Average Cost Of Full Coverage Car Insurance A Year Indiana

Average Cost Of Full Coverage Car Insurance A Year In Indiana

What Is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance policy that provides a wide range of protection for your vehicle. It is typically more expensive than a basic insurance policy, but it can help to cover a wider range of damages and losses that you may incur while driving. Full coverage car insurance typically includes bodily injury liability, property damage liability, collision, and comprehensive coverage. The coverage and the cost of the policy will vary depending on the type of vehicle you have, and the amount of coverage you choose.

Average Cost Of Full Coverage Car Insurance A Year In Indiana

The average cost of full coverage car insurance a year in Indiana is around $1,500. This amount is based on the state’s average insurance rates for a standard policy. The cost of full coverage car insurance is typically higher for those who have a history of bad driving or other factors that can increase their risk of having an accident. Additionally, the cost of full coverage car insurance will also vary depending on the type of vehicle you drive and the level of coverage you choose.

How To Lower The Cost Of Full Coverage Car Insurance

There are several ways that you can lower the cost of full coverage car insurance in Indiana. One way is to shop around and compare rates from different insurance companies. Comparing rates will help you find the best deal and save money on your insurance. Additionally, you can also look into discounts or other incentives that may be available, such as safe driving discounts, multiple policy discounts, or discounts for low mileage. Other ways to save money on your insurance include increasing your deductible, reducing optional coverage, and bundling your insurance policies.

What Factors Affect The Cost Of Full Coverage Car Insurance

The cost of full coverage car insurance in Indiana is determined by several factors. These factors include your age, gender, driving record, credit score, the type of vehicle you drive, and the amount of coverage you choose. Additionally, the cost of your insurance can also be affected by the area in which you live, as well as the amount of miles you drive. The best way to ensure that you get the best rate is to shop around and compare rates from different insurance companies.

Conclusion

The average cost of full coverage car insurance a year in Indiana is around $1,500. There are several ways to save money on your insurance, such as shopping around and comparing rates, increasing your deductible, reducing optional coverage, and bundling your insurance policies. The best way to ensure that you get the best rate is to shop around and compare rates from different insurance companies. Additionally, you should also consider the factors that can affect the cost of your insurance, such as age, gender, driving record, credit score, the type of vehicle you drive, and the amount of coverage you choose.

The average cost of car insurance in the US, from coast to coast

Average Car Insurance Cost In Indiana - danikdesign

Quotes + Definitive Coverage Guide for Indiana Car Insurance

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

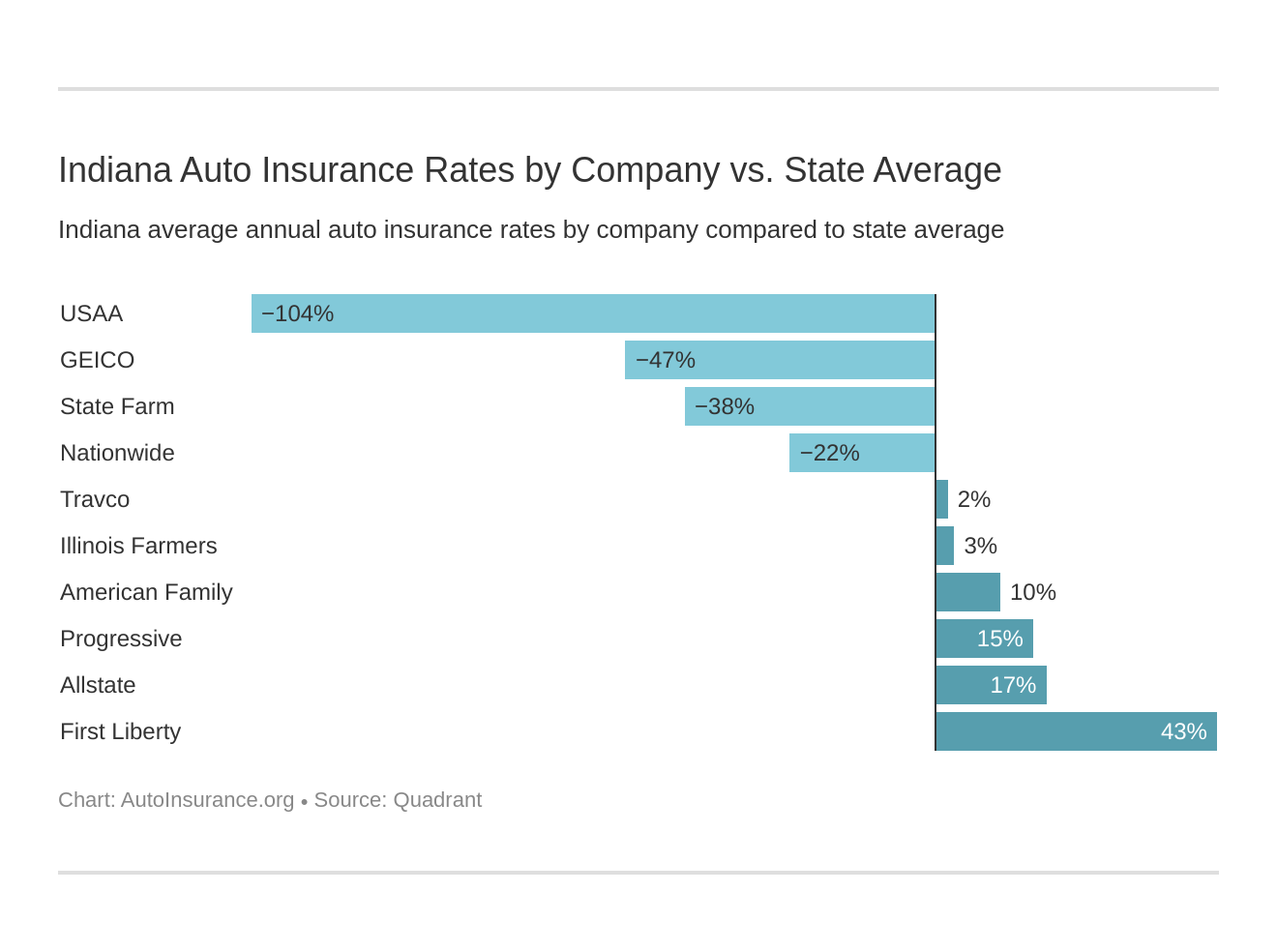

Who Has the Cheapest Auto Insurance Quotes in Indiana?