Car Insurance With Gap Coverage

Car Insurance With Gap Coverage Explained

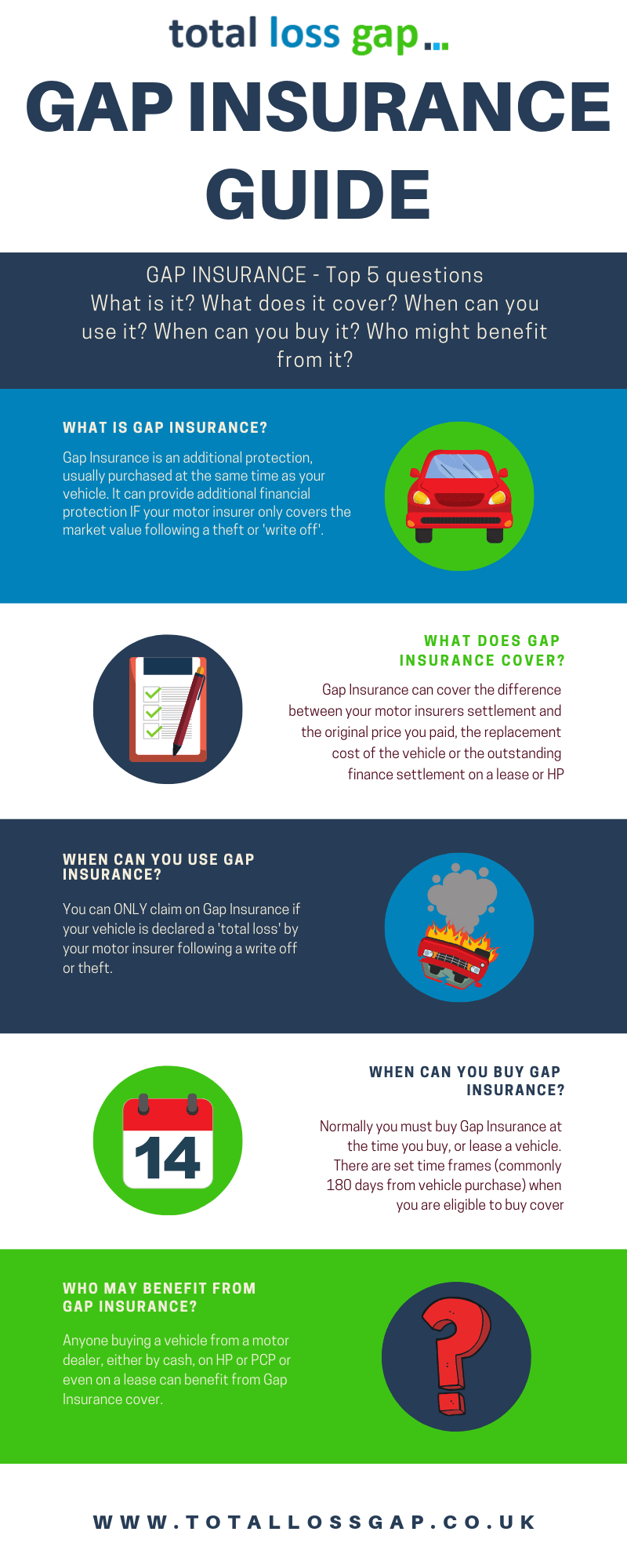

What is Gap Insurance?

Gap insurance is a type of auto insurance that is specifically designed to provide coverage when you owe more on your car loan than the car is actually worth. In the event of a total loss or theft, gap insurance will cover the difference between the actual cash value of your car and the balance of the loan or lease that you owe. It is typically used when you have purchased a car with a loan or lease and the car’s value depreciates more rapidly than the loan balance is paid down. Gap insurance is often offered as part of an auto insurance package.

Why Do I Need Gap Insurance?

If you have an auto loan or lease, you may need gap insurance to protect yourself from potential financial losses in the event of an accident or theft. If you are making payments on an auto loan or lease, you may owe more on the loan than the actual value of the car. This is called being “upside down” on the loan or lease. If something happens to the car and it is declared a total loss or stolen, you could be left with a large balance due on the loan. Gap insurance helps to protect you from this potential financial loss.

How Does Gap Insurance Work?

Gap insurance is designed to provide coverage in the event of a total loss or theft. If your car is declared a total loss or stolen, gap insurance will cover the difference between the actual cash value of the car and the balance of the loan or lease. Gap insurance does not cover maintenance or repair costs. It is important to make sure that your gap insurance coverage is up to date in order to be fully protected.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the type of car, the amount of coverage, and the insurer. Generally, gap insurance is more expensive for newer cars and for cars that are more expensive to insure. Most insurers offer gap insurance as an add-on to a comprehensive auto insurance policy. The cost of gap insurance is usually a percentage of the total cost of the comprehensive auto insurance policy.

What Are the Benefits of Gap Insurance?

Gap insurance provides peace of mind and can help to protect you from unexpected financial losses in the event of an accident or theft. It can also help to ensure that you are not left with a large balance due on an auto loan or lease. Gap insurance can also provide additional protection in the event of a total loss or theft. It can help to cover the difference between the actual cash value of the car and the loan balance.

Conclusion

Gap insurance is an important part of an auto insurance package. It is designed to provide coverage in the event of a total loss or theft. Gap insurance can help to protect you from potential financial losses and ensure that you are not left with a large balance due on an auto loan or lease. The cost of gap insurance depends on the type of car, the amount of coverage, and the insurer. Gap insurance can provide peace of mind and help to protect you from unexpected financial losses.

Understanding Auto Insurance “Gap Coverage“

Do I Need Gap Insurance On New Car - TRAVELVOS

Do Not Get Taken For A Ride When Looking For Auto Insurance — shaketext5

What Is Gap Insurance On A Vehicle - Insurance Reference

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS