Does Capital One Offer Car Insurance

Does Capital One Offer Car Insurance?

It is no secret that Capital One is one of the most recognized banks in the world. With a wide range of products and services, it is no surprise that people are curious whether they offer car insurance. The answer is yes, Capital One does offer car insurance, but not in the traditional sense.

How Does Capital One Offer Car Insurance?

Capital One does not actually offer car insurance in the traditional sense. However, they do offer something called a “Credit Protection” plan. This plan is similar to car insurance in that it provides coverage for a variety of items related to credit, including rental cars, debit cards, bank accounts, and more. The plan is designed to protect your credit score in the event of an accident or other unforeseen event.

What Does Credit Protection Cover?

The Credit Protection plan from Capital One covers a variety of items related to your credit. These include rental cars, debit cards, bank accounts, and more. It also covers any fees associated with transferring or closing accounts. Additionally, the plan covers up to $25,000 in the event of an accident or other unforeseen event. This coverage is designed to help you protect your credit score in the event that something unexpected happens.

What Are the Benefits of Credit Protection?

The Credit Protection plan from Capital One provides a number of benefits. First, it helps to protect your credit score in the event of an accident or other unforeseen event. In addition, the plan covers any fees associated with transferring or closing accounts. It also covers up to $25,000 in the event of an accident or other unforeseen event. Finally, the plan offers peace of mind knowing that your credit score is protected.

What Are the Drawbacks of Credit Protection?

The Credit Protection plan from Capital One does come with some drawbacks. First, it does not cover damage to your car in the event of an accident. Additionally, the plan does not cover any damage to your vehicle caused by an uninsured motorist. Finally, the plan does not provide coverage for theft, vandalism, or other damages caused by a third party. These drawbacks should be taken into consideration when deciding whether or not to purchase the plan.

Conclusion

Capital One does offer car insurance, but not in the traditional sense. The Credit Protection plan from Capital One provides coverage for a variety of items related to credit, including rental cars, debit cards, bank accounts, and more. The plan helps to protect your credit score in the event of an accident or other unforeseen event, and can provide peace of mind knowing that your credit score is protected. However, the plan does have some drawbacks, such as not covering any damage to your car in the event of an accident. Therefore, it is important to weigh the pros and cons before deciding if the Credit Protection plan from Capital One is the right choice for you.

Capital One Attempts To Ease Customer Concern Over Massive Hack With

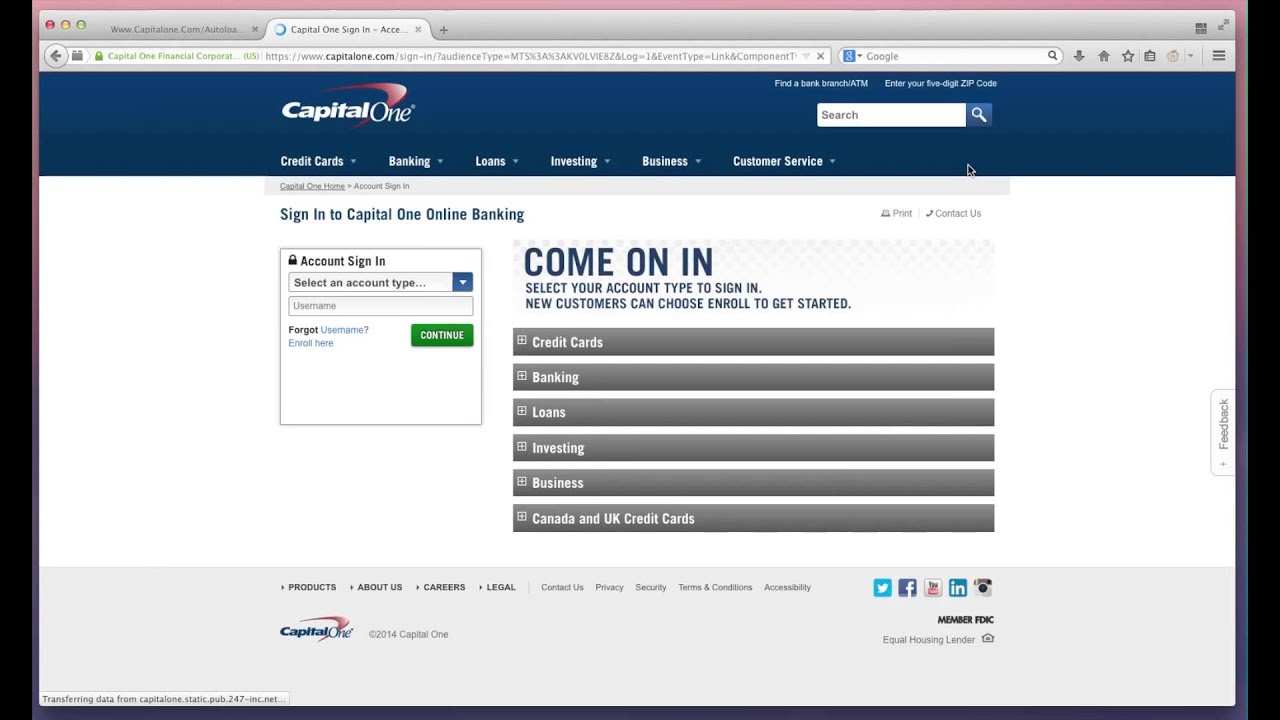

Capital One Auto Finance Login at www.capitalone.com – Login Wizard

Capital One Auto Refinance: In-Depth Review (Apr 2020) | SuperMoney!

Lack of Confidence Continues to Weigh on Car Shoppers

Capital One Auto Pay Bill Online - MyBillCom.com - YouTube