Car Insurance For High Risk Drivers In California

Tuesday, October 29, 2024

Edit

Car Insurance For High Risk Drivers In California

The High Risk of Driving in California

Driving in California can be a risky endeavor. With one of the highest populations in the country, California roads are often congested and chaotic. In addition, the cost of living in California is high, and that includes the cost of car insurance. Depending on your driving record and other factors, you could be classified as a “high-risk” driver and be faced with extremely expensive insurance rates.

High-risk drivers are those who have been found to be at a higher risk of being involved in an accident. This is usually due to a history of moving violations, DUI/DWI convictions, or other factors. Insurance companies calculate your risk based on your driving history, age, gender, and other factors. Unfortunately, they often charge higher rates to high-risk drivers in order to offset their potential risk.

Options for High-Risk Drivers in California

If you’re classified as a high-risk driver in California, you still have options for car insurance. You may be able to find a company that specializes in providing coverage for high-risk drivers. These companies may be able to offer you a lower rate than other insurers. Additionally, you may be able to find an insurer that offers discounts for drivers who have taken a defensive driving course or completed other safety-related courses.

You may also be able to find an insurer that offers a pay-as-you-go plan. These plans are based on the number of miles you drive, so you only pay for the coverage you need. Additionally, some insurers offer discounts to drivers who drive fewer miles and maintain a clean driving record.

What to Look for When Shopping for Car Insurance

When shopping for car insurance, it’s important to do your research. Compare rates from multiple companies and look for discounts. Ask about the company’s customer service and claims process. Make sure you understand the terms and conditions of the policy, including the deductible and coverage limits. Additionally, make sure you understand the company’s cancellation policy.

It’s also important to read customer reviews. You can find reviews online or ask friends and family for their opinion. It’s also a good idea to get quotes from at least three different companies. This will give you an idea of what’s available and allow you to compare rates.

Tips for Keeping Your Rates Low

There are several things you can do to keep your car insurance rates low. If you’re a high-risk driver, be sure to maintain a clean driving record. Avoid speeding tickets, reckless driving, and other moving violations. Additionally, take a defensive driving course or enroll in a safe driving program. This may help to reduce your rates.

It’s also a good idea to shop around for car insurance. Compare rates from multiple companies and look for discounts. Ask about the company’s customer service and claims process. Additionally, make sure you understand the terms and conditions of the policy, including the deductible and coverage limits.

Finally, consider raising your deductible. Increasing your deductible can lower your rates, but make sure you can afford to pay the higher deductible in the event of an accident.

Conclusion

If you’re a high-risk driver in California, you may be faced with expensive car insurance rates. However, there are options available to you. Shop around for car insurance and look for discounts. Additionally, maintain a clean driving record and take a defensive driving course in order to keep your rates low. With a little bit of research, you can find the right car insurance for you.

Full coverage car insurance in california by Promax Insurance Agency

Auto Insurance for High Risk Drivers - 2017 High Risk Auto Insurance

Cheap Car Insurance High Risk Drivers

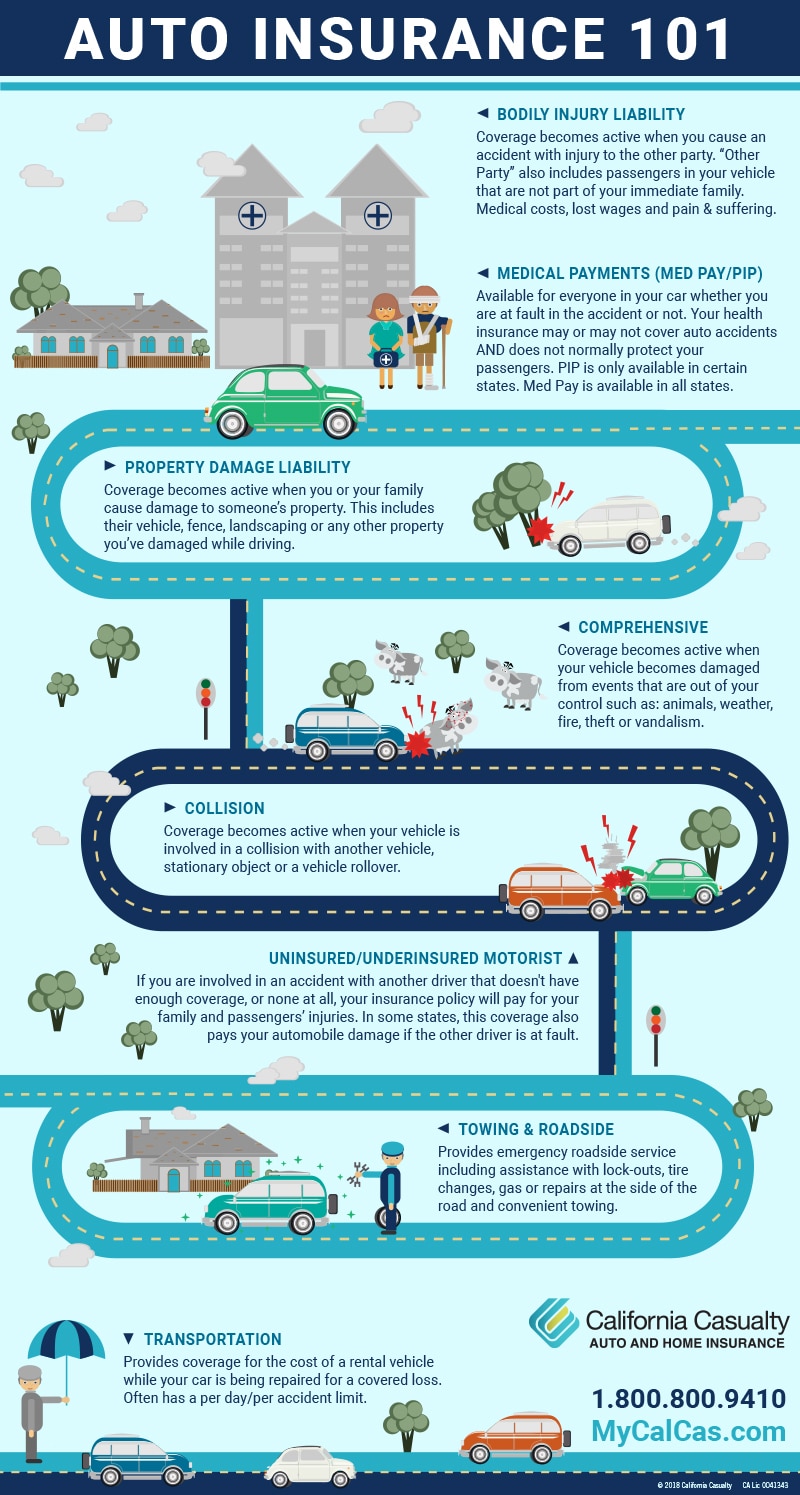

Auto Insurance 101 | California Casualty

California High Risk Auto Insurance | Low SR22 Insurance Rates