Car Insurance Cover Note Template

Monday, September 16, 2024

Edit

Car Insurance Cover Note Template: All You Need to Know

What is a Car Insurance Cover Note?

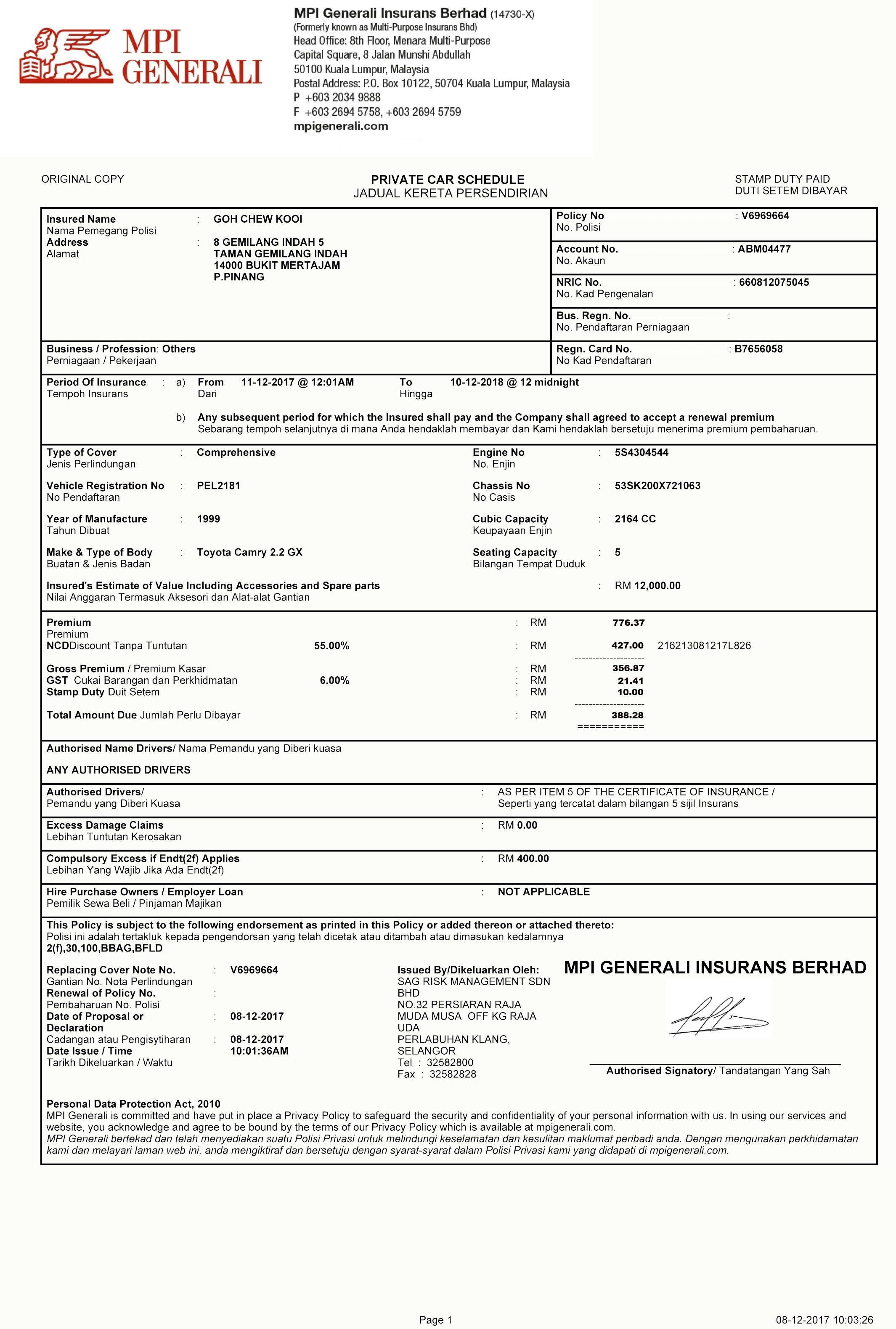

A car insurance cover note is a document issued by insurance companies to their customers to provide proof that they have the necessary cover for their vehicles. This document is usually issued in the event of a claim or when the policyholder is changing their insurer. The cover note provides the policyholder with a temporary insurance cover until their new policy is issued. It is important to note that the cover note is not a valid insurance policy but rather a temporary cover until the new policy is issued.

