Adding A Second Car To Insurance Cost

Adding a Second Car to Your Insurance Coverage

The Benefits of Adding a Second Car to Your Insurance Coverage

Adding a second car to your insurance coverage can be a great way to save money and protect both vehicles. Having multiple cars on the same policy can qualify you for discounts on both vehicles, and also increase your chances of being covered in the event of an accident. When you add a second car to your insurance, you can also save on premiums, depending on the type of coverage you choose. Additionally, having multiple cars on the same policy can make filing a claim easier, as you only need to deal with a single insurer.

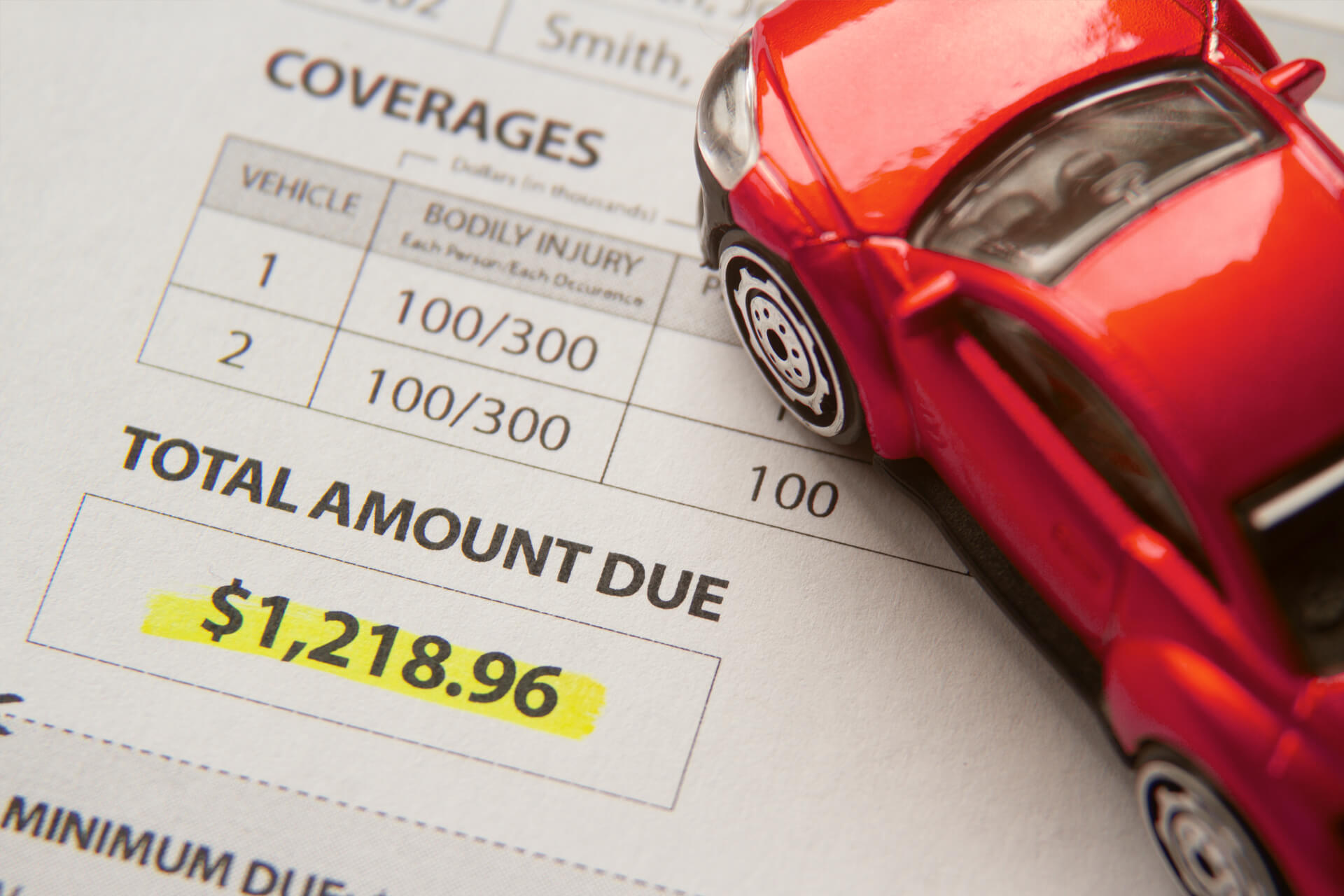

Understanding the Cost of Adding a Second Car to Your Insurance

When you add a second car to your insurance policy, the cost of the coverage will likely depend on several factors, such as the type of car, where you live, and the type of coverage you select. Generally, the more expensive the car, the more expensive the insurance policy will be. Additionally, if you live in an area with higher insurance rates, you may have to pay more for the coverage. It’s important to compare rates from different companies to find the best coverage at the best price.

Tips for Saving Money When Adding a Second Car to Your Insurance

There are several ways to save money when adding a second car to your insurance policy. First, make sure you shop around for the best deal. Comparing rates from different companies can help you find the best coverage for the best price. Additionally, you may be able to qualify for discounts if you have multiple cars on the same policy, if you’re a safe driver, or if you have other safety features in your car, such as an alarm system. Finally, make sure you understand the coverage you’re buying and only purchase what you need.

What You Need to Know Before Adding a Second Car to Your Insurance

Before you add a second car to your insurance policy, there are a few important things you should know. First, make sure the car you’re adding qualifies for coverage. Some cars may not be eligible for certain types of coverage, or may require additional coverage. Additionally, make sure you understand the coverage you’re purchasing, and how it will affect the cost of your policy. Finally, make sure you understand the limits of your coverage, as some policies may not cover certain types of accidents.

Conclusion

Adding a second car to your insurance policy can be a great way to protect your vehicles and save money. Make sure you shop around for the best deal, and understand the coverage you’re buying. Additionally, make sure you qualify for any discounts that may be available, and understand the limits of your coverage. By following these tips, you can ensure that you get the best coverage at the best price.

Looking at the costs of auto insurance in Ontario, and ways motorists

Insurance Prices - Triple-I Blog | Commercial insurance rates variable

The Average Cost of Car Insurance in the US | Car RC

Car Lease Gap Insurance Cost - girlscandesigns

Page for individual images • Quoteinspector.com