How Much Does State Farm Car Insurance Cost

How Much Does State Farm Car Insurance Cost?

State Farm is one of the largest car insurance companies in the US, providing coverage for millions of drivers across the country. It's no surprise that many people are curious about how much State Farm car insurance costs. The cost of car insurance can vary widely depending on a variety of factors, so it can be hard to give an exact estimate. However, there are some general guidelines you can use to get an idea of what you might expect to pay for State Farm car insurance.

Factors That Impact the Cost of State Farm Car Insurance

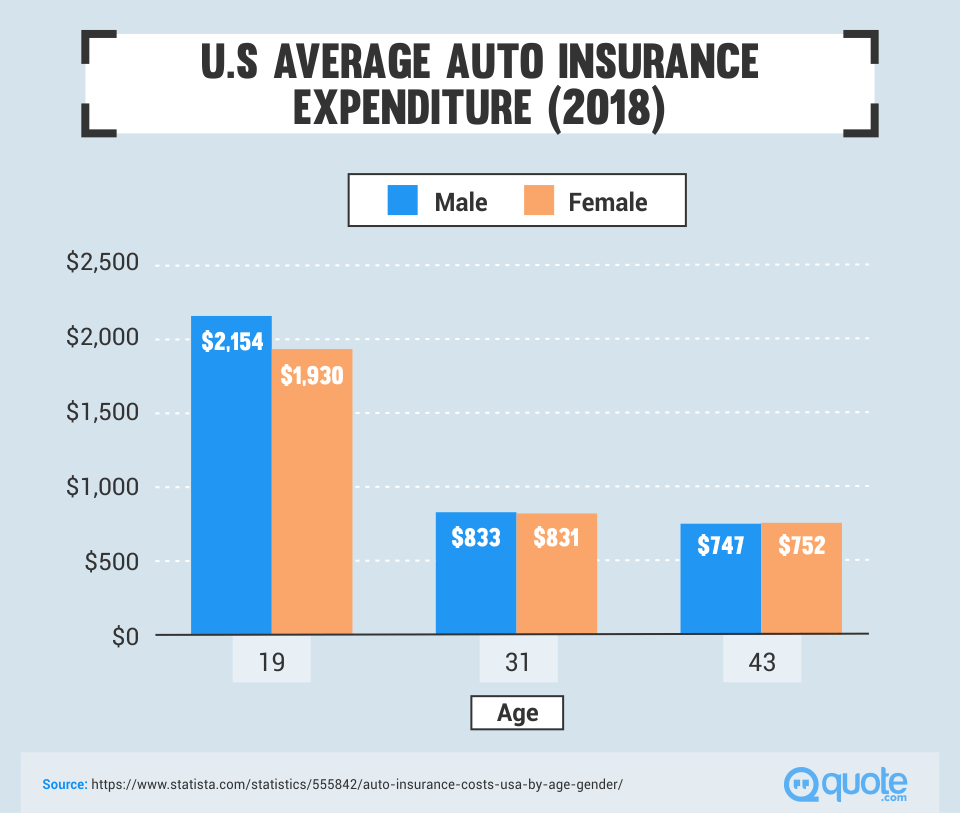

The cost of State Farm car insurance is going to depend on a number of different factors, including your age, location, driving record, and type of car. Your age is one of the most important factors when it comes to car insurance. Generally speaking, younger drivers are considered to be riskier, so they will usually pay more for their insurance. Location also plays a role in the cost of car insurance. If you live in an area with a high rate of car accidents and theft, you can expect to pay more for your insurance.

Your driving record is also a major factor when it comes to the cost of your car insurance. If you have a history of traffic violations or accidents, you can expect to pay more. Similarly, if you have a long history of safe driving, you may be eligible for discounts. Finally, the type of car you drive is another important factor in the cost of car insurance. Luxury cars and sports cars tend to cost more to insure, because they are more expensive to repair or replace if they're damaged in an accident.

Average Cost of State Farm Car Insurance

The average cost of a State Farm car insurance policy varies depending on the factors mentioned above. According to the Insurance Information Institute, the average annual cost of a State Farm car insurance policy in 2018 was $1,227. Keep in mind that this figure is just an average, and your actual cost could be higher or lower, depending on your individual circumstances.

How to Save on State Farm Car Insurance

There are a few different ways you can save on your State Farm car insurance. First, you may be eligible for discounts if you have a good driving record or if you insure more than one vehicle with State Farm. Additionally, some insurers offer discounts if you pay your premium in full or if you sign up for automatic payments. You may also be able to save money if you raise your deductible, although doing so can increase your out-of-pocket costs if you ever need to make a claim.

Ultimately, the cost of State Farm car insurance will vary depending on a variety of factors. However, by understanding the different factors that can impact the cost of your insurance and by taking advantage of any discounts you may be eligible for, you can save money on your car insurance policy.

State Farm Auto & Home Insurance Review: Quality Service and Lots of

Should you get car insurance through your credit union? - Clark Howard

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

Review of State Farm Auto Insurance: Features, Pros & Cons, and Costs

State Farm Non Owner Car Insurance - How Much is State Farm Car