Does My Insurance Cover Any Car I Drive Hastings Direct

Does My Insurance Cover Any Car I Drive?

When it comes to insurance, it is important to understand what is covered and what is not. It can be a tricky process to figure out, especially if you are driving someone else’s car. Many people wonder if they are covered if they drive a car that isn’t theirs, and the answer can vary depending on the type of policy that you have with your insurance company. In this article, we will cover the basics of insurance coverage when it comes to driving cars that aren’t your own.

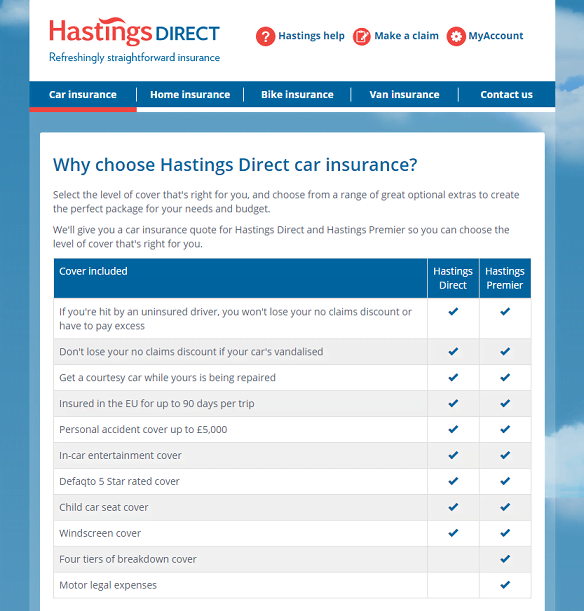

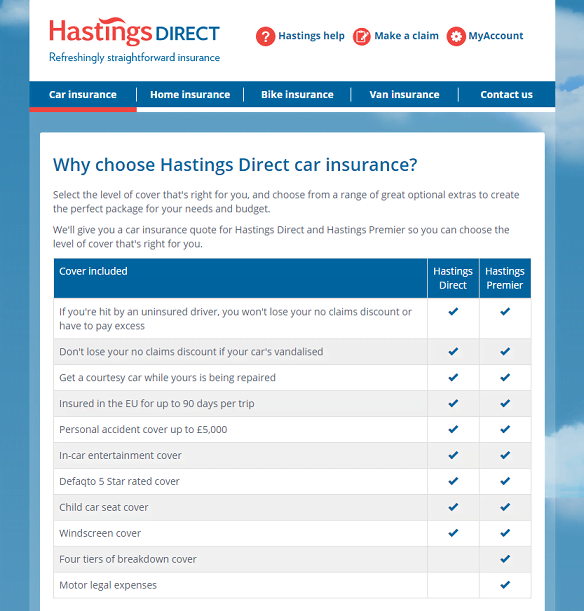

Hastings Direct Insurance Policies

Hastings Direct offers a range of different insurance policies to suit different needs. Depending on the policy you have, you may be covered if you drive someone else’s car. For example, if you have a Comprehensive policy with Hastings Direct, then you will be covered for any damage caused to the car you are driving, as well as any liability for third-party property.

If you have a Third-Party Fire and Theft policy with Hastings Direct, then you may be covered if the car you are driving is stolen, or if it is damaged due to fire. However, you will not be covered for any damage caused by an accident. If you have a Third-Party Only policy, then you will not be covered for any damage caused to the car you are driving, as well as any liability for third-party property.

Restrictions to Consider

It is important to note that even if you have a policy with Hastings Direct that covers you for driving someone else’s car, there are likely to be restrictions in place. For example, you may only be covered for a certain number of days, or you may only be covered if the car is owned by a family member. You should check your policy documents carefully to ensure that you are aware of any restrictions that may apply.

Alternative Options

If you are planning to drive someone else’s car for an extended period of time, then it is worth considering taking out additional cover. Hastings Direct offers temporary car insurance policies that can cover you for a specified period of time. This can be a good option if you are planning to drive someone else’s car for a few days or weeks.

Questions to Consider

When considering insurance coverage for driving someone else’s car, there are a few key questions that you should consider. Firstly, you should check with your insurance provider to see what is covered by your policy. Secondly, you should consider any restrictions that may apply, such as the length of time you can be covered for. Finally, you should consider taking out additional cover if you plan to drive someone else’s car for an extended period of time.

In conclusion, it is important to understand what is covered by your insurance policy when it comes to driving someone else’s car. It is worth taking the time to read your policy documents carefully and to understand any restrictions that may apply. If you are planning to drive someone else’s car for an extended period of time, then it is worth considering taking out additional cover.

Hastings Direct Car Insurance January Discount Offers & Cashback Deals

Hastings Direct Car Insurance Discount Offers & Cashback Deals