Third Party Administrators For The Self Insured

Thursday, September 5, 2024

Edit

Third Party Administrators For The Self Insured

What Is a Third Party Administrator (TPA)?

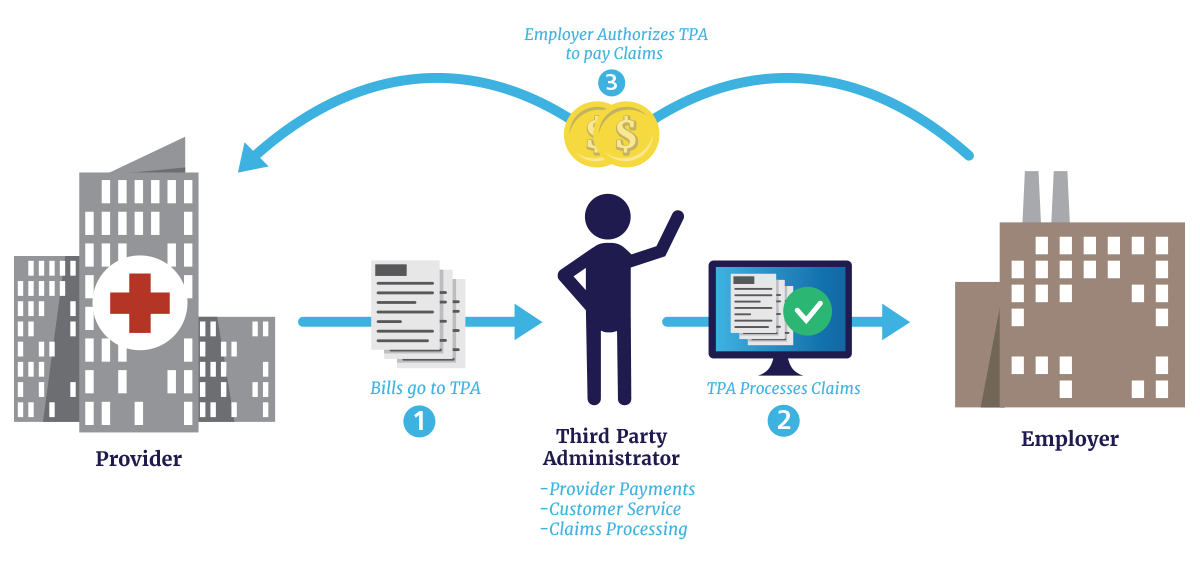

A third-party administrator (TPA) is a company that specializes in administering employee benefits and other services on behalf of an employer. TPAs provide services such as claims processing, network management, utilization review, and other administrative services, often at a lower cost than the employer could do in-house. TPAs also provide employers with expertise in areas such as compliance, employee communication, and cost containment. TPAs are often used by self-insured employers, who are responsible for the cost of their employee benefits and other services, such as workers’ compensation, rather than having the insurer handle the risk.

The Benefits of Using a TPA for Self-Insured Employers

When it comes to self-insured employers, a TPA can provide a variety of benefits. By outsourcing the administrative tasks of employee benefits and other services, employers can focus on their core business activities. TPAs provide the expertise and experience needed to ensure the employer is in compliance with applicable laws and regulations, as well as providing cost savings and improved efficiency. TPAs can also help employers to provide better communication and education to employees, leading to a more informed workforce and better utilization of benefits.

What Services Do TPAs Provide?

TPAs provide a variety of services to self-insured employers. These services include claims processing, network management, utilization review, and other administrative services. TPAs can also provide expertise in areas such as compliance, employee communication, and cost containment. The services provided by TPAs are tailored to the needs of the employer and can be expanded or contracted as needed.

How Do TPAs Help Self-Insured Employers?

TPAs can help self-insured employers in many ways. They provide the expertise needed to ensure the employer is in compliance with applicable laws and regulations. TPAs can also provide cost savings and improved efficiency by taking over the administrative tasks associated with employee benefits and other services. TPAs can also help employers to provide better communication and education to employees, leading to a more informed workforce and better utilization of benefits.

Choosing a TPA

When choosing a TPA, it is important to consider the services they offer and the expertise they have in the areas that are important to your business. It is also important to look for a TPA that will provide the best value for your business. This includes looking at their fees, the quality of their services, and the level of customer service they provide.

Conclusion

Third-party administrators can provide a variety of services to self-insured employers, including claims processing, network management, utilization review, and other administrative services. They can also provide expertise in areas such as compliance, employee communication, and cost containment. When choosing a TPA, it is important to consider the services they offer and the expertise they have in the areas that are important to your business. It is also important to look for a TPA that will provide the best value for your business.

Self-Insured and The Need for Third-Party Administrators

Self-Insured and The Need for Third-Party Administrators

What are Self-Funded Health Benefit Plans? - Varipro

Third Party Administrators - ProPeer

Self Funded Insurance Plans - Understanding the Basics of Self- funded