Car Insurance Claim Process Coles

Understanding the Car Insurance Claim Process with Coles

Coles offers a range of car insurance products, designed to cover you in the event of an accident or other unforeseen incident. While no one likes to think about it, understanding the car insurance claim process with Coles can help you prepare in the event of an accident. This article will explain what is involved in the car insurance claim process with Coles, so you can ensure you have the right cover for your needs.

What is the Car Insurance Claim Process?

The car insurance claim process is the process by which you make a claim on your car insurance policy. It involves filing a claim with Coles, providing evidence of the accident or incident, and working with Coles to determine the amount of compensation you will receive. Depending on the type of car insurance policy you have and the details of your claim, the process may take several weeks to complete.

When Should You Make a Car Insurance Claim?

You should make a car insurance claim when you experience an accident or incident that is covered by your policy. This could include a car accident, theft of your vehicle, or damage caused by a natural disaster. It’s important to remember that each policy is different and will cover different types of incidents, so you should check your policy to make sure you are eligible for a claim.

What Steps Are Involved in the Car Insurance Claim Process?

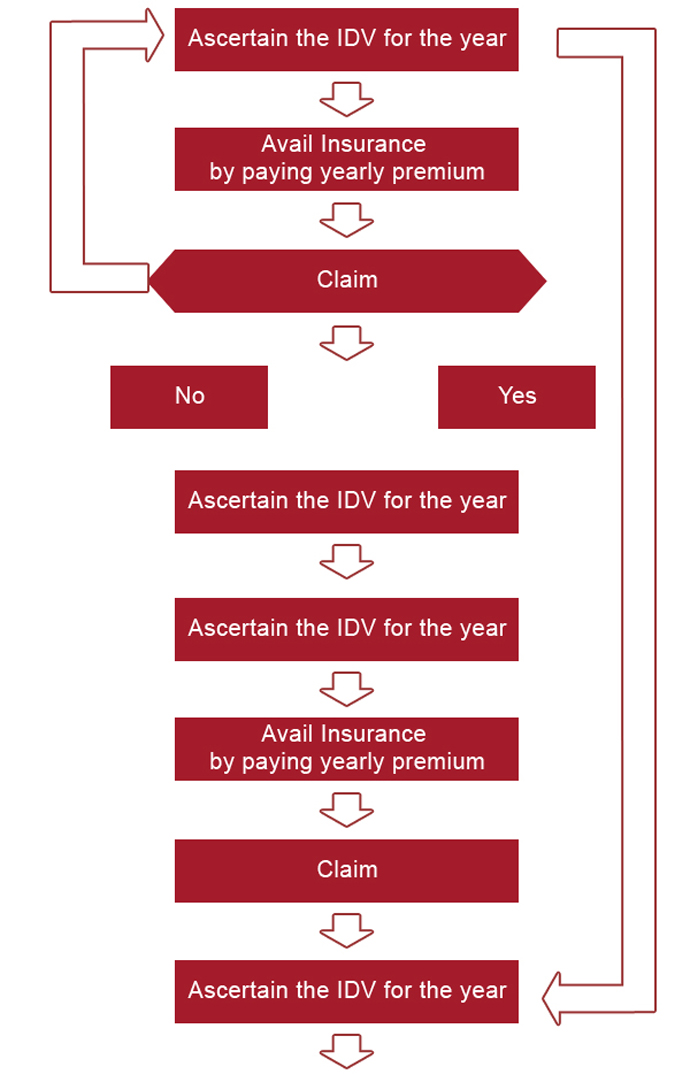

The first step in the car insurance claim process is to contact Coles and file a claim. You will need to provide details of the incident, including the date and time, as well as any information on the other vehicle or person involved. You will also need to provide evidence of the incident, such as photos or police reports. Once your claim is filed, Coles will assess the claim and determine if you are eligible for compensation.

The Second Step in the Claim Process

The second step in the car insurance claim process is to provide Coles with any evidence they request. This could include photos of the incident, police reports, or witness statements. Depending on the type of claim you have filed, Coles may also request additional information, such as repair bills or proof of ownership. Once Coles has all the evidence they need, they will assess your claim and determine the amount of compensation you will receive.

The Third Step in the Claim Process

The third step in the car insurance claim process is for Coles to process your claim and provide you with a final decision. This could include a payment for the repairs to your vehicle, or a payout for the replacement of your vehicle if it is a total loss. Once you have received the final decision from Coles, you can decide whether to accept or reject the decision.

Conclusion

Understanding the car insurance claim process with Coles can help you prepare in the event of an accident. It is important to remember that each policy is different and will cover different types of incidents, so you should check your policy to make sure you are eligible for a claim. Additionally, Coles will require evidence of the incident, such as photos or police reports, which you should provide as soon as possible to ensure a smooth and speedy process.

Filing an Insurance Claim After an Accident - McIntyre Law P.C.

How Long Do You Have To File An Insurance Claim For An Accident

Steps for Making A Car Insurance Claim | Visual.ly

Demystifying Car Insurance

Insurance Claim Process - Car Insurance Claim Motor Insurance - Like