Duplicate Car Insurance Policy New India Assurance

Thursday, October 31, 2024

Edit

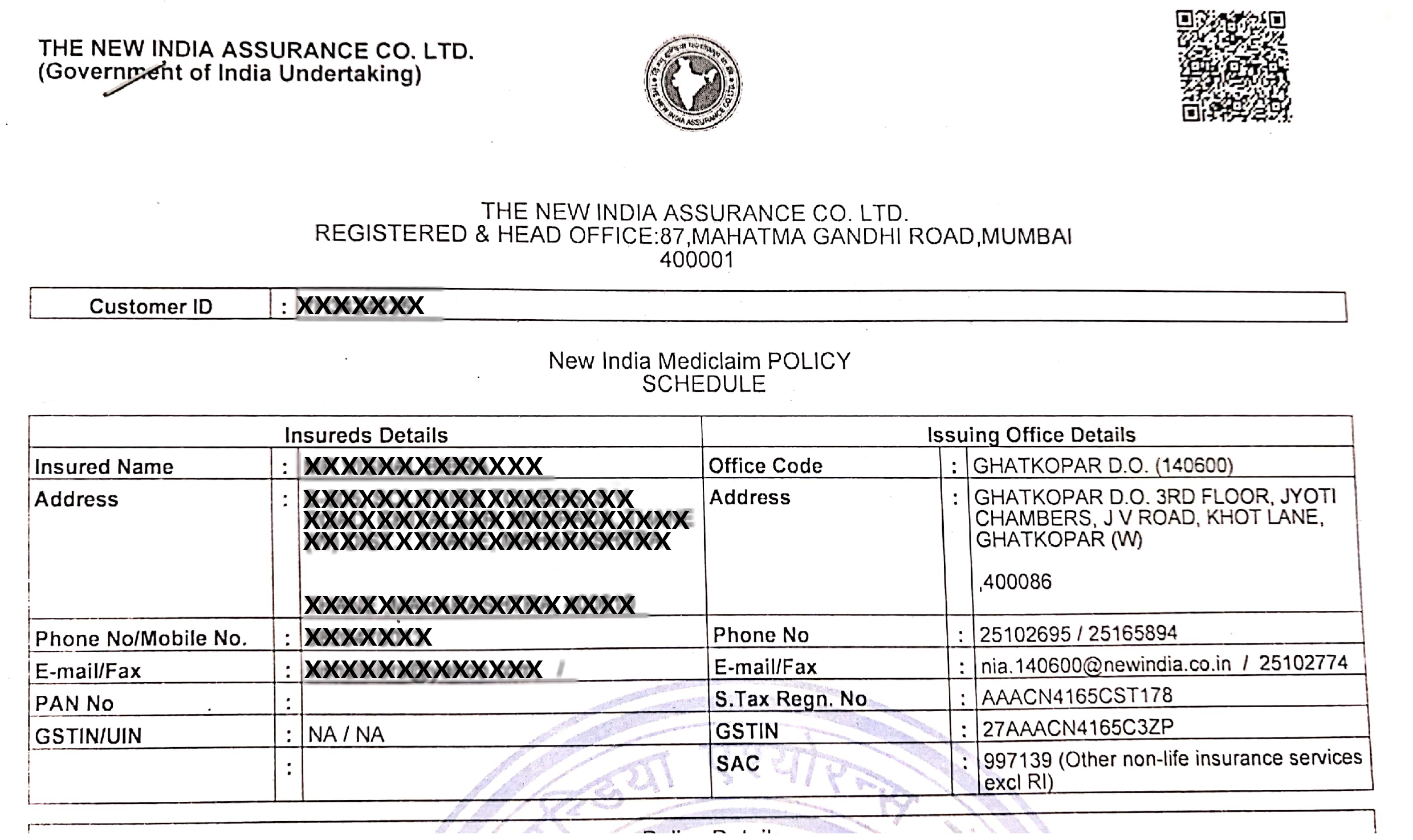

Duplicate Car Insurance Policy from New India Assurance

Understanding Duplicate Car Insurance Policy from New India Assurance

Buying a car insurance policy can be a difficult task. When it comes to car insurance, one must understand the various types of policies, their coverage and other important factors. New India Assurance offers a variety of car insurance policies that can meet all sorts of customer needs. One of the most popular types of car insurance policy offered by New India Assurance is the Duplicate Car Insurance Policy. This policy is designed to provide coverage for the same vehicle from two different policies. This ensures that the car is covered from both the liabilities arising from an accident as well as theft.

Benefits of Duplicate Car Insurance Policy from New India Assurance

There are several benefits of opting for a Duplicate Car Insurance Policy from New India Assurance. The most important benefit is that the policyholder can avail of the coverage from two policies, which means that the car is doubly secured from any untoward incident. Moreover, the policyholder can also avail of discounts on the premium amount if they opt for two policies. This means that the policyholder can save money on the overall policy amount. In addition to this, the policyholder can also avail of additional benefits such as roadside assistance, towing services and 24/7 customer service.

