6 Month Car Insurance Plans

6 Month Car Insurance Plans – The Benefits

Having the right car insurance is a must if you want to stay on the right side of the law. Depending on the state you live in, you may even be required to carry a certain amount of auto insurance. In many states, you are required to have at least a liability policy that covers the costs of any injuries or damage to another vehicle or property if you are in an accident. You may also choose to purchase additional coverage for your own vehicle. One of the most popular options for car insurance is a 6-month policy.

What Does a 6-Month Policy Include?

A 6-month car insurance plan typically includes the same coverage that you would get with a full-year policy. This includes liability, collision, comprehensive, and any other add-on coverage that you may choose to purchase. The only difference is that a 6-month policy is only valid for 6 months, while a full-year policy is valid for 12 months. This means that you will have to renew your policy every 6 months in order to keep your coverage in effect.

Benefits of a 6-Month Plan

There are several benefits to choosing a 6-month policy over a full-year policy. The first is that it is often cheaper than a full-year policy. This is because it is less of a commitment for the insurance company, and they are willing to offer a cheaper rate for 6 months of coverage. Additionally, if you know your driving habits may change in the near future, you can opt for a 6-month policy so that you can make adjustments to your coverage as needed.

Who Should Consider a 6-Month Plan?

A 6-month car insurance plan may be a good option for anyone who isn’t sure how long they will need coverage. For example, if you are considering a move to a new state, you may want to opt for a 6-month policy so that you can get a better handle on what kind of coverage is required in your new home state. Additionally, if you are planning to buy a new car or are changing jobs, you may want to consider a 6-month policy as it will give you the flexibility to adjust your coverage as needed.

How to Find the Best 6-Month Car Insurance Plan

When looking for the best 6-month car insurance plan, it’s important to compare quotes from several different insurance companies. This will help you get the best rate and coverage for your needs. Additionally, you should look for discounts and special offers that may be available. Finally, make sure to read the fine print so that you understand exactly what is covered and what isn’t.

Conclusion

A 6-month car insurance plan can be a great option for anyone who isn’t sure how long they need coverage, or who is planning to make changes to their driving habits in the near future. It’s important to compare quotes from several different insurance companies so that you can get the best rate and coverage for your needs. Additionally, make sure to read the fine print so that you understand exactly what is covered and what isn’t.

How To Get Cheap 6 