Best Insurance Rates For Young Drivers

Best Insurance Rates For Young Drivers

Finding the Right Insurance for Young Drivers

When it comes to finding the right insurance for young drivers, there are many factors that need to be taken into consideration. As a young driver, you may be required to pay more for coverage because of your age and inexperience. It is important to shop around and compare different companies to make sure you are getting the best rate for your coverage. Though insurance rates vary from company to company and from state to state, there are certain steps you can take to lower your insurance rates and ensure that you are getting the best coverage possible.

Research and Comparison Shopping

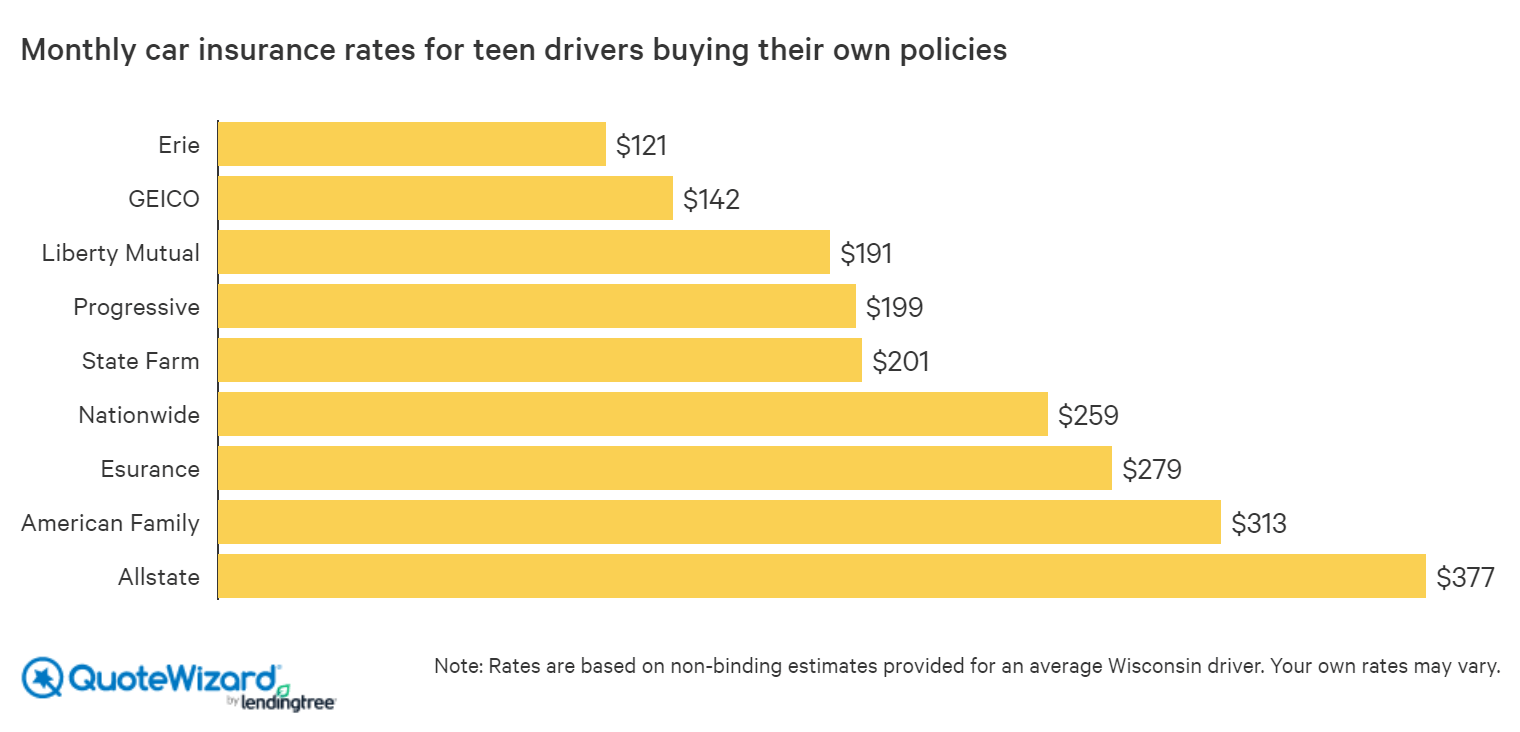

The first step in finding the best insurance rates for young drivers is to do your research. You should look into different companies and compare the coverage they offer. When comparing different companies, make sure to look at their customer service ratings, as well as their financial stability. Additionally, it is important to read any fine print so you know exactly what kind of coverage you will be getting. Doing research and comparison shopping can help you find the best insurance rate for young drivers.

Discounts

Another way to get the best insurance rates for young drivers is to take advantage of discounts. Many companies offer discounts to drivers who have a good driving record and have completed a defensive driving course. Additionally, some companies offer discounts for good grades, so if you are still in school, you may be able to get a better rate. Make sure to ask about any discounts that may be available when you are looking for the best rate.

Raising Your Deductible

Raising your deductible can also help you get the best insurance rates for young drivers. Increasing your deductible can lower your monthly premiums, allowing you to save money in the long run. It is important to remember, however, that raising the deductible can increase your out of pocket expenses if you do get into an accident. You should make sure that you can afford to pay the higher deductible if you do need to file a claim.

Group Insurance

If you are a student, you may be able to get a better rate by getting group insurance from your school or university. Group insurance is typically less expensive than individual policies, so it can be a great way to get the coverage you need at an affordable rate. Additionally, many companies offer discounts for students, so it is important to ask about any special discounts or rates that may be available.

Finding the Best Rates

Finding the best insurance rates for young drivers can be a challenge, but with a bit of research and comparison shopping, you can find the right coverage at an affordable rate. Make sure to ask about any discounts that may be available and consider raising your deductible to lower your monthly premiums. Additionally, if you are a student, make sure to look into group insurance from your school or university to see if you can get a better rate. By taking the time to research and compare different companies, you can ensure that you are getting the best rate for your coverage.

Top 10 Car Insurance Rates 2019 | EINSURANCE

Best Car Insurance for Teens | QuoteWizard

Best Car Insurance For Teens And Young Drivers (2022)

Best car insurance for young drivers | Finder UK

Compare Car Insurance Companies for Young Drivers | NimbleFins