being insured.

What Are Some Ways To Lower The Cost Of High Risk Auto Insurance?

There are a few ways to lower the cost of high risk auto insurance. One way is to shop around and compare rates from different insurance companies. It is important to find an insurance company that offers the best rate for the type of coverage that is needed. Another way to lower the cost of high risk auto insurance is to take a defensive driving course. Taking a defensive driving course can help to lower the cost of high risk auto insurance by showing the insurance company that the driver is taking the necessary steps to reduce their risk of getting into an accident.

What Should I Do If I Can't Afford High Risk Auto Insurance?

If you find that you are unable to afford high risk auto insurance, there are a few options available. One option is to look for an insurance company that offers a low-cost policy. This type of policy is designed to provide coverage at a lower cost than standard auto insurance. Another option is to look for an insurance company that offers a higher deductible. This will allow the driver to pay a lower premium, but will also require the driver to pay a larger portion of any claim that is filed.

Conclusion

High risk auto insurance is a type of insurance that is required for those who have a higher chance of filing a claim. The cost of high risk auto insurance is typically higher than the cost of standard auto insurance. There are a few ways to lower the cost of high risk auto insurance, such as shopping around and taking a defensive driving course. If you find that you are unable to afford high risk auto insurance, there are a few options available, such as looking for a low-cost policy or a higher deductible.

Best Car Insurance Rates in Arkansas | QuoteWizard

2021 Car Insurance Rates by Age and Gender - NerdWallet

Average Cost of Car Insurance UK 2020 | NimbleFins

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

13 Ways to Save On Car Insurance - Dale Adams Automotive