Requirements of Duplicate Car Insurance Policy from New India Assurance

In order to avail of a Duplicate Car Insurance Policy from New India Assurance, there are certain requirements that must be met. Firstly, the policyholder must be the owner of the vehicle in question and must possess a valid vehicle registration certificate. Secondly, the policyholder must have a valid driving license. Thirdly, the policyholder must be over 18 years of age and must have a valid insurance policy from a recognized insurer. Finally, the policyholder must provide all relevant documents such as the vehicle registration certificate, insurance policy and driving license.

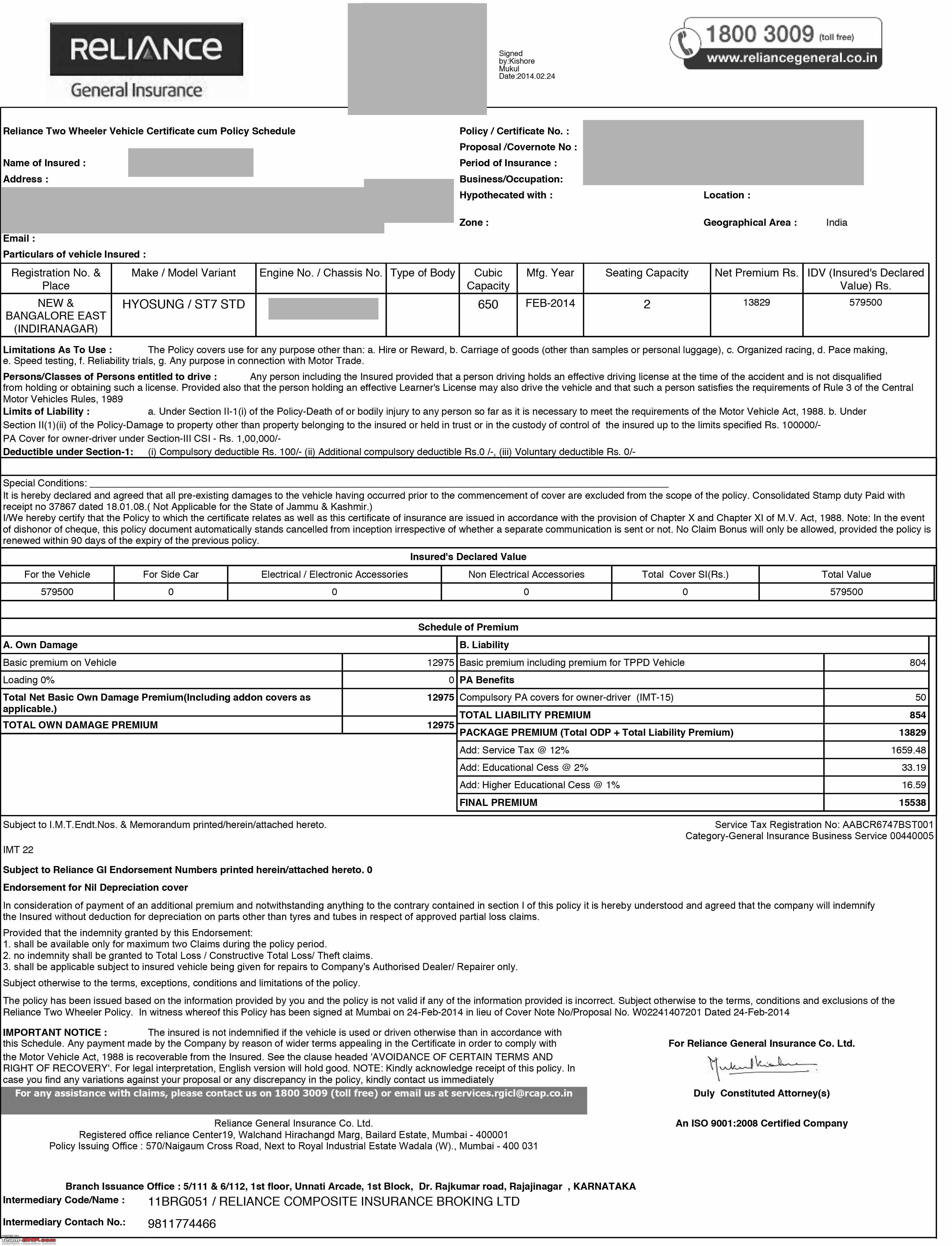

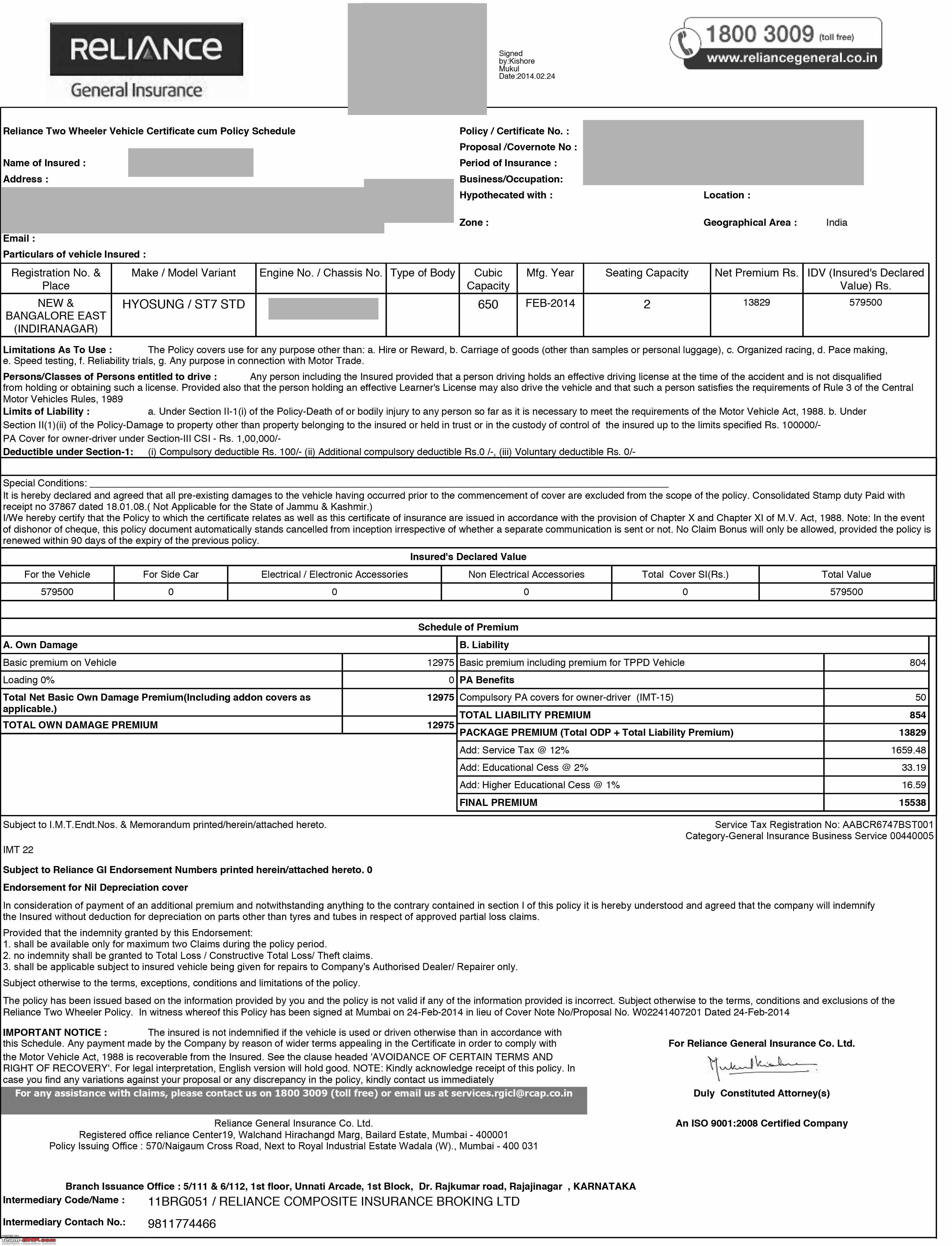

Premium of Duplicate Car Insurance Policy from New India Assurance

The premium of a Duplicate Car Insurance Policy from New India Assurance depends on several factors such as the make and model of the vehicle, the age of the vehicle, the driving history of the policyholder, the coverage opted for, the location of the vehicle and the type of coverage. Generally, the premium of a Duplicate Car Insurance Policy from New India Assurance is slightly higher than a single policy. This is because the policyholder is availing of the coverage from two policies.

Claim Process of Duplicate Car Insurance Policy from New India Assurance

In the event of an accident or theft, the policyholder can file a claim for both the policies simultaneously. The policyholder must first inform the insurer about the incident and provide all the relevant documents. The insurer will then assess the damage and inform the policyholder of the amount that can be claimed. The claim amount is usually processed within a few days and the policyholder can avail of the payment within a few weeks.

Conclusion

Duplicate Car Insurance Policy from New India Assurance is a great way to secure a car against any untoward incident. The policyholder can avail of the coverage from two policies and can also avail of discounts on the premium amount. In addition to this, the policyholder can avail of various benefits such as roadside assistance, towing services and 24/7 customer service. The policyholder must meet the eligibility criteria and provide all the relevant documents in order to avail of this policy. The premium of this policy is slightly higher than a single policy and the claim process is straightforward and hassle-free.

Four Wheeler Insurance Duplicate Insurance Copy Pdf / Guide To Get A

Policy Ownership Transfer Service for Motor Insurance Policy | New

Car Insurance Policy Sample Pdf - Financial Report

United India Insurance Proposal Form For Individual Personal Accident

Vehicle Insurance Transfer Form New India Assurance - INSURANCE DAY