New India Car Insurance Renewal

New India Car Insurance Renewal – Get the Best Deals & Coverage

Getting Your Car Insured – Why Should You Do It?

Car insurance is essential for any vehicle owner, as it offers financial protection against physical damage and bodily injury caused by road accidents and other such perils. It is a legal requirement to have car insurance in India, and the Motor Vehicles Act 1988 makes it mandatory for all car owners to purchase and renew their car insurance policy at regular intervals. Car insurance is not only required for legal reasons, but also for your own protection. An insurance policy offers you protection from financial losses, covers for medical expenses and any damages that may be caused to your vehicle.

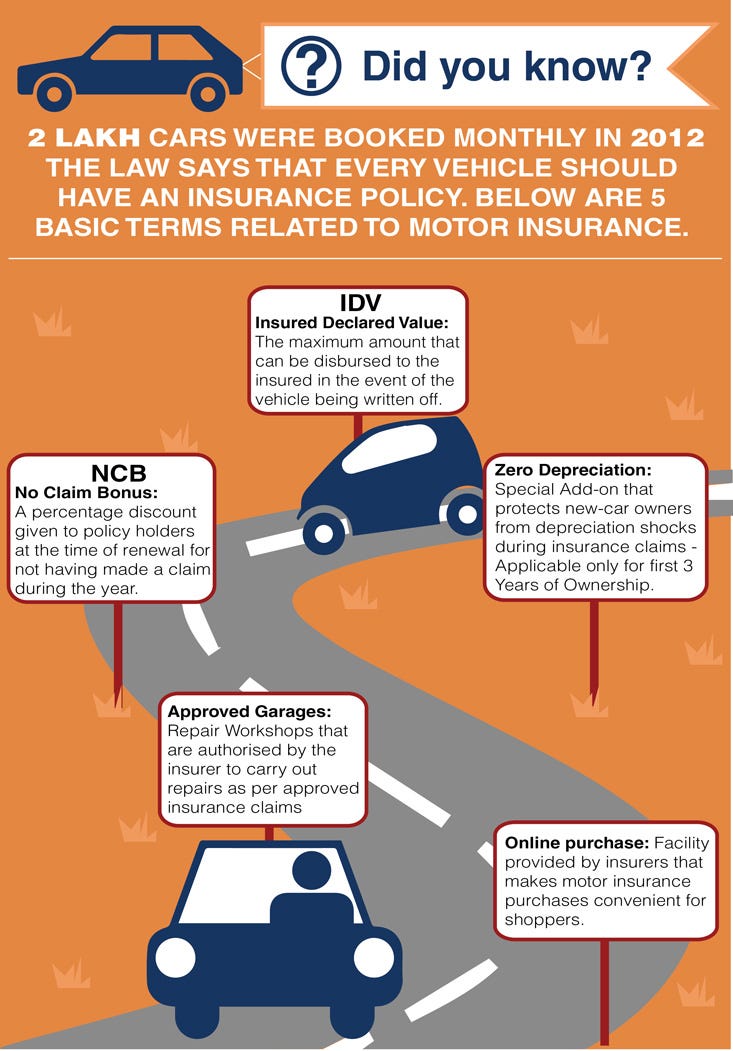

What Does a Car Insurance Policy Cover?

A car insurance policy covers you against any losses or damages caused to your car due to accidents, fire, theft, or any other legal liability. It also covers you against any legal liabilities that may arise due to the damage caused to other people, property, or vehicles. Generally, the coverage of a car insurance policy includes the following:

- Cover for third-party liabilities

- Cover for damage to own car due to accidents

- Cover for theft of the car

- Cover for personal accident

- Cover for damage caused due to natural calamities

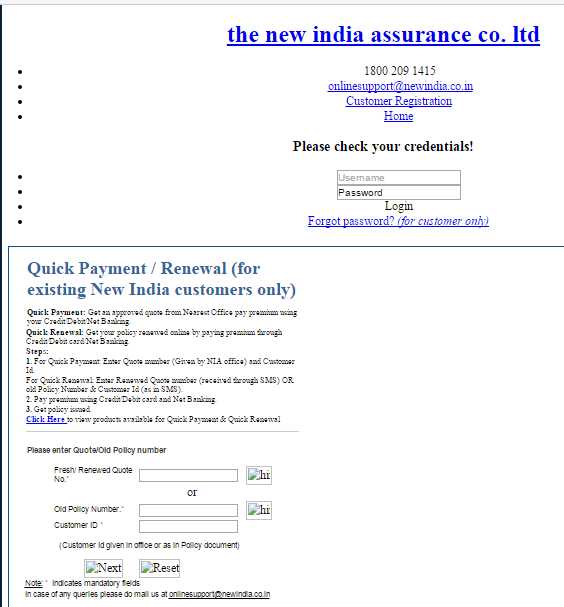

How to Renew Your India Car Insurance?

Renewing your car insurance policy is an easy and hassle-free process. You can renew your car insurance online, either by visiting the insurance company’s website or by using a third-party online insurance aggregator. You can also renew your car insurance offline, by visiting the nearest branch of the insurance company. Before renewing your car insurance policy, it is important to compare the different policies available from different insurers and select the one that best suits your needs and budget. Here are the steps you need to follow to renew your car insurance policy:

- Visit the website of the insurer or an online aggregator.

- Enter your car details, such as the registration number and the make and model of your car.

- Fill in the required information, such as your contact details, address, and other relevant details.

- Choose the type of policy you want to purchase and select the coverage and other features.

- Make the payment and your policy will be issued.

Important Points to Consider Before Renewing Your Car Insurance

Before renewing your car insurance policy, it is important to consider the following points:

- Compare the premiums, coverage and other features of different insurers.

- Check the add-on covers and opt for the ones that best suit your needs.

- Check for discounts or cashback offers.

- Check the claim settlement ratio of the insurer.

- Check the online reviews of the insurer.

Renewing your car insurance policy is an important step towards protecting yourself and your vehicle. Make sure that you compare the different policies available and select the one that best suits your needs and budget. With the right car insurance policy, you can ensure that you are covered against any losses or damages caused due to accidents or other perils.

New India Car Insurance - Renewal, Reviews & Premium Calculator

new-india-assurance-co-ltd-car-insurance-renewal.pdf | DocDroid

What Is Renewed Quote Number New India Assurance | tamararossean

Car Insurance Renewal Online Zero Depreciation - New Cars Review

Maruti Insurance Policy | Maruti Insurance Renewal.