Cheapest Auto Insurance In Illinois

Cheapest Auto Insurance In Illinois

Are You Looking for the Cheapest Auto Insurance in Illinois?

If you live in the state of Illinois and are looking for the best and cheapest auto insurance available, you've come to the right place. Auto insurance is required in the state of Illinois and it is important to make sure you are getting the best coverage and the best rate possible. In this article, we will discuss the cheapest auto insurance options in Illinois and how to get the best deal. Read on to learn more.

What Factors Influence Auto Insurance Rates?

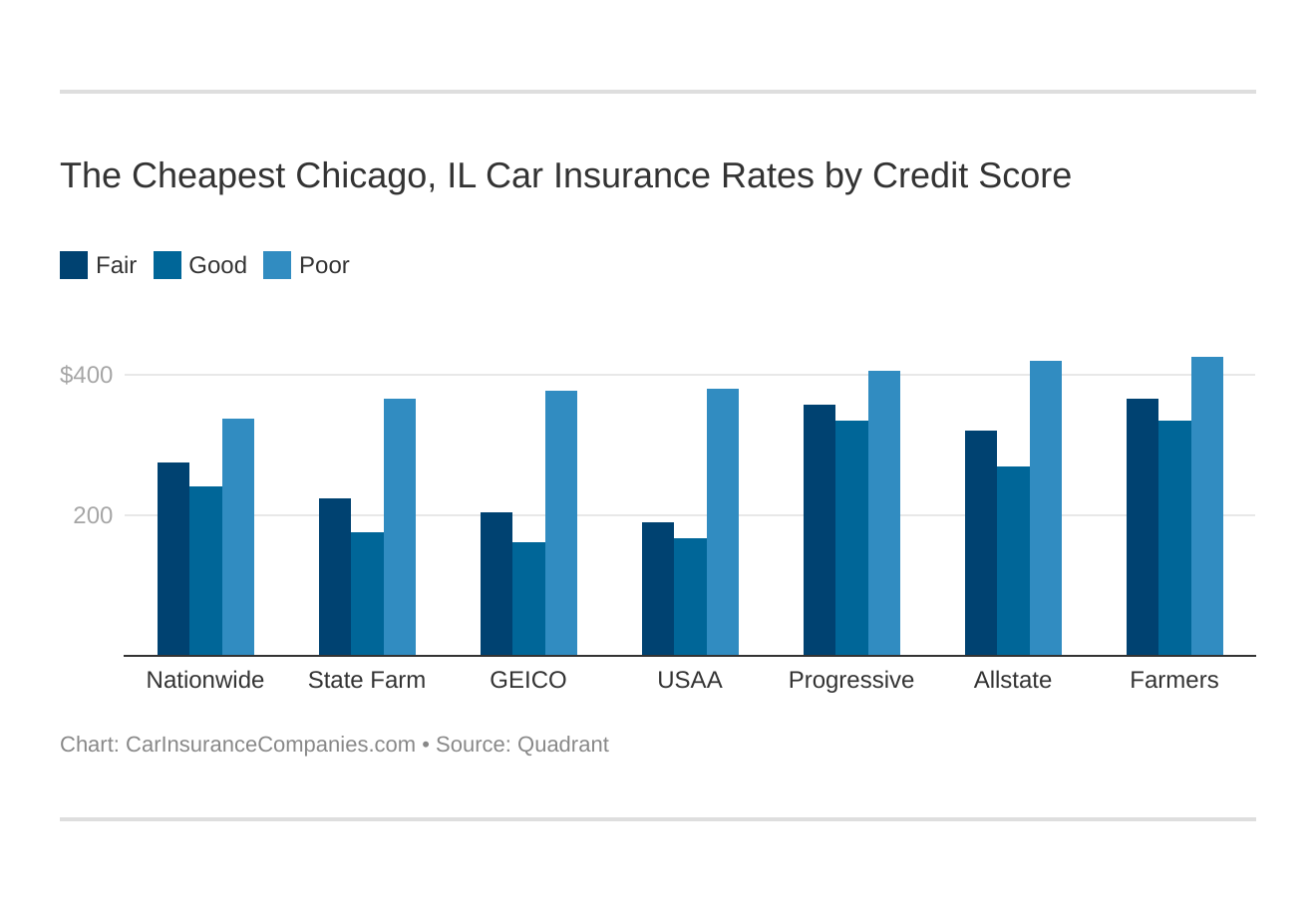

When it comes to auto insurance, there are a few factors that can influence the rate you are offered. The state of Illinois requires that all drivers carry a minimum amount of coverage, but beyond that, the amount you pay for coverage can vary based on a variety of factors. These factors include your driving record, age, gender, vehicle type, and more. It is important to understand all of these factors when attempting to get the cheapest auto insurance in Illinois.

