Shop For Car Insurance Rates

Shop For Car Insurance Rates

Comparing Car Insurance Rates

Shopping for car insurance rates can be a daunting task. With so many insurance companies offering different rates and packages, it can be difficult to find the best deal. Fortunately, there are several ways to compare car insurance rates so that you can find the coverage that fits your individual needs. Here are a few tips for comparing car insurance rates.

The first step is to research your options. Start by finding out what types of coverage are available for your vehicle. Different insurance companies offer different levels of coverage, so it's important to research your options before making a decision. You can also use online comparison tools to quickly compare rates from multiple providers.

Once you know what type of coverage you need, it's time to start comparing rates. Start by looking at the different companies in your area. Look at the rates they offer and compare them to the coverage you need. You can also ask your friends and family for recommendations. This can help you narrow down your choices and find the right policy for your needs.

When you are ready to purchase a policy, make sure to read the fine print. Look for any hidden costs or restrictions that may be included with the policy. Some companies may offer better rates but may also include additional fees or restrictions. Be sure to ask questions and get clarification on any confusing terms before signing the contract.

Saving Money on Car Insurance

Once you have found the right policy, it's time to start looking for ways to save money on car insurance. One of the most important ways to save is by increasing your deductible. The higher the deductible, the less you'll have to pay out of pocket for an accident. However, it's important to remember that a higher deductible also means you'll be responsible for more of the repair costs if you're ever in an accident.

You can also save money on car insurance by bundling your policies. Many companies offer discounts when you purchase multiple policies, such as home and auto insurance. You can also get discounts for being a safe driver or for taking a defensive driving course. Additionally, some companies offer discounts for having anti-theft devices installed in your vehicle.

Finally, be sure to shop around for the best rates. Different companies often have different rates, so it pays to compare. Use online comparison tools to quickly compare rates from multiple providers. This can help you find the right policy at the best price.

Conclusion

Shopping for car insurance rates can be a difficult task, but it doesn't have to be. By researching your options, comparing rates from multiple providers, and taking advantage of discounts, you can find the coverage that fits your individual needs. So start shopping today and save money on car insurance.

What Are Some of The Hidden Costs of Purchases - Big Blind Money

Who Has the Cheapest Auto Insurance Quotes in New York? - ValuePenguin

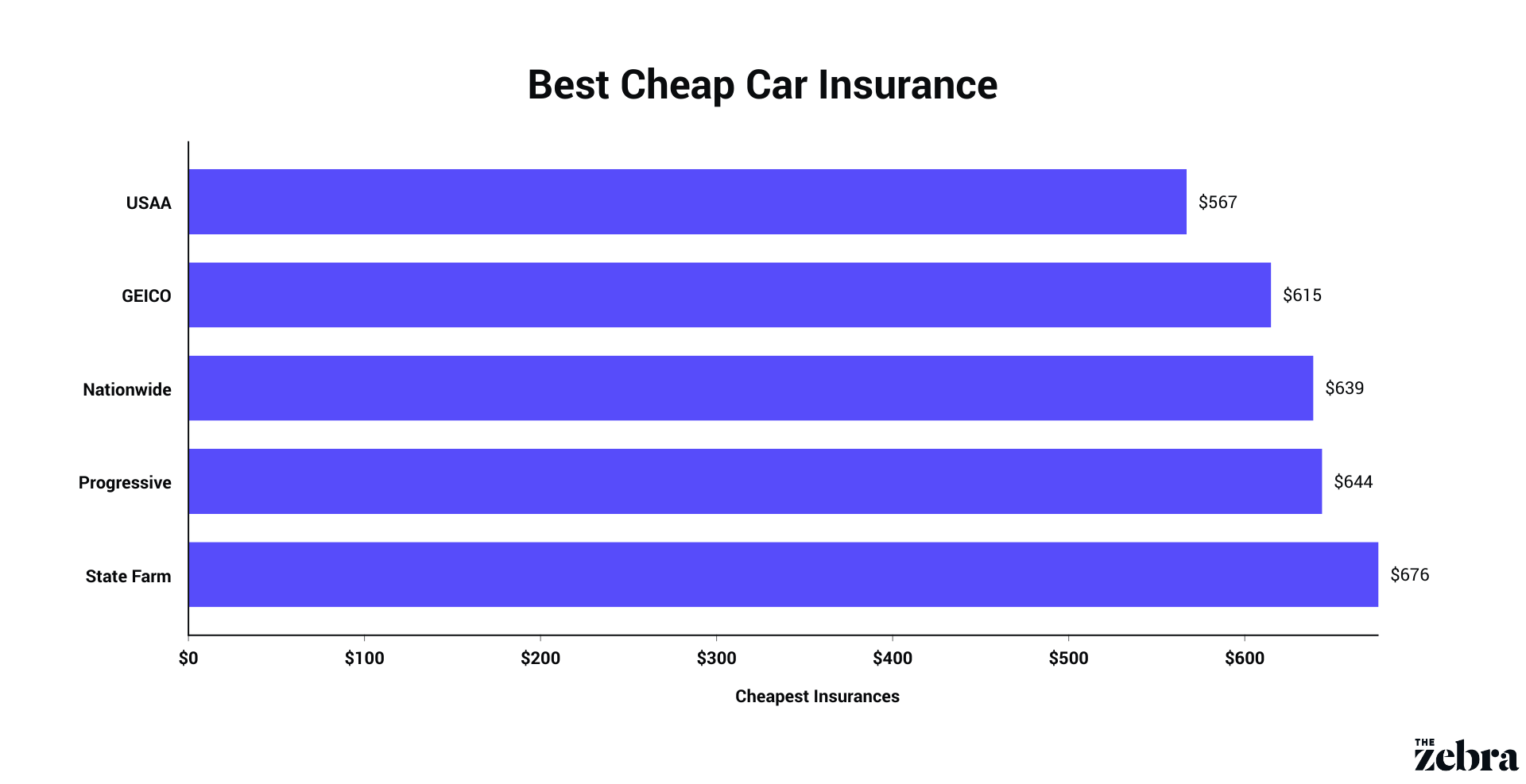

Cheapest Car Insurance Companies (September 2021) | The Zebra

Midland Tx Auto Insurance: Average Auto Insurance Rates By Car

2021 Car Insurance Rates by Age and Gender - NerdWallet