Hdfc Vehicle Insurance Two Wheeler

HDFC Vehicle Insurance Two Wheeler - Get Protected Now

What Is HDFC Vehicle Insurance Two Wheeler?

HDFC Vehicle Insurance Two Wheeler is a comprehensive insurance policy that provides coverage for losses or damages caused to your two-wheeler due to an accident, theft, natural calamities, and other unforeseen events. It provides financial protection to the policyholder in case of any damage to their two-wheeler, or any liabilities arising out of any third-party damages or injuries. This policy also covers certain add-on benefits like medical expenses, personal accident cover, roadside assistance, and so on. HDFC Vehicle Insurance Two Wheeler is a must-have insurance policy if you own a two-wheeler and want to stay secured.

Benefits of HDFC Vehicle Insurance Two Wheeler

HDFC Vehicle Insurance Two Wheeler offers a host of benefits to its policyholders, some of which are:

- Comprehensive coverage – HDFC Vehicle Insurance Two Wheeler provides coverage for losses or damages caused to your two-wheeler due to an accident, theft, natural calamities, and other unforeseen events.

- Add-on benefits – HDFC Vehicle Insurance Two Wheeler also provides additional coverage for medical expenses, personal accident cover, roadside assistance, and so on.

- Affordable premiums – HDFC Vehicle Insurance Two Wheeler offers highly affordable premiums, so you can make sure that you are financially secured without having to spend too much.

- Cashless claims – HDFC Vehicle Insurance Two Wheeler provides cashless claims, so you don’t have to worry about dealing with the tedious paperwork and other hassles.

- Simple process – HDFC Vehicle Insurance Two Wheeler has an easy and simple process for purchasing and renewing the policy.

Coverage of HDFC Vehicle Insurance Two Wheeler

HDFC Vehicle Insurance Two Wheeler provides coverage for the following:

- Loss or damage of your two-wheeler due to an accident, theft, natural calamities, and other unforeseen events.

- Third-party liabilities due to any bodily injuries or property damages caused to a third-party due to an accident with your two-wheeler.

- Medical expenses incurred due to an accident with your two-wheeler.

- Personal accident cover for the policyholder.

- Roadside assistance in case of any breakdown or accidents.

Eligibility Criteria for HDFC Vehicle Insurance Two Wheeler

The eligibility criteria for HDFC Vehicle Insurance Two Wheeler are as follows:

- The policyholder must be at least 18 years old.

- The two-wheeler should be registered under the Motor Vehicle Act, 1988.

- The two-wheeler should have valid insurance.

- The two-wheeler should have valid registration and pollution certificates.

- The two-wheeler should not be more than 10 years old.

Conclusion

HDFC Vehicle Insurance Two Wheeler is a comprehensive insurance policy that provides coverage for losses or damages caused to your two-wheeler due to an accident, theft, natural calamities, and other unforeseen events. It provides financial protection to the policyholder in case of any damage to their two-wheeler, or any liabilities arising out of any third-party damages or injuries. This policy also covers certain add-on benefits like medical expenses, personal accident cover, roadside assistance, and so on. HDFC Vehicle Insurance Two Wheeler is a must-have insurance policy if you own a two-wheeler and want to stay secured.

HDFC Ergo Two Wheeler Insurance- Inclusions and Exclusions | Policy

HDFC ergo policy download | hdfc ergo two wheeler insurance policy copy

How to make Two Wheeler insurance policy by CSC Portal in 2019 with

HDFC Two Wheeler Insurance: Know In Details About It - Your Guide to

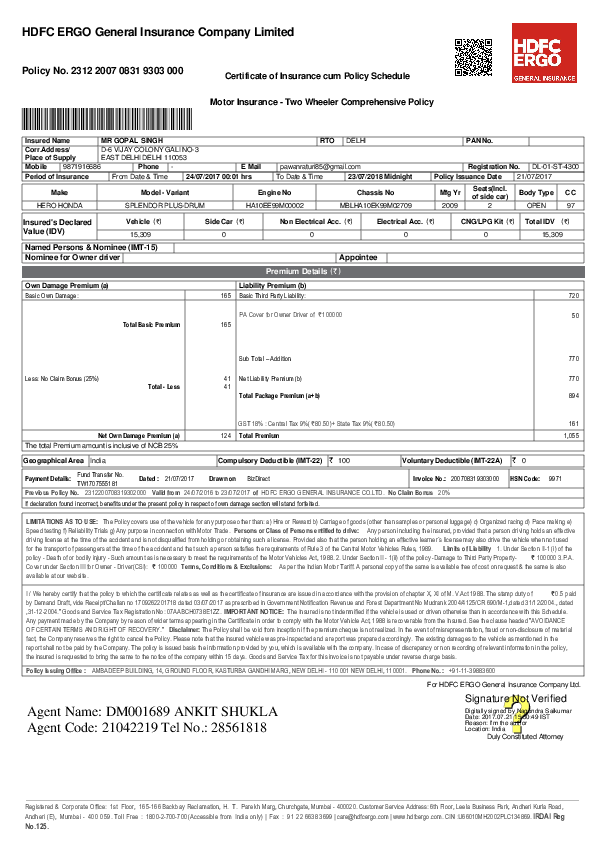

(PDF) Motor Insurance -Two Wheeler Comprehensive Policy T 0 | Pradeep