Kotak Mahindra Car Loan Insurance

Sunday, October 6, 2024

Edit

Kotak Mahindra Car Loan Insurance

Insurance for Your Car Loan Made Easy with Kotak Mahindra

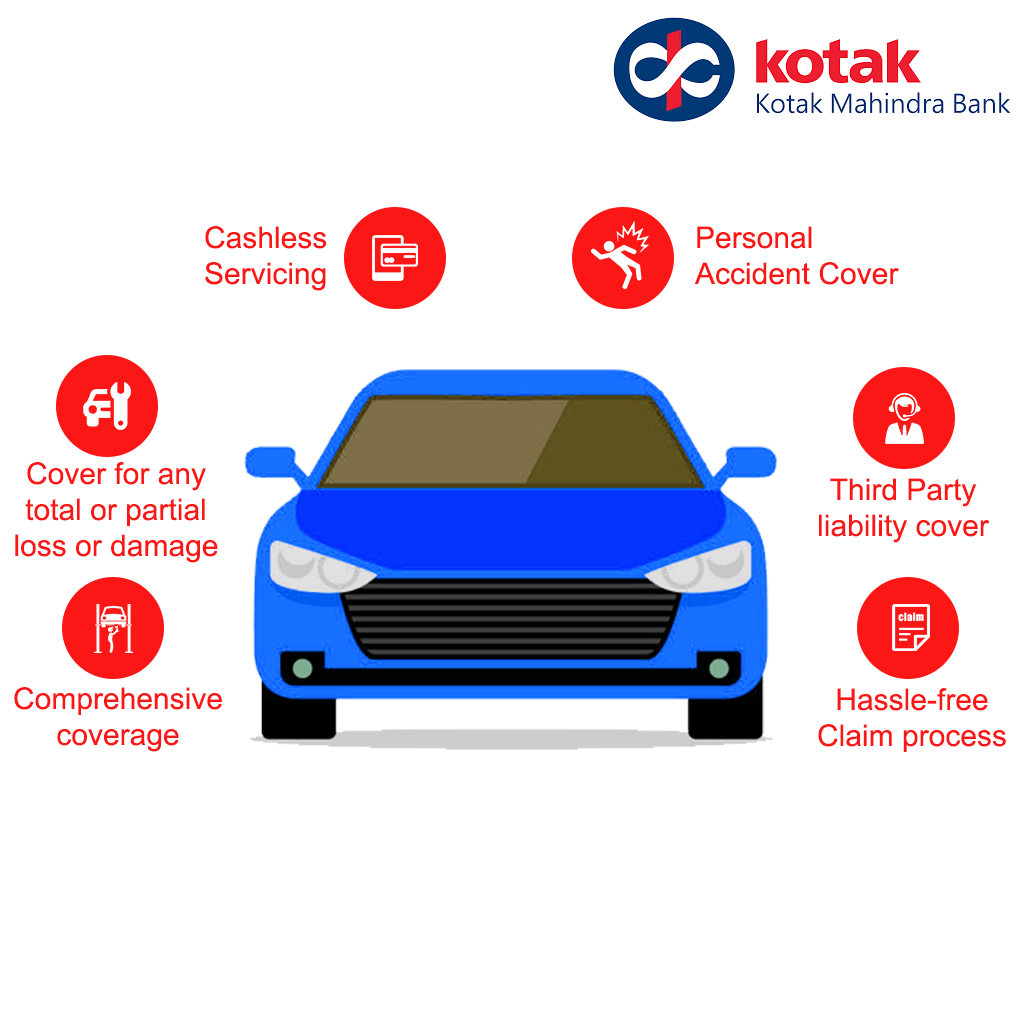

For those who own a car, it can be a major financial burden, especially if you have taken a loan to purchase it. But with the introduction of Kotak Mahindra Car Loan Insurance, you can now protect your car and your finances. Kotak Mahindra Car Loan Insurance offers comprehensive and affordable protection for your car loan and the car itself.

The insurance plan from Kotak Mahindra offers a wide range of coverage options, including coverage for accidental damage, theft and third-party liability. It also provides protection against the depreciation in the value of the car and the outstanding loan amount.

Why Opt for Kotak Mahindra Car Loan Insurance?

Kotak Mahindra Car Loan Insurance is an ideal way to protect your car and your finances. With the insurance coverage, you can be sure that you will not have to bear the financial burden of repairing or replacing your car in case of an accident.

The insurance coverage also helps you to stay financially secure in case of any unexpected expenditure. In case of an accident, the insurance company will cover the cost of the repair or replacement, depending on the extent of the damage.

Features and Benefits of Kotak Mahindra Car Loan Insurance

Kotak Mahindra Car Loan Insurance offers a wide range of features and benefits to its customers. Some of the features and benefits of this insurance plan include:

- Coverage for accidental damage, theft, and third-party liability.

- Coverage for the outstanding loan amount and the depreciation in the value of the car.

- Coverage for medical expenses incurred due to an accident.

- Easy claim procedure.

- Cashless payment of claims.

- Low premiums.

How to Avail the Insurance Plan?

Availing Kotak Mahindra Car Loan Insurance is very easy and hassle-free. You can apply for the insurance plan online or visit one of the Kotak Mahindra branches. You will be required to submit some documents, such as your car loan agreement and car registration papers, along with the insurance application.

Once your application is approved, you will be issued with an insurance policy that will be valid for the duration of the loan. You will then be required to make regular premium payments to keep the policy active.

Conclusion

Kotak Mahindra Car Loan Insurance is an ideal way to protect your car and your finances. With the comprehensive coverage offered by the insurance plan, you can be sure that you and your car will be adequately protected against financial losses due to accidents, theft, and third-party liability. With the easy application process and low premiums, Kotak Mahindra Car Loan Insurance is an ideal way to secure your car loan.

KOTAK MAHINDRA LIFE INSURANCE Reviews, KOTAK MAHINDRA LIFE INSURANCE

Kotak Life Insurance expects to incur up to Rs 275 cr loss in Q1 due to

Kotak Mahindra Car Insurance - Compare Plans, Renewal & Reviews

Top 10 Cheapest loans available in India | A Listly List

The Best Loan On Kotak Insurance Policy Ideas - RAMAH.MY.ID