Maruti Car Insurance Policy Print

Maruti Car Insurance Policy Print: Avail Comprehensive Coverage!

All About Maruti Car Insurance

Maruti Suzuki, India’s leading car manufacturer, offers a wide range of cars that are reliable, affordable, and are a great choice for budget-conscious buyers. Additionally, Maruti Suzuki offers comprehensive car insurance policies that offer the much-needed financial security in case of an emergency. With Maruti Suzuki’s car insurance policy, you can get coverage for accidental damage, third-party liability, and other losses. In this article, we will discuss the Maruti car insurance policy print and how you can avail comprehensive coverage.

Benefits of Maruti Car Insurance

Maruti Suzuki car insurance offers a range of benefits for its customers. Some of these benefits include:

- Comprehensive coverage for accidental damage, third-party liability, and other losses.

- Easy and hassle-free claim settlement process.

- Round-the-clock customer support.

- Cashless claim settlement at Maruti Suzuki authorized garages.

- Discounts on premiums when the policy is renewed.

- Discounts on premiums when the car is fitted with an anti-theft device.

- Discounts on premiums when the car is fitted with an anti-theft device.

Maruti Car Insurance Policy Print

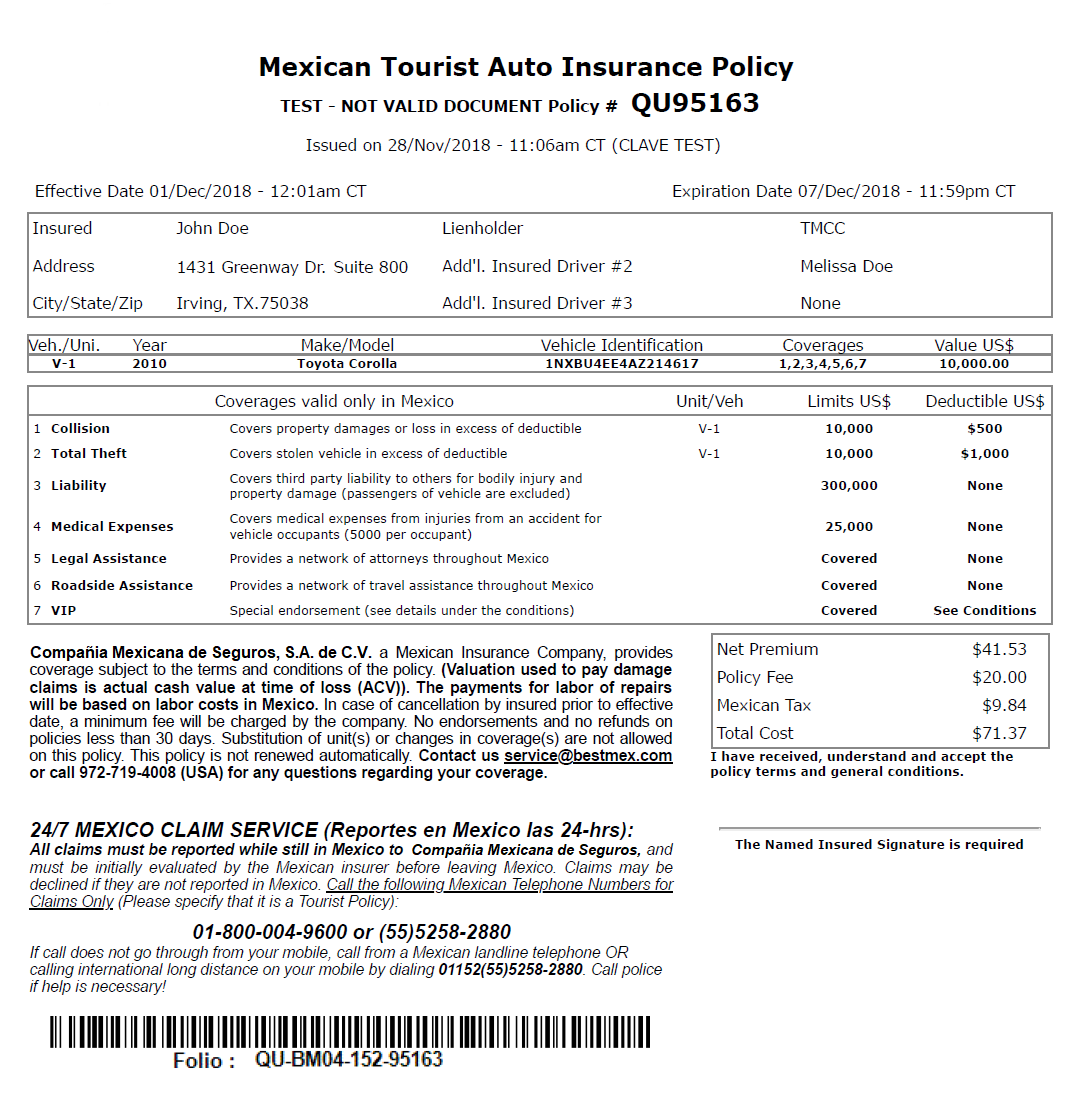

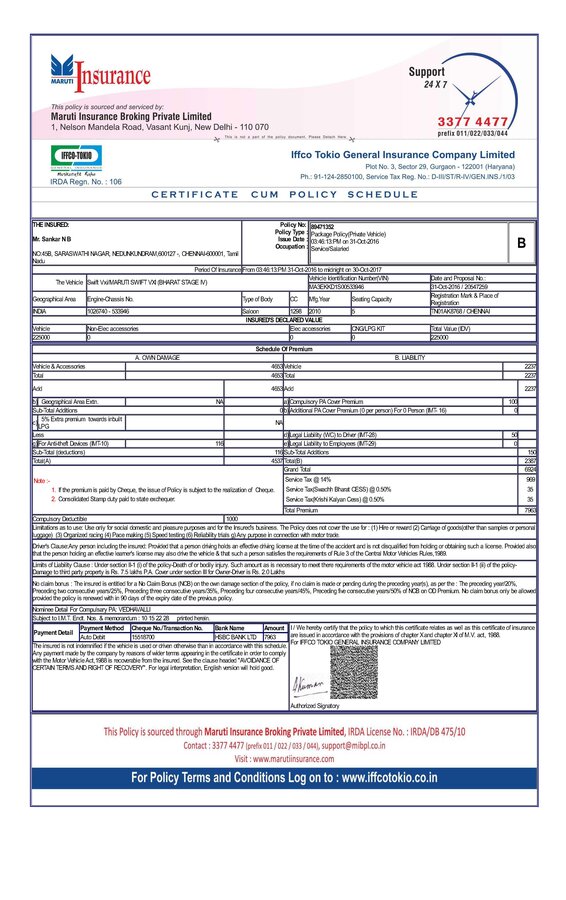

Maruti Suzuki offers a wide range of car insurance policies, with each policy having a different set of features and benefits. The Maruti car insurance policy print contains all the important details about the policy such as the coverage, the premiums, the policy term, the exclusions, etc. The policy print also contains important instructions on how to make a claim in case of an emergency. It is important to go through the policy print carefully before taking out a car insurance policy so that you understand the terms and conditions of the policy.

