States With Cheapest Car Insurance

Monday, October 21, 2024

Edit

States With Cheapest Car Insurance

High Rates Are Just Part of the Story

When it comes to car insurance rates, the cost of coverage can vary widely from state to state. While some states boast the lowest rates in the nation, others can be downright expensive. But the high cost of car insurance in some states doesn’t necessarily mean that you’re getting the best coverage for your money. In fact, some of the states with the highest rates offer some of the worst coverage. That’s why it’s important to do your research and shop around to find the best deal that fits your budget and lifestyle.

Which States Have the Cheapest Car Insurance Rates?

When it comes to finding the cheapest car insurance rates, there are a few states that stand out. The states with the lowest average annual premiums include Maine, Ohio, Virginia, Wisconsin, and New Hampshire. Each of these states offers a variety of discounts and other features that can help drivers save money on their insurance. For example, Maine offers a Good Driver Discount, which allows drivers with no at-fault accidents or moving violations to receive up to 15% off their premiums.

How Can I Find the Cheapest Car Insurance in My State?

The best way to find the cheapest car insurance in your state is to compare rates from multiple companies. Shopping around allows you to compare rates and coverage levels, as well as any discounts that may be available. In addition to online comparison sites, you can also call your local insurance agents to get quotes. Make sure to ask about any discounts that may be available, such as multi-car, good driver, and loyalty discounts.

What Factors Affect My Car Insurance Rate?

There are a number of factors that can affect your car insurance rate, including your age, driving record, credit score, type of vehicle, and the coverage levels you choose. For example, younger drivers tend to pay more for car insurance due to their lack of experience, while older drivers may pay less because they typically have a longer driving history. Your driving record is also important, as drivers with a history of accidents or moving violations will typically pay more than those with a clean record. Additionally, your credit score can have an impact on your insurance rate, as some insurers use it as a factor in their risk assessment.

What Are Some Other Ways to Save on Car Insurance?

There are a number of other ways to save on car insurance, such as increasing your deductible, bundling policies, and taking advantage of discounts. Increasing your deductible is one way to reduce your premium, but it’s important to remember that you’ll be paying more out of pocket if you need to make a claim. Bundling your policies is also a great way to save, as many insurance companies offer discounts for customers who purchase multiple types of coverage, such as auto, home, and life insurance. Finally, it’s important to ask your insurer about any discounts they may offer. Many companies offer discounts for good drivers, multi-car households, and even military members.

The Bottom Line

When it comes to car insurance, rates can vary widely from state to state. While some states boast the lowest rates in the nation, others can be quite expensive. But high rates don’t necessarily mean you’re getting the best coverage for your money. That’s why it’s important to shop around to find the best deal that fits your budget and lifestyle. There are a number of ways to save on car insurance, such as increasing your deductible, bundling policies, and taking advantage of discounts. By doing your research and comparing rates from multiple companies, you can find the best car insurance policy for you.

CoverHound’s Steepest and Cheapest States for Auto Insurance in 2015

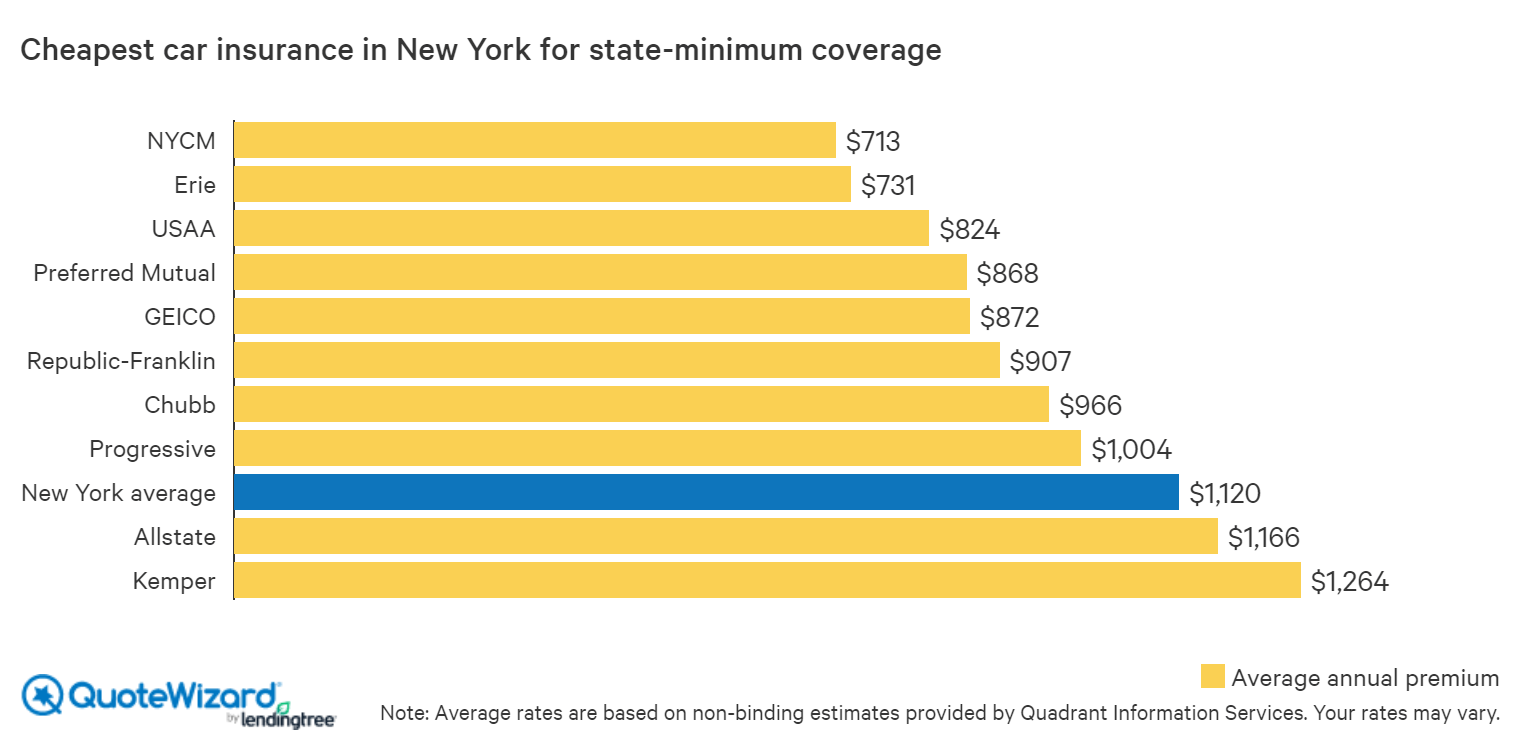

The Cheapest Car Insurance in New York | QuoteWizard

Best Cheapest Home Auto Insurance Washington State

Who Has the Cheapest Auto Insurance Quotes in Florida? (2019

How Much Is Car Insurance? Average Car Insurance Cost 2020