Good Car Insurance In Texas

Finding the Right Car Insurance in Texas

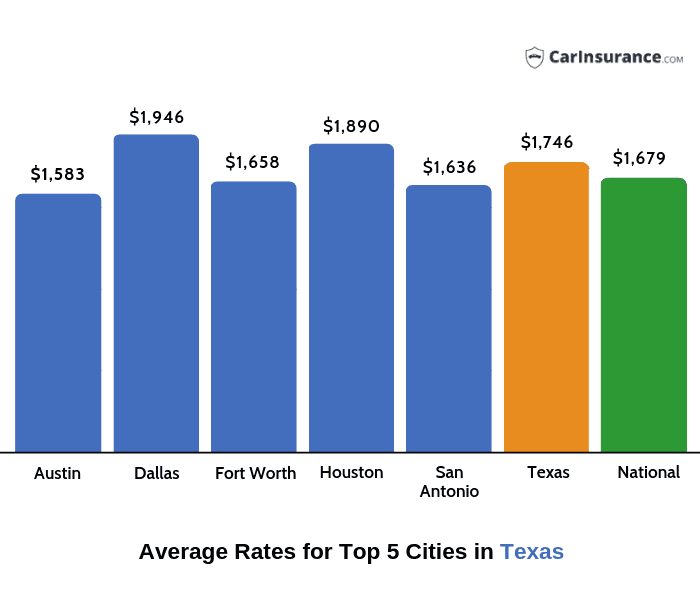

Texas is the second most populous state in the United States, with a population of over 28 million. With such a high population and a high number of drivers on the roads, it’s no surprise that car insurance costs in Texas are high. That’s why it’s important to find the right car insurance. In order to get the best coverage at the best price, you need to understand the different types of car insurance available in Texas, and how to choose the right one.

Types of Car Insurance in Texas

Texas requires all drivers to have at least minimum liability coverage. This covers bodily injury and property damage that is caused by the driver. It is important to note that this coverage only applies to other drivers and their property, not to the driver’s own vehicle. Texas also requires all drivers to have uninsured and underinsured motorist coverage, which covers the driver in the event that they are in an accident with a driver who does not have insurance or does not have enough insurance.

In addition to minimum liability coverage, drivers in Texas can also purchase optional coverage. This includes collision coverage, which covers damage to the driver’s own vehicle in the event of an accident. Comprehensive coverage is also available, which covers damage to the vehicle from non-accident related causes, such as vandalism or theft. Other optional coverage includes rental reimbursement, towing and labor, and gap coverage.

Choosing the Right Car Insurance in Texas

When it comes to choosing the right car insurance in Texas, it’s important to understand your personal needs and budget. It’s also important to compare different companies and policies to find the best coverage at the best price. There are several factors to consider when looking for car insurance, including the type of coverage, the amount of coverage, the deductible, and the premiums.

It’s also important to understand the different discounts that are available. Many insurance companies offer discounts for safe drivers, drivers who have multiple policies with the same company, and drivers who have taken certain driving courses. It’s also important to understand the different types of coverage and how they work together.

Tips for Finding the Right Car Insurance in Texas

If you’re looking for the best car insurance in Texas, here are some tips to help you make the right choice:

- Understand your personal needs and budget.

- Compare different companies and policies.

- Know the different types of coverage and how they work together.

- Understand the different discounts that are available.

- Shop around and get multiple quotes.

- Read the fine print and understand the policy.

By following these tips, you can ensure that you find the right car insurance in Texas that meets your needs and budget.

Best Cheap Car Insurance In Texas For 2020 + Savings Tips

Best Cheap Car Insurance in Texas for 2020 | Millennial Money

Texas Car Insurance - How Much is Car Insurance in Texas?

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

PPT - Texas Cheapest Car Insurance PowerPoint Presentation, free