How to Buy Maruti Car Insurance?

Buying Maruti car insurance is an easy and hassle-free process. You can buy a Maruti car insurance policy either online or offline. If you opt for the online route, you can visit the official website of Maruti Suzuki and fill out the required details. You will then be presented with a list of policies to choose from. Once you have selected the policy, you can make the payment online and the policy will be sent to your email address.

If you opt for the offline route, you can visit the nearest Maruti Suzuki dealership and purchase the policy from there. The dealer will provide you with the policy print and other documents. You can then make the payment and the policy will be activated immediately.

Conclusion

Maruti Suzuki car insurance policies are a great way to protect your car from any damages or losses. With Maruti Suzuki’s car insurance policy, you can avail comprehensive coverage at an affordable price. You can buy the policy either online or offline and the process is simple and hassle-free. Make sure to go through the policy print carefully before taking out the policy so that you understand the terms and conditions of the policy.

Maruti Insurance Policy | Maruti Insurance Renewal.

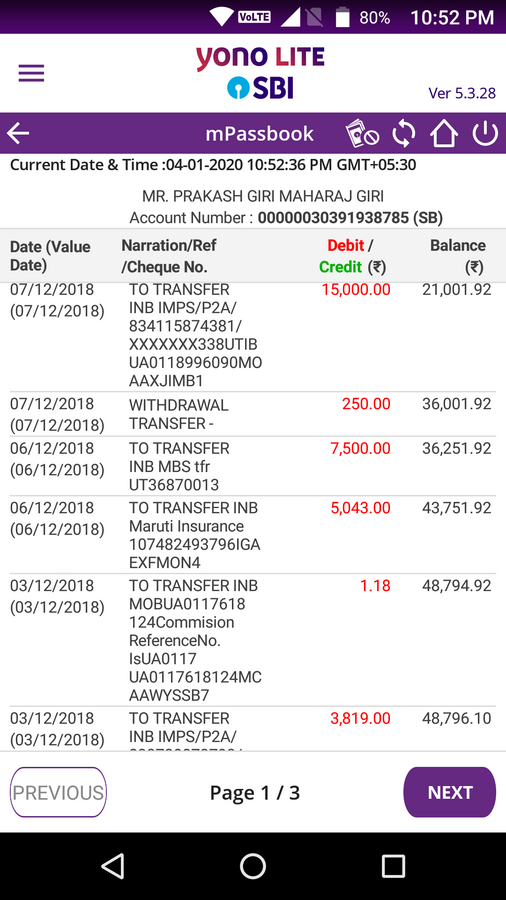

Maruti Insurance — Accidental claim with Insurance

Maruti Insurance — reading clean

Maruti Service is cheap - A myth! - Page 36 - Team-BHP

Car Insurance Policy Document : Vehicle Insurance Policy Format