Marks And Spencer Car Insurance For Card Holders

Marks & Spencer Car Insurance For Card Holders

The Benefits of M&S Car Insurance

If you are looking for a car insurance policy that is tailored to your needs, then Marks and Spencer (M&S) Car Insurance is the perfect choice. M&S Car Insurance is specifically designed for card holders and offers competitive rates and comprehensive cover for your car. M&S Car Insurance offers a range of benefits that make it an attractive option for customers. This includes a range of discounts, no-claims bonuses, and a flexible payment schedule.

M&S Car Insurance also offers a range of additional benefits to customers, such as an accident helpline, a 24-hour claims service, and a courtesy car if your car is off the road for more than 24 hours due to an accident or breakdown. This means that you can get back to your regular routine as soon as possible. M&S Car Insurance also offers a range of cover options, such as windscreen cover, breakdown cover and legal cover.

The M&S Car Insurance also offers a range of optional extras that you can add to your policy. These include personal accident cover, medical expenses and personal possessions cover. This means that you can tailor your policy to suit your individual needs and budget.

How to Get the Best Deals on M&S Car Insurance

Getting the best deals on M&S Car Insurance is easy. All you need to do is shop around and compare different policies from different providers. You can compare policies online or by speaking to an insurance broker. Comparing different policies is the best way to make sure that you are getting the best deals on your M&S Car Insurance.

When you are comparing policies, it is important to consider the level of cover that you need and the type of car that you are insuring. It is also important to consider any discounts that you may be eligible for, as well as any additional benefits that you may be entitled to.

Once you have chosen your policy, it is important to read the terms and conditions carefully. This will help you understand exactly what is covered and what is not. It is also important to make sure that you are aware of any exclusions or restrictions that may apply.

Making a Claim on Your M&S Car Insurance

If you need to make a claim on your M&S Car Insurance, you should contact the claims helpline as soon as possible. The claims helpline is available 24 hours a day, seven days a week, and a representative will be able to answer any questions that you may have. If you need to make a claim, it is important to have all the necessary information to hand, such as the registration number of your car and the date and time of the incident.

It is also important to remember that you may be liable to pay an excess if you make a claim on your M&S Car Insurance. This is a set amount of money that you must pay towards the cost of a claim and this will be specified in your policy documents.

Conclusion

Marks and Spencer (M&S) Car Insurance is a great choice for those looking for a tailored car insurance policy. The policy offers competitive rates and comprehensive cover, as well as a range of additional benefits and optional extras. There are also a number of discounts and no-claims bonuses available to customers. It is important to compare different policies and read the terms and conditions carefully before making a decision.

Insurance Card Holders - 9-1/4"(W) x 4-1/4"(H) - Opens on Short Side

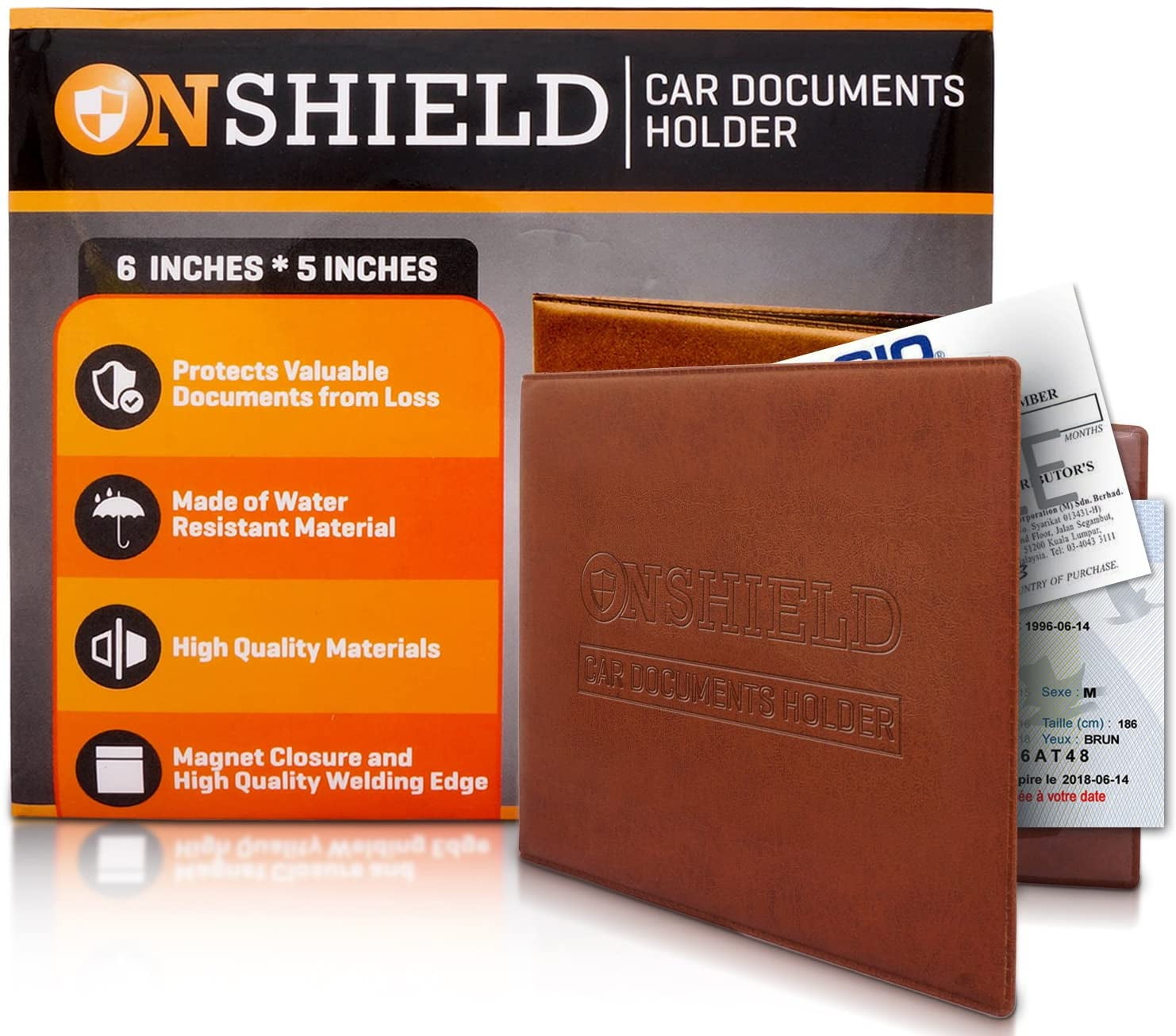

Car Registration and Insurance Card Holder with Magnetic Closure

Insurance Card Holders - 9-3/4"(W) x 4-3/4"(H) - with Business Card

Insurance Card Holder-Single Pocket | Car Accessories | 0.46 Ea

Insurance Card Holders - 5-3/4"(W) x 4-1/16"(H) - with Extra Pocket