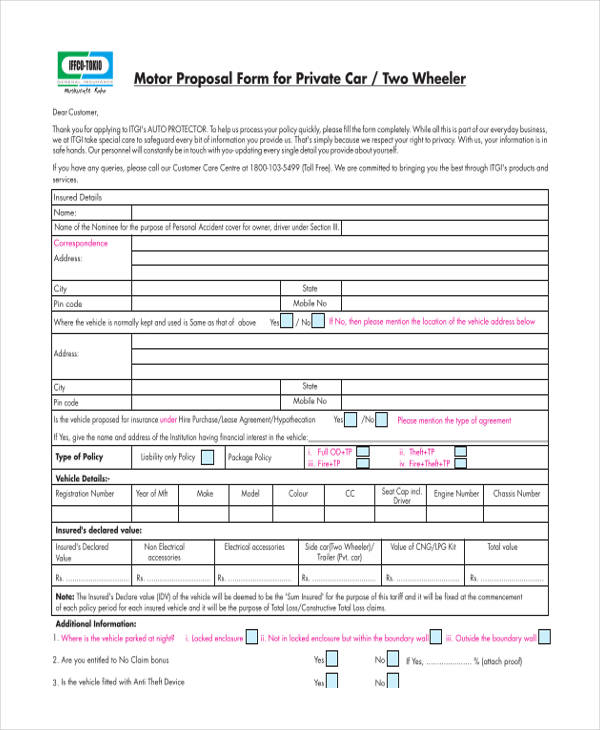

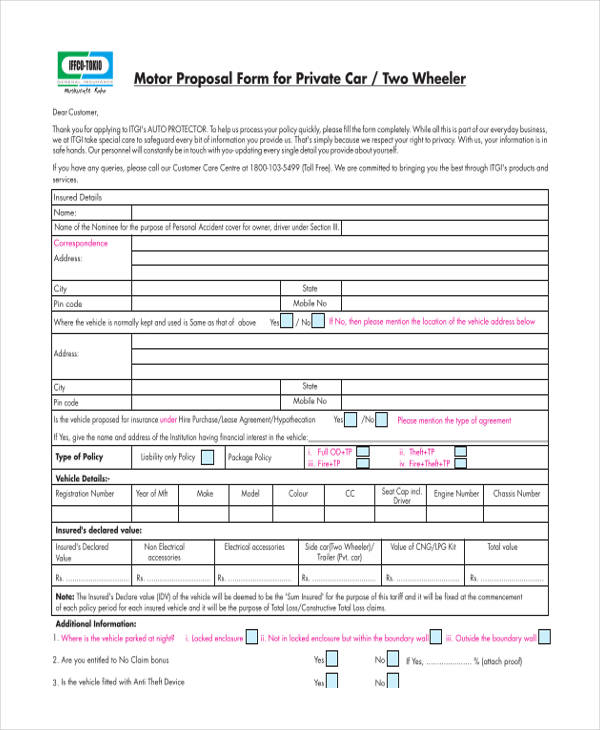

What Does a Car Insurance Cover Note Include?

A car insurance cover note typically includes information such as the name and address of the policyholder, the make and model of the vehicle, the duration of the cover and the amount of cover that is provided. It also includes the type of policy that is being taken out, such as third party only or comprehensive cover. In addition, the cover note will also include the amount of excess that is applicable to the policy. The excess is the amount that the policyholder will have to pay in the event of a claim.

How to Obtain a Car Insurance Cover Note?

In most cases, the cover note will be issued by the insurance company when the policyholder takes out a new policy. It is important to note that the cover note is only valid for a specific period of time and must be renewed when the policy expires. In some cases, the insurance company may also issue a cover note to existing policyholders when they are making changes to their policy, such as adding a new vehicle or changing the level of cover.

What Are the Benefits of a Car Insurance Cover Note?

The primary benefit of a car insurance cover note is that it provides the policyholder with a temporary insurance cover until their new policy is issued. This means that the policyholder can drive their vehicle without having to worry about being uninsured in the event of an accident. In addition, the cover note can also provide the policyholder with peace of mind as it provides proof that they have the necessary cover for their vehicle.

What Are the Risks of Not Having a Car Insurance Cover Note?

It is important to note that the cover note is only valid for a specific period of time and must be renewed when the policy expires. If the policyholder does not renew the cover note and their policy has expired, they will be deemed to be driving without insurance. This can lead to severe penalties, including the suspension of the policyholder's license or even a criminal conviction.

Conclusion

A car insurance cover note is an important document that is issued by insurance companies to their customers to provide proof that they have the necessary cover for their vehicles. It is important to note that the cover note is only valid for a specific period of time and must be renewed when the policy expires. It is also important to note that the policyholder can face serious consequences if they are found to be driving without insurance.

car insurance cover note template 11 Things About Car - bybloggers.net

Gambar Cover Note Insurance - Galeri Sampul

Car & Motor Insurance

cover note insurance kereta

Auto Insurance Allstate Insurance Card Template