How to Find the Cheapest Auto Insurance in Illinois

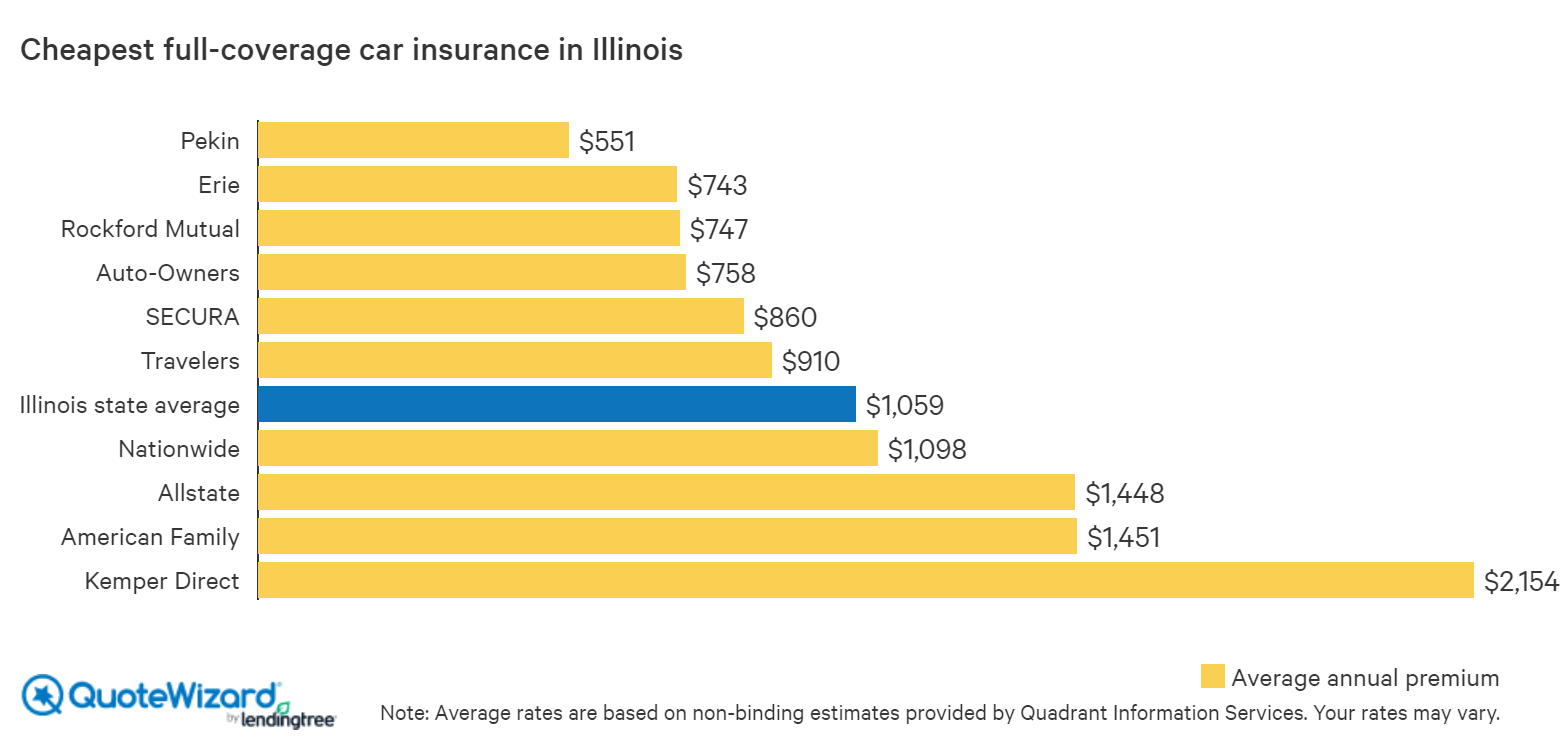

The best way to find the cheapest auto insurance in Illinois is to shop around and compare rates. Many insurance companies offer online quotes, so this can be a great way to quickly compare rates. It is important to make sure you are comparing the same coverage levels and deductibles when getting quotes from different companies. You should also be aware of any discounts that may be available, such as good driver discounts, multi-car discounts, and more. Taking advantage of discounts can help you get the lowest rate possible.

Questions to Ask Your Insurance Company

When shopping for auto insurance in Illinois, it is important to ask the right questions. Be sure to ask your insurance company about any discounts that may be available. You should also ask about what kind of coverage you are getting and if there are any restrictions or limitations. It is also important to ask about any additional coverage that may be available, such as rental car coverage or road-side assistance. Asking these questions can help you make sure you are getting the best rate and coverage.

Types of Auto Insurance in Illinois

In Illinois, drivers are required to carry a minimum amount of coverage, but there are a few different types of coverage that could be beneficial. Liability coverage is the most common type of auto insurance and it is designed to cover any damage you cause to another person's property or vehicle. Collision coverage is another type of auto insurance that covers damage to your own vehicle. Comprehensive coverage is also available and it covers damage to your vehicle caused by things like theft, fire, or weather-related events. Knowing the different types of auto insurance available in Illinois can help you get the best coverage for your needs.

The Bottom Line

Finding the best and cheapest auto insurance in Illinois can be a challenge, but with the right research and knowledge, you can get a great deal. Be sure to compare rates from multiple companies and take advantage of any discounts you may be eligible for. It is also important to understand the different types of coverage available and what kind of coverage you need. With the right information, you can find the best and cheapest auto insurance in Illinois.

Who Has the Cheapest Car Insurance Quotes in Chicago, IL? - ValuePenguin

Find Cheap Car Insurance in Illinois | QuoteWizard

Cheap Auto Insurance Companies In Illinois With Full Coverage

Best Cheap Car Insurance In Illinois – Forbes Advisor

Cheap Car Insurance Il - Get Free Auto Insurance Quotes And Get The