Average Car Insurance Rates By State And Age

Average Car Insurance Rates By State And Age

What Factors Determine Car Insurance Rates?

When it comes to car insurance, everyone wants to know what factors determine their rates. Car insurance is an important purchase to make as it keeps you protected in the event of an accident, and getting the best rates for your situation is essential. There are a few factors that come into play when insurance companies determine your rates. The most common factors are your age, where you live, your driving record, the type of car you drive, and the coverage you select.

Average Car Insurance Rates By State

Car insurance rates vary from state to state due to a variety of factors, including the minimum coverage requirements, the number of uninsured drivers, and the overall cost of living in the area. For example, states with higher population density, such as Florida and California, tend to have higher rates. On the other hand, states with lower population density, such as Wyoming and Montana, tend to have lower rates.

The average annual car insurance rate in the US is $1,548 according to the Insurance Information Institute. The most expensive state is Michigan, with an average annual rate of $2,693, while the cheapest is Maine, with an average annual rate of $874.

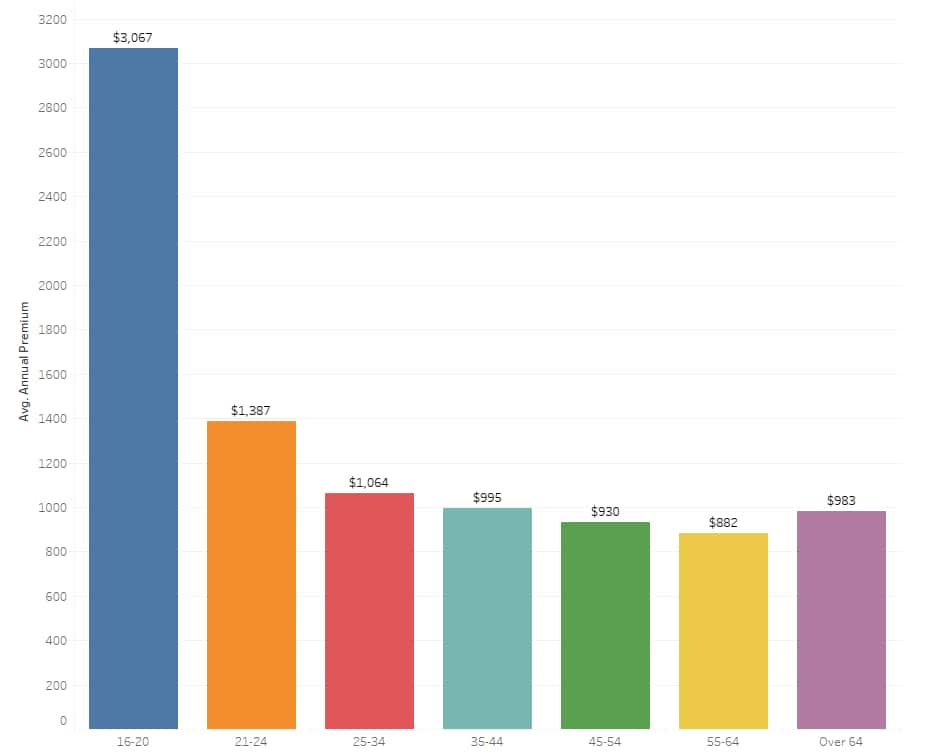

Average Car Insurance Rates By Age

Your age is another important factor that determines your car insurance rates. Generally speaking, the younger you are, the higher your rates will be. This is because younger drivers are more likely to be involved in an accident. As you get older and gain more experience, your rates will start to decrease.

According to the Insurance Information Institute, the average annual rate for drivers aged 16-19 is $5,987, while the average annual rate for drivers aged 20-24 is $3,383. For drivers aged 25-29, the average annual rate is $2,403, and for drivers aged 30-39, the average annual rate is $2,034. Drivers aged 40-49 have an average annual rate of $1,845, while drivers aged 50-59 have an average annual rate of $1,637. Finally, drivers aged 60-69 have an average annual rate of $1,560.

How To Get The Best Car Insurance Rates

When it comes to getting the best car insurance rates, there are a few things you can do. First, shop around and compare rates from different providers. You may find that one provider offers better rates than another. Second, take advantage of discounts. Many providers offer discounts for things such as having a good driving record, bundling multiple policies, or having a certain type of car. Finally, consider raising your deductible. A higher deductible means that you will have to pay more out of pocket in the event of an accident, but it can also mean lower rates.

Conclusion

Car insurance rates vary by state and age, so it's important to shop around to get the best rates for your situation. By taking advantage of discounts and raising your deductible, you may be able to save money on your car insurance. Ultimately, your goal should be to find the right balance between coverage and cost.

ALL You Need to Know About the Average Car Insurance Cost

The average cost of car insurance in the US, from coast to coast

Find Out Which States Have the Most Expensive Car Insurance Rates in 2018

Auto insurance for seniors: Discounts and tips for saving| Insurance.com

What do Americans Pay for Car Insurance in 2019?