Does Liability Insurance Cover My Car If I Hit Someone

Does Liability Insurance Cover My Car If I Hit Someone?

What is Liability Insurance?

Liability insurance is a type of insurance coverage that is designed to protect you financially if you are found to be legally responsible for an accident or incident. It helps to cover the cost of any damages or injuries suffered by other people, as well as any legal fees or court costs that may be incurred. Liability insurance is usually included in most standard automobile insurance policies. It is important to understand the limitations of liability insurance and how it applies to your particular situation.

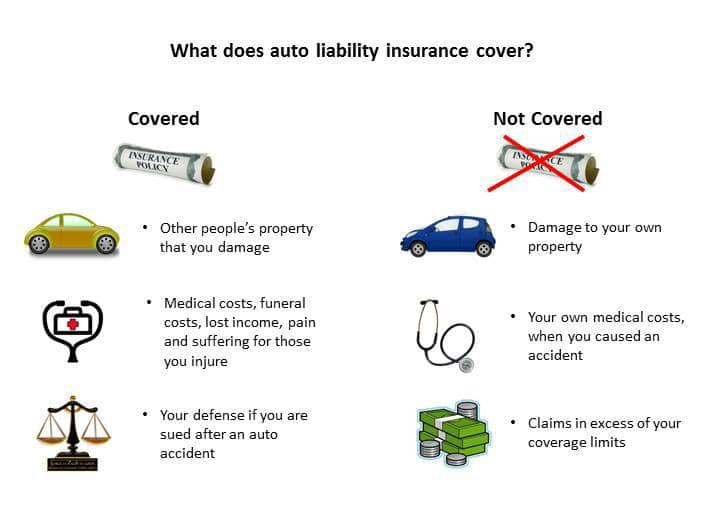

What Does Liability Insurance Cover?

When it comes to liability insurance, it covers expenses related to bodily injury or property damage that you may be legally responsible for in the event of an accident. This includes medical bills, lost wages, property damage, legal fees, and other related expenses. It does not cover any damages to your own car or any personal items that may be inside it. Additionally, liability insurance does not cover any damage that you may cause to yourself in the event of an accident.

Does Liability Insurance Cover My Car if I Hit Someone?

The short answer is no. Liability insurance does not cover any damage to your own car in the event of an accident. If you are at fault for an accident, liability insurance will help to cover any medical bills, property damage, and other costs associated with the accident, but it will not cover any damage to your own car. If you are concerned about covering your own car in the event of an accident, you may want to consider purchasing collision or comprehensive coverage.

What Other Types of Insurance Coverage are Available?

In addition to liability insurance, there are other types of automobile insurance coverage available. Collision coverage helps to cover any repairs or replacement of your car if you are involved in an accident, regardless of who is at fault. Comprehensive coverage helps to cover any repairs or replacement of your car in the event of theft, vandalism, fire, or other non-accident related events. Uninsured/underinsured motorist coverage helps to cover any expenses related to an accident caused by another driver who does not have adequate insurance coverage.

Conclusion

Liability insurance is an important part of any automobile insurance policy. It helps to cover any expenses related to an accident in which you are found to be legally responsible. However, it does not cover any damage to your own car in the event of an accident. To protect yourself and your car, you may want to consider purchasing additional types of coverage such as collision or comprehensive coverage. Be sure to speak to your insurance agent to determine the best coverage for your particular situation.

What Does Liability Car Insurance Cover? | Direct Auto

Auto Liability Insurance - What It Is and How to Buy

What Is Liability Insurance? | Allstate

What Does Liability Auto Insurance Cover ~ wow

What Does Liability Only For Auto Insurance Cover? - YouTube