Car Insurance New York Price

Thursday, September 19, 2024

Edit

Car Insurance in New York: How Much Does it Cost?

Searching for car insurance in New York can be a daunting task. With so many different insurance companies and policies available, it can be difficult to know which policy is right for you. The cost of car insurance in New York is also an important factor to consider when choosing a policy. Here, we’ll take a look at the average cost of car insurance in New York and what you can do to get the best deal.

Average Cost of Car Insurance in New York

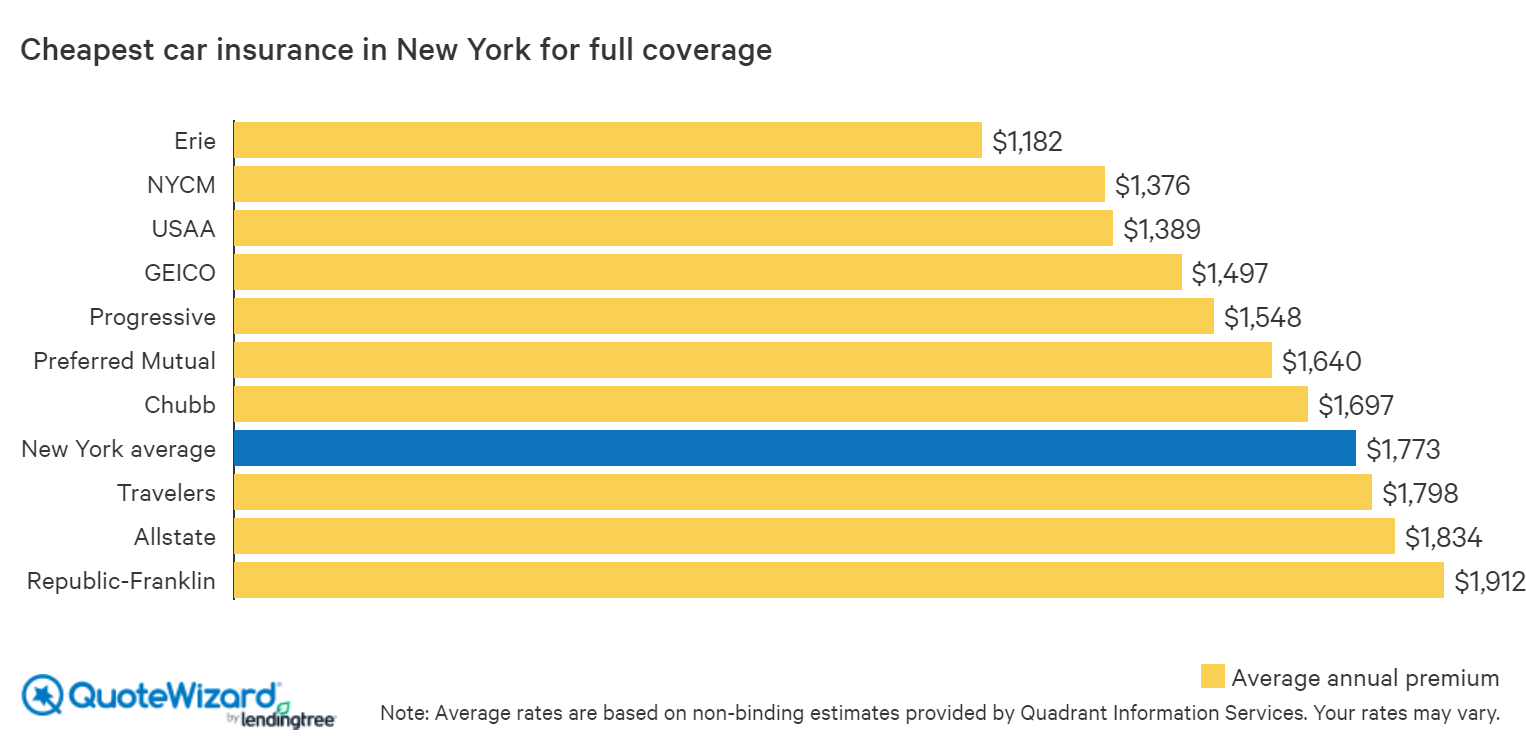

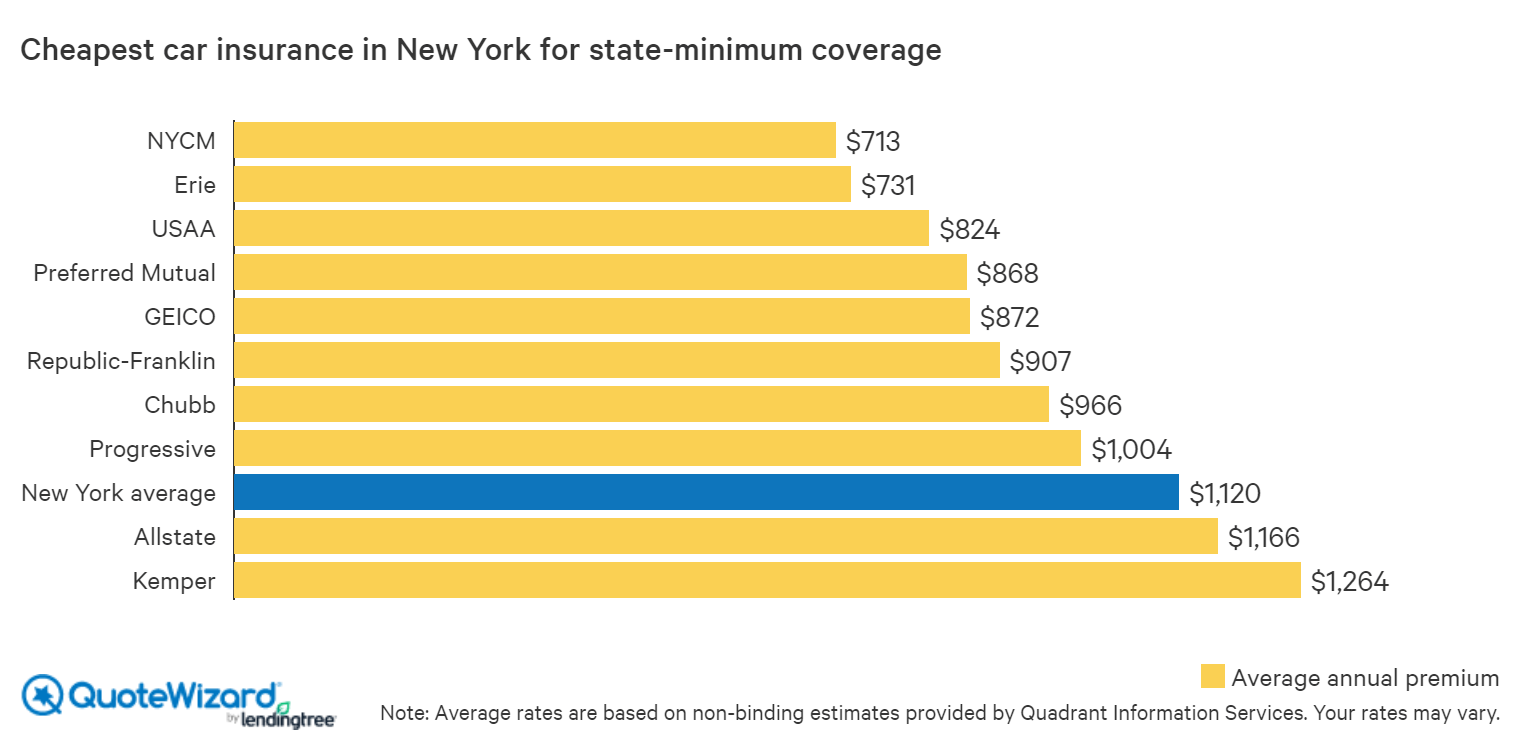

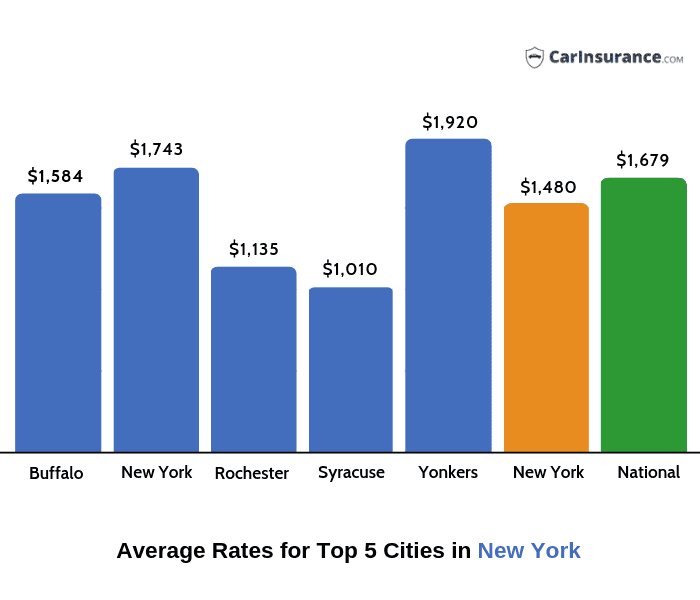

According to the Insurance Information Institute, the average cost of car insurance in New York is $1,314 per year. This is slightly higher than the national average of $1,009, making it one of the most expensive states to insure a car. However, New York also has some of the most comprehensive insurance laws in the country, which means that drivers are more likely to be adequately covered in the event of an accident.

Factors That Affect The Cost of Car Insurance in New York

The cost of car insurance in New York is affected by a variety of factors, such as your age, driving record, vehicle type, and even your credit score. Younger drivers tend to pay higher rates due to their lack of driving experience. If you have a poor driving record, you can expect to pay higher rates as well. The type of vehicle you drive is also an important factor, as more expensive vehicles tend to cost more to insure. Finally, your credit score can also play a role in determining your rates. Those with poor credit scores may be charged higher rates than those with good credit.

How to Save Money on Car Insurance in New York

If you’re looking to save money on car insurance in New York, there are a few strategies you can employ. First, consider raising your deductible. This is the amount of money you’ll pay out of pocket before your insurance kicks in. By raising your deductible, you can lower your monthly premiums. You should also shop around for different insurance companies to compare rates and coverage. Finally, consider bundling your car insurance with other policies, such as home or life insurance. This could result in a discount on your premiums.

Minimum Coverage Requirements in New York

New York requires all drivers to carry a minimum level of liability insurance. This includes $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $10,000 in property damage coverage. While these are the minimum requirements, it’s important to note that most insurance companies recommend a higher level of coverage.

Conclusion

The cost of car insurance in New York is higher than the national average, but there are ways to save. By raising your deductible, shopping around for different companies, and bundling your policies, you can reduce your monthly premiums. It’s also important to make sure you have the minimum required coverage in New York and consider getting additional coverage for more comprehensive protection.

Who Has the Cheapest Auto Insurance Quotes in New York? - ValuePenguin

The Cheapest Car Insurance in New York | QuoteWizard

Download New Insurance Images Pictures

Car Insurance in New York - Find Best & Cheapest Car Insurance in NY

Cheapest Car Insurance New Drivers NYC ★ How to Get the Best Auto