How Many States Are No Fault Auto Insurance

What Is No Fault Auto Insurance?

No Fault Auto Insurance is a type of coverage that is required by law in some states. It is a system of insurance that is meant to provide compensation for any damages that occur in an accident regardless of who caused the accident. This type of insurance is designed to provide protection to both drivers and passengers, as well as to any third parties that may have been involved in the accident. No Fault Auto Insurance is meant to be a form of financial protection in the event of an accident, and it is also meant to help ensure that the costs associated with any damage caused by an accident are taken care of.

How Many States Have No Fault Auto Insurance?

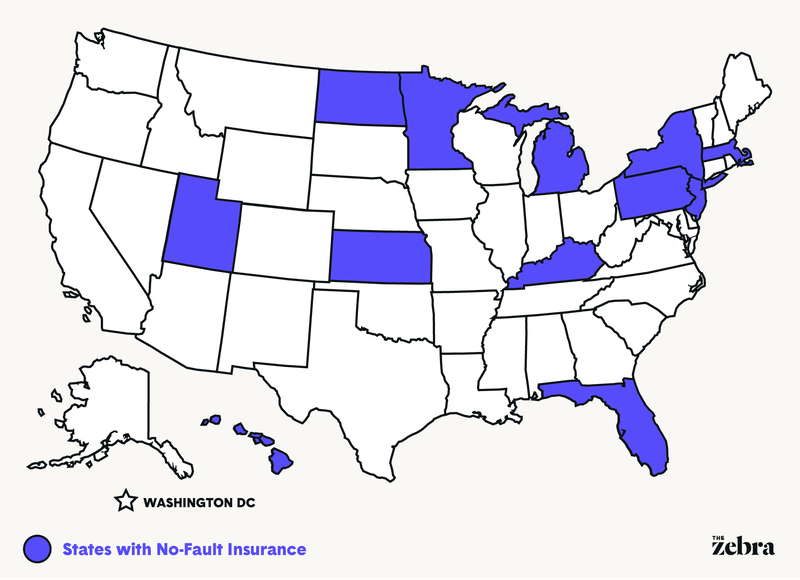

Currently, there are 12 states that require drivers to carry a minimum amount of No Fault Auto Insurance. These states are Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. It is important to note that each of these states has its own set of regulations and requirements when it comes to No Fault Auto Insurance, so it is important to research the laws in your state before you purchase a policy.

What Are the Benefits of No Fault Auto Insurance?

No Fault Auto Insurance is beneficial for both drivers and passengers in the event of an accident. It helps to minimize the cost of medical expenses, property damage, and other costs associated with an accident. Furthermore, it helps to provide financial protection to both drivers and passengers in the event that they are injured or killed in an accident. Additionally, No Fault Auto Insurance helps to protect drivers from being sued in the event of an accident, as it can help to pay for any medical expenses and property damage that may be incurred.

What Are the Requirements for No Fault Auto Insurance?

The requirements for No Fault Auto Insurance vary from state to state. Generally speaking, these policies usually require drivers to carry a minimum amount of coverage, which is usually a set amount per person and per accident. The amount of coverage required can vary, so it is important to research the laws in your state before purchasing a policy. Additionally, these policies usually also require drivers to carry Uninsured/Underinsured Motorist coverage, which can provide additional protection in the event of an accident.

How Much Does No Fault Auto Insurance Cost?

The cost of No Fault Auto Insurance will vary depending on the coverage limits and the type of policy that you purchase. Generally speaking, these policies are more expensive than traditional auto insurance policies, as they provide additional protection. Additionally, the cost of these policies can vary depending on the state in which you live, so it is important to research the laws and regulations in your area before purchasing a policy. Additionally, the age, driving record, and other factors can also affect the cost of No Fault Auto Insurance.

Where Can I Get No Fault Auto Insurance?

No Fault Auto Insurance is available from most major auto insurance companies. It is important to shop around and compare quotes from different insurers in order to find the best coverage at the best price. Additionally, it is important to make sure that the insurer you choose is licensed to do business in your state, as some companies may only offer coverage in certain states. Furthermore, it is also important to read the policy thoroughly and make sure that it meets all of your needs before signing any documents.

Ultimate Guide to No-Fault Auto Insurance

Can Someone Sue you for a Car Accident if you Have Insurance - Honest

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

What is no fault car insurance?

What is PIP Insurance and Do You Need It? | The Zebra