Auto Owners Car Insurance Claims

Auto Owners Car Insurance Claims: Everything You Need to Know

Introduction

Having car insurance is an important step for any car owner. It offers peace of mind and financial protection in the event of an accident or other unexpected event. Auto Owners Car Insurance is one of the top insurance companies in the United States and is well known for its high quality customer service and competitive prices. Whether you are a new car owner or you have been insured with Auto Owners for years, knowing how to make a claim can be beneficial. Here is an overview of the Auto Owners Car Insurance claims process.

Types of Claims

Auto Owners offers a variety of different types of claims. These include: bodily injury, property damage, medical payments, and uninsured/underinsured motorist protection. Depending on the type of coverage you have, you may be able to make a claim for any of these types of claims. It is important to understand the coverage you have so that you can make the best decision when filing a claim.

Filing a Claim

When filing a claim with Auto Owners, you will need to provide certain documents and information. This includes documentation of the incident, such as a police report, pictures of the damage, and any medical bills or other expenses that are related to the incident. You will also need to provide your contact information and the contact information of any witnesses that may have been present. Once all of this information has been provided, Auto Owners will review the claim and determine if it is valid. If the claim is valid, they will provide you with an estimate of the cost of repairs or medical bills.

Making Payment

Once an estimate has been provided, it is time to make payment. Auto Owners will work with you to determine the best payment plan for you. This may include a lump sum payment or monthly payments. You may also be able to use a payment plan to spread the cost of repairs over several months. Depending on the type of claim, Auto Owners may also provide a rental car while your car is being repaired or while you are waiting for reimbursement.

Closing a Claim

Once the claim has been resolved and payment has been made, the claim is considered closed. Auto Owners may require that you provide proof of payment before closing the claim. This may include a copy of the check or a copy of the bank statement that shows the payment was received. Once all of the paperwork has been received and reviewed, Auto Owners will close the claim.

Conclusion

The Auto Owners Car Insurance claims process is simple and efficient. Knowing the details of the process can help you make sure that you are taking the right steps when filing a claim. Whether you are a new or existing policyholder, Auto Owners is committed to providing a smooth and hassle-free claims process. With the right information and documents, you can ensure that your claim is resolved quickly and efficiently.

Revealed: the best and worst car insurers for claims handling

Auto-Owners Insurance – Logos Download

5 Types of Car Insurance Claims | ABS-CBN News

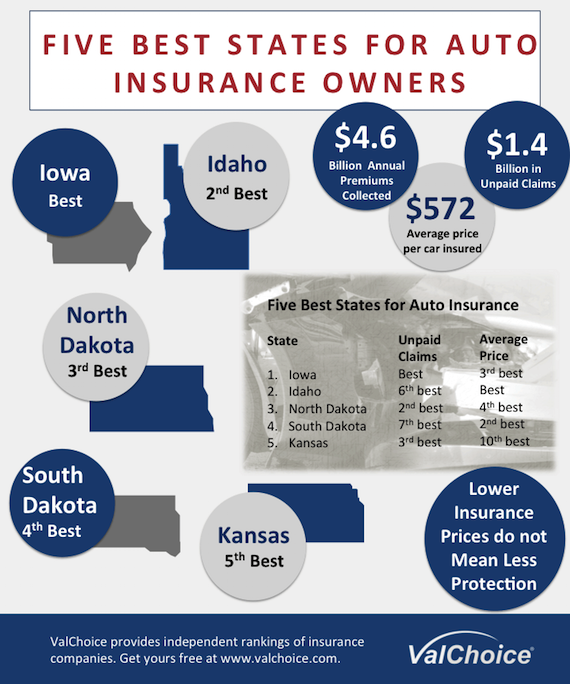

Five Best States for Auto Insurance Owners - ValChoice