Dual Fault Car Insurance Xoverage

What is Dual Fault Car Insurance Coverage?

Dual fault car insurance coverage is a type of automobile insurance policy that covers drivers in the event of an accident where both drivers are at fault. It is also known as shared fault or shared liability insurance. This type of coverage is offered by a few select insurance companies, and it can be an invaluable asset to drivers who are often involved in accidents. It can help to reduce the amount of money that is paid out in the event of an accident, and it can also provide additional peace of mind for drivers who are concerned about their financial liability.

How Dual Fault Car Insurance Coverage Works

Dual fault car insurance coverage works by providing coverage to the drivers involved in the accident. If both drivers are found to be at fault, then the insurance company will cover the costs associated with the accident. This coverage can be particularly helpful in situations where one driver is found to be more at fault than the other. In these cases, the insurance company can cover the costs associated with the accident, such as medical bills and property damage, up to the limits of the policy.

Benefits of Dual Fault Car Insurance Coverage

One of the primary benefits of dual fault car insurance coverage is that it can help to reduce the amount of money that is paid out in the event of an accident. If both drivers are found to be at fault, then the insurance company can cover the costs associated with the accident up to the limits of the policy. This can help to save drivers money in the long run, as it can help to reduce the amount of money that is paid out in the event of an accident. Additionally, this type of coverage can provide drivers with additional peace of mind, knowing that they will be covered in the event of an accident.

Drawbacks of Dual Fault Car Insurance Coverage

One of the primary drawbacks of dual fault car insurance coverage is that it can be difficult to obtain. This type of coverage is only offered by a select few insurance companies, and it can be difficult to find a company that offers this type of coverage. Additionally, this type of coverage can be expensive, as it can be more expensive than traditional automobile insurance policies. Additionally, this type of coverage can be difficult to understand, as the terms and conditions of the policy can be difficult to understand.

Conclusion

Dual fault car insurance coverage is a type of coverage that can be an invaluable asset for drivers who are often involved in accidents. It can help to reduce the amount of money that is paid out in the event of an accident, and it can also provide additional peace of mind for drivers who are concerned about their financial liability. However, it can be difficult to obtain this type of coverage, and it can be expensive. Additionally, the terms and conditions of the policy can be difficult to understand. It is important for drivers to understand the coverage they are purchasing and to make sure that it meets their needs.

What is Collision Insurance? | Allstate

Basic types of car insurance coverage explained | ABS-CBN News

“Full Coverage” Car Insurance Explained - YouTube

At Fault vs No Fault Auto Insurance - YouTube

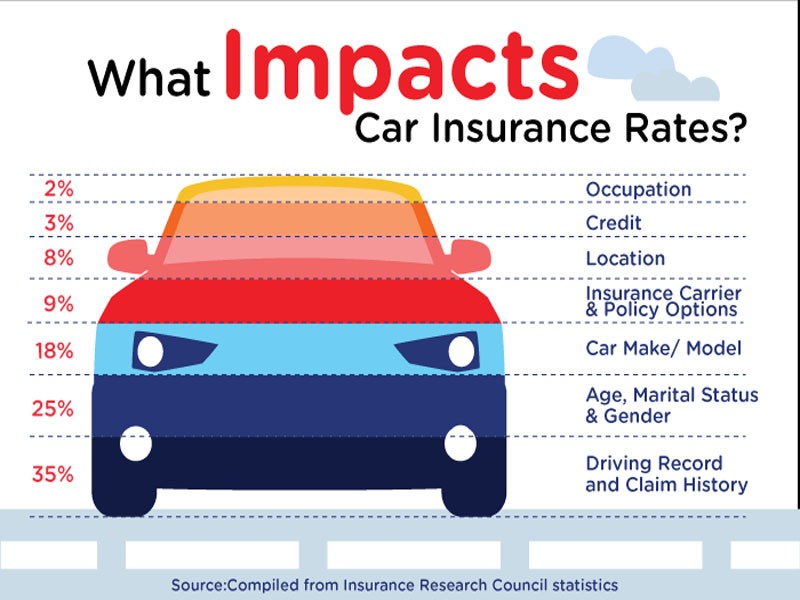

Recommended Car Insurance Coverage