What Is Car Insurance Full Coverage

What is Car Insurance Full Coverage?

What Does Full Coverage Mean?

Full coverage car insurance is a combination of auto insurance coverage that covers a wide range of potential damages that can happen while driving a vehicle. It usually includes liability, collision, comprehensive and uninsured/underinsured motorist coverage. These are the four main types of car insurance coverage that are typically included in a full coverage insurance policy. Liability coverage pays for property damage and medical expenses incurred by the other party if you are at fault in an accident. Collision coverage pays for any damage to your vehicle caused by a collision with another vehicle or object. Comprehensive coverage pays for any damage to your vehicle caused by something other than a collision, such as a fire, theft or vandalism. Uninsured/underinsured motorist coverage pays for medical expenses and property damage incurred by you and your passengers if the at-fault driver is uninsured or underinsured.

What Does Full Coverage Car Insurance Cover?

Full coverage car insurance will cover any damages to your car caused by an accident, as well as any damages to someone else’s property as a result of your accident. It will also cover any medical expenses incurred by you or your passengers as a result of the accident. Full coverage car insurance typically includes liability coverage, collision coverage, comprehensive coverage and uninsured/underinsured motorist coverage. Liability coverage pays for property damage and medical expenses incurred by the other party if you are at fault in an accident. Collision coverage pays for any damage to your vehicle caused by a collision with another vehicle or object. Comprehensive coverage pays for any damage to your vehicle caused by something other than a collision, such as a fire, theft or vandalism. Uninsured/underinsured motorist coverage pays for medical expenses and property damage incurred by you and your passengers if the at-fault driver is uninsured or underinsured.

What Does Full Coverage Car Insurance Not Cover?

Full coverage car insurance does not cover all possible damages that can occur while driving a vehicle. It does not cover any damages to your vehicle caused by any activity that is not considered a collision, such as running into a guardrail or hitting a deer. It also does not cover any damage caused by an act of nature, such as a flood or hurricane. Additionally, full coverage car insurance does not cover any damage caused by a driver who is uninsured or underinsured, unless you have purchased uninsured/underinsured motorist coverage.

What Does Full Coverage Cost?

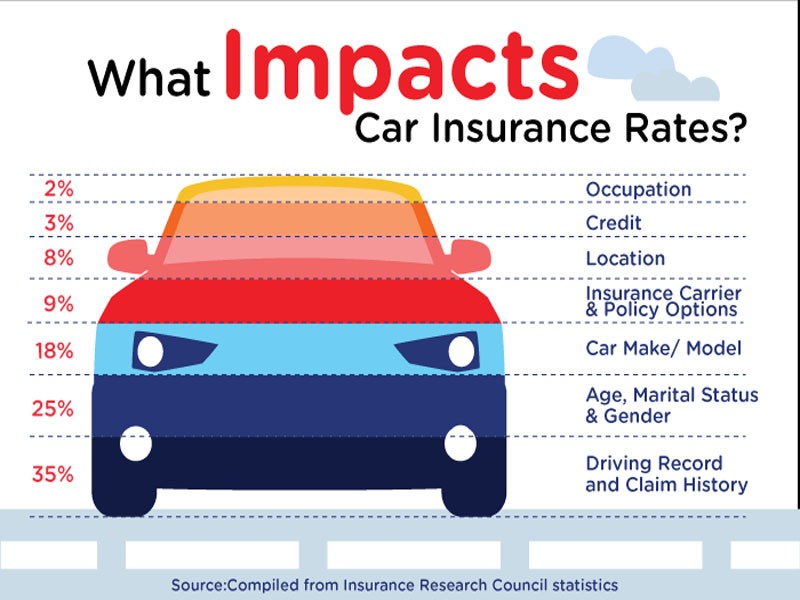

The cost of full coverage car insurance can vary greatly depending on the type of vehicle you have, your driving record and the coverage limits you choose. Generally, the more coverage you have, the more expensive your premiums will be. Additionally, if you have a poor driving record or a vehicle that is more likely to be in an accident, you will likely pay more for full coverage car insurance. To get an accurate estimate of the cost of full coverage car insurance, it’s best to get quotes from multiple insurance companies.

Conclusion

Full coverage car insurance is a combination of auto insurance coverage that covers a wide range of potential damages that can happen while driving a vehicle. It typically includes liability, collision, comprehensive and uninsured/underinsured motorist coverage. The cost of full coverage car insurance can vary greatly depending on the type of vehicle you have, your driving record and the coverage limits you choose. To get an accurate estimate of the cost of full coverage car insurance, it’s best to get quotes from multiple insurance companies.

What Is Comprehensive vs. Collision Coverage | Allstate

What is Full Coverage Car Insurance? - eTrustedAdvisor

List of the Best Car Insurance

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

18+ Full Coverage Car Insurance Quotes - Best Day Quotes