Should I Buy Insurance For Rental Car Online

Should You Buy Insurance For Rental Car Online?

Why Buy Insurance For Rental Car?

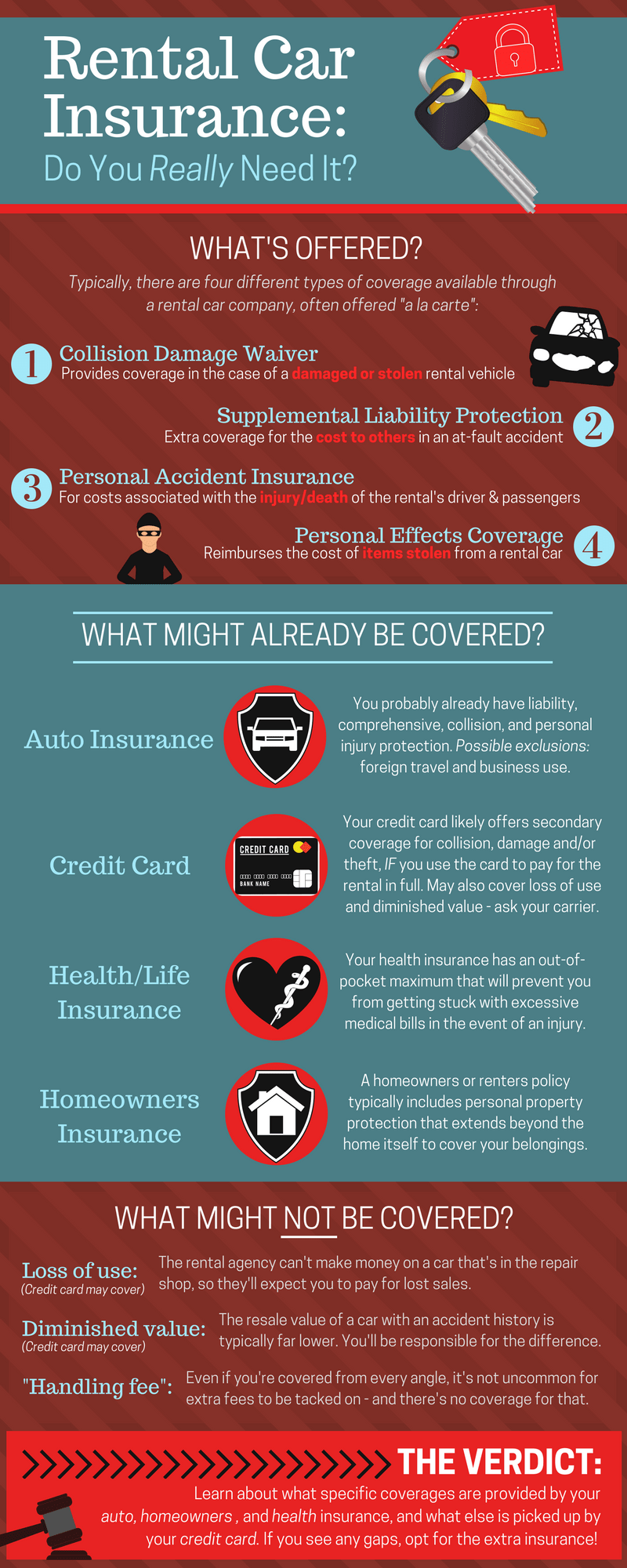

When booking a rental car online, you may be offered a variety of insurance options. It's important to understand why these are necessary, and whether or not they're worth it. When you rent a car, you're responsible for any damage to the vehicle, so it's important to make sure you have the right coverage to protect you in the event of an accident or other damage.

Car rental insurance can provide you with the peace of mind of knowing you're covered in the event of an accident or other damage. It can also provide you with additional coverage in the event of a breakdown or other mechanical issue. Additionally, if you're using a rental car for travelling, you may be able to get some additional coverage for theft or vandalism.

Types of Insurance

When you buy insurance for a rental car online, you'll typically be offered two types of insurance – liability and collision. Liability covers any damages to other people or property, while collision covers any damages to the vehicle itself. You may also be offered additional coverage, such as personal accident insurance, uninsured motorist coverage, or rental car reimbursement.

When considering the type of coverage you need, it's important to consider the risks you'll be taking. For example, if you're travelling in a remote area, you may want to consider additional coverage for theft or vandalism. Additionally, if you plan to use the rental car for business trips, you may want to consider personal accident insurance or rental car reimbursement.

Cost of Insurance

The cost of insurance for a rental car will vary depending on the type of coverage you choose and the length of your rental period. Generally, the longer the rental period, the more expensive the insurance. Additionally, the type of car you rent, as well as the rental company, can also affect the cost of insurance.

It's important to compare different rates from different companies to make sure you're getting the best deal. Additionally, if you're a member of an auto club or credit union, you may be eligible for additional discounts. It's also important to make sure you understand the terms and conditions of the insurance policy, as some policies may have exclusions or limitations.

When To Buy Insurance

It's best to buy insurance for a rental car before you pick up the vehicle. That way you can make sure you have the coverage you need and the cost of the insurance is included in the total price of the rental. Additionally, if you purchase insurance online, you may be able to save money by taking advantage of discounts or promotions.

It's important to note that you may be able to purchase insurance from your own auto insurance provider. This may be a more cost-effective option, as you may already be covered for rental car insurance. You should also check with your credit card company, as some cards offer complimentary rental car insurance.

Conclusion

Buying insurance for a rental car online is a great way to make sure you have the coverage you need. It's important to compare different policies to make sure you're getting the best deal. Additionally, you should make sure you understand the terms and conditions of the policy, as some policies may have exclusions or limitations. By doing your research and shopping around, you can ensure that you have the right coverage for your rental car.

Is It Necessary to Buy Rental Car Insurance? | RamseySolutions.com

Michigan Personal Property Tax Car Registration - Property Walls

Should I Purchase Rental Car Insurance? | Central Oregon

Car Rental Insurance: Do I Really Need It? - Crush the Road

Do You Need To Buy The Insurance When Renting A Car - BOOKCASE IDEAS