Home Insurance Pays More Than Estimate

Friday, October 11, 2024

Edit

Home Insurance Pays More Than Estimate

What is Home Insurance?

Home insurance is a type of insurance policy that helps protect your home and its contents. It typically covers damage or destruction to the structure of your home, as well as your personal belongings inside it. It also helps protect you from liability if someone gets injured on your property. Home insurance policies vary widely in the coverage they provide, so it’s important to be aware of the specific coverage you have and shop around for a policy that meets your needs.

How Does Home Insurance Pay More Than Estimate?

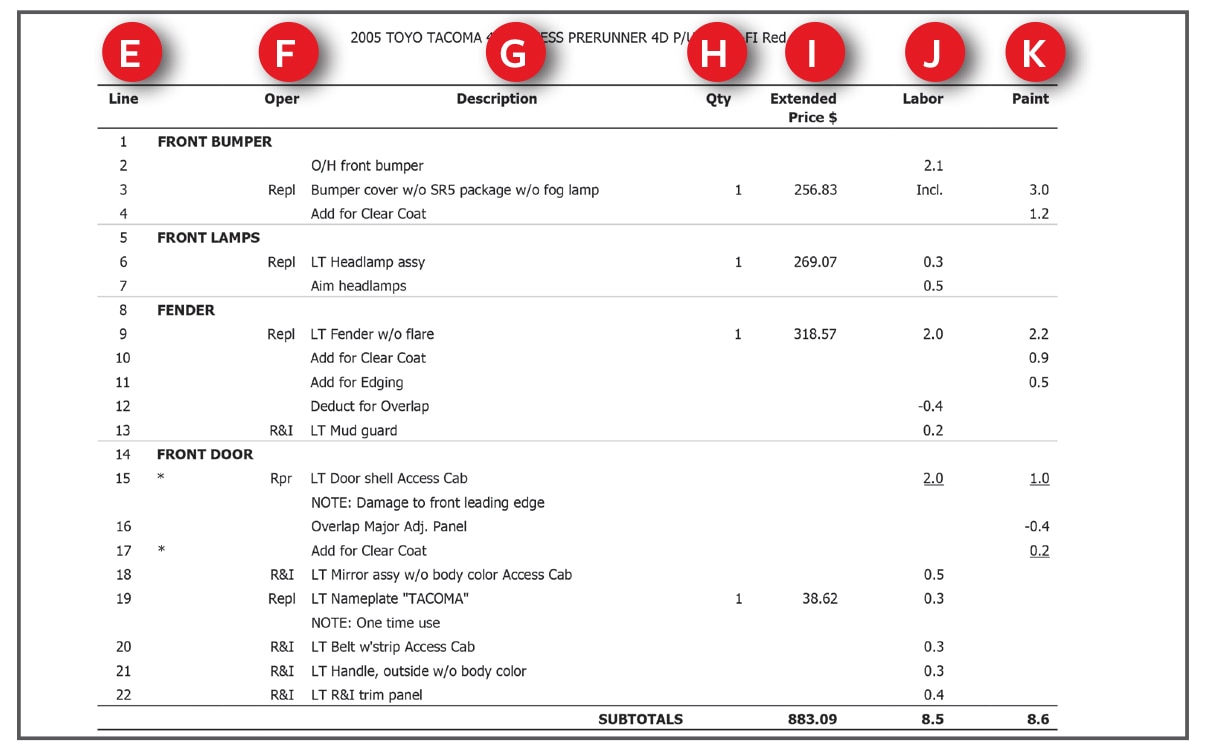

When you file an insurance claim for damage to your home, the insurance company will send an adjuster to assess the damage and estimate the cost of repair. If the repair costs exceed the estimate, the insurance company is responsible for covering the extra costs. This is known as “overages” and is a common occurrence when it comes to home insurance claims.

How to Maximize Your Home Insurance Payout?

In order to get the most out of your home insurance payout, it’s important to be aware of some important tips and tricks. First, make sure to document all damage to your home with photos or videos. This will help the adjuster assess the extent of the damage and make sure you are fairly compensated. You should also keep all receipts related to the repair costs, as this will make it easier for the insurance company to reimburse you.

What to Do If the Insurance Company Won’t Pay?

If the insurance company refuses to pay the full amount for the repair costs, you have the right to dispute the amount. You can contact the insurance company and explain why you believe the amount is insufficient and provide evidence to support your claim. You can also contact your state’s insurance department to lodge a complaint and seek legal recourse.

The Bottom Line

Home insurance is an important part of protecting your home and its contents. It’s important to make sure you have the right kind of coverage and to document all damage and repair costs in order to receive the full amount of your insurance payout. If the insurance company refuses to pay the full amount, you have the right to dispute the amount and seek legal recourse.

What Is Home Insurance Cost - STAETI

Homeowners Insurance Estimate

Most Expensive Home Insurance Claims [Infographic] | Insurance Center

![Home Insurance Pays More Than Estimate Most Expensive Home Insurance Claims [Infographic] | Insurance Center](https://www.answerfinancial.com/insurance-center/wp-content/uploads/2011/09/Most-Expensive-Home-Insurance-Claims-Infographic.jpg)

Mapped: Average Homeowners Insurance Rates for Each State – CoreHub 核心投资学院

-e7a2.jpg)

Home Insurance: Estimate Home Insurance