Is California A Fault State For Auto Insurance

Is California A Fault State For Auto Insurance?

California is one of the few states in the US that uses a fault-based auto insurance system. This means that when an accident happens, the person who is at fault is responsible for covering the damages. This system is different from no-fault states, where both drivers are responsible for their own damages, regardless of who is at fault. It is important to understand how the fault-based system works in California and how it can affect your auto insurance.

What is a Fault-based System?

In a fault-based system, the person who is found to be at fault for an accident is responsible for covering the damages. This includes medical bills, property damage, and any other costs related to the accident. In order to determine who is at fault, the insurance company may investigate the accident and evaluate the evidence to make a determination. The fault-based system is different from a no-fault system, where both drivers are responsible for their own damages, regardless of who is at fault.

Is California A Fault State?

Yes, California is a fault-based state for auto insurance. This means that when an accident happens, the person who is found to be at fault is responsible for covering the damages. In order to determine who is at fault, the insurance company may investigate the accident and evaluate the evidence to make a determination. It is important to understand how the fault-based system works in California and how it can affect your auto insurance.

What Does This Mean For Drivers?

The fault-based system in California means that drivers need to be more aware of their actions on the road. If you are found to be at fault for an accident, you will be responsible for covering the damages. This includes medical bills, property damage, and any other costs related to the accident. It is important to remember that even if you are found to be at fault, you may still be able to receive compensation from the other driver's insurance company if they are found to be partially at fault.

What Are The Benefits of A Fault-based System?

A fault-based system encourages drivers to be more careful on the road and take responsibility for their actions. Drivers who are found to be at fault for an accident are responsible for covering the damages. This can help reduce the costs of auto insurance for all drivers, as the costs of damages are not spread across all drivers. Additionally, the fault-based system helps to ensure that drivers who are responsible for an accident are held accountable for their actions.

What Are The Drawbacks of A Fault-based System?

The fault-based system in California can be complicated and difficult to understand. Additionally, if you are found to be at fault for an accident, you will be responsible for covering the damages. This can be a financial burden for drivers, as they may be required to pay for medical bills and property damage. Furthermore, if the other driver is found to be at fault, they may be able to receive compensation from your insurance company, which can increase your premiums.

Is California a No-Fault State for Auto Insurance?

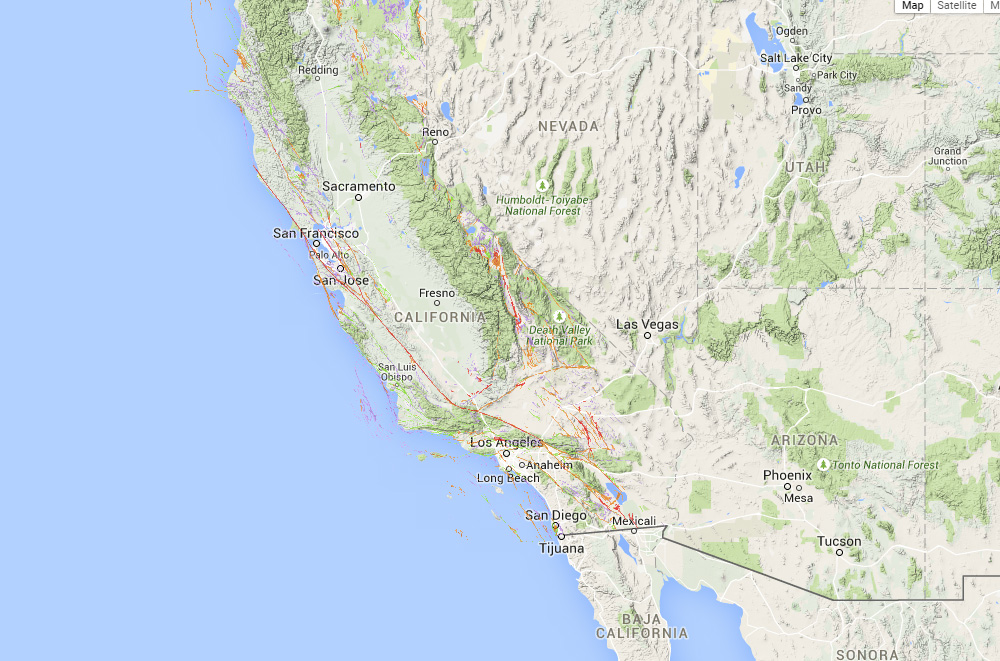

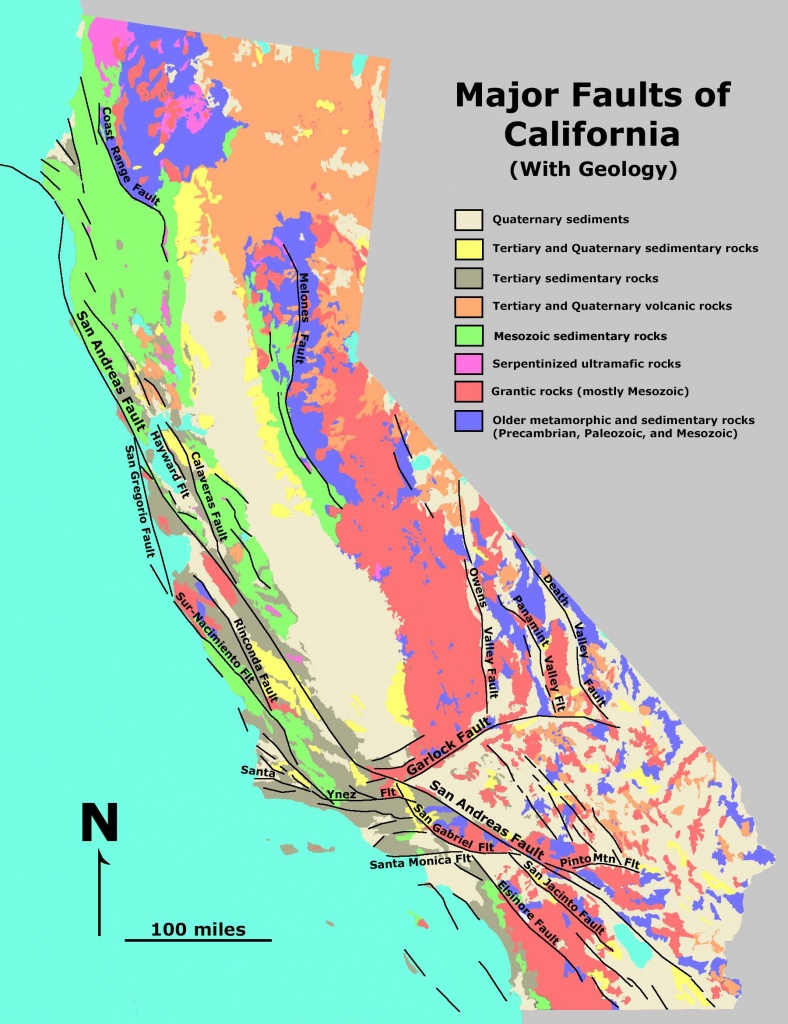

California Fault Lines Map | Free Printable Maps

Auto Insurance Explained: At Fault States - YouTube

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

California Fault Lines Map | Zip Code Map