Auto Insurance That Offers Gap Coverage

What is Gap Insurance?

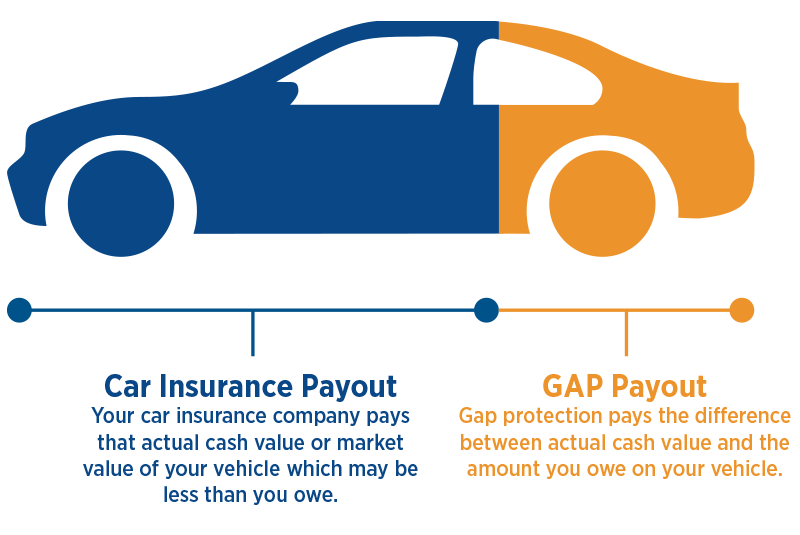

Gap Insurance is a type of car insurance coverage that helps to protect you if you have an auto loan or lease. Gap Insurance is designed to help you pay off the difference between the actual cash value of your car and what you owe on the loan if the car is totaled or stolen. The coverage will pay off the difference between what you owe on the car and the amount that your insurance company pays you. In order to be eligible for Gap Insurance, you must have a car loan or lease and you must purchase comprehensive and collision coverage.

Gap Insurance is important to have if you owe more money on your car than it is worth. If you have an auto loan or lease, the amount you owe could be higher than the value of the vehicle. This is because cars start to depreciate in value quickly after they are purchased. If you are in an accident, the insurance company will pay what the car is worth at the time of the accident. If you owe more than the car is worth, you will be responsible for the remaining balance.

Benefits of Gap Insurance

Gap Insurance can be a great way to protect yourself financially in the event of a total loss. Without Gap Insurance, you could end up owing your lender thousands of dollars. Gap Insurance can help you to avoid this financial burden. It can also help you to get a better deal on your car loan or lease, as lenders may be willing to offer lower rates if you have Gap Insurance.

Another benefit of Gap Insurance is that it can help to protect you if you have to buy a new car after an accident. If you have Gap Insurance, your insurance company will pay the difference between what your car was worth at the time of the accident and the cost of a new car. This can help to ensure that you don’t have to pay out of pocket for a new car after an accident.

Finding an Auto Insurance Company That Offers Gap Coverage

When looking for an auto insurance company, it is important to make sure that the company offers Gap Insurance. Many auto insurance companies offer Gap Insurance, so it is important to compare rates and coverage. You should also make sure that the coverage is adequate for your needs. You should also make sure that the company offers other types of coverage, such as liability and collision coverage.

It is also important to read the fine print of your policy carefully. Gap Insurance is a type of coverage that is often excluded from auto insurance policies. It is important to make sure that you understand what is and is not covered by Gap Insurance before you purchase a policy.

Conclusion

Gap Insurance is a type of auto insurance coverage that can help to protect you financially in the event of a total loss. If you have an auto loan or lease, Gap Insurance can help to pay off the difference between the actual cash value of your car and what you owe. It is important to make sure that you find an auto insurance company that offers Gap Insurance, and to read the fine print of your policy carefully.

Gap Insurance Protects During Hard Times | Wichita Toyota Financing Options

Understanding Auto Insurance “Gap Coverage“

Buying A Car Gap Insurance ~ designologer

Guaranteed Asset Protection | Texas Car GAP Insurance | CRCU

Car Insurance With Gap Coverage - Gap Coverage Plan Buick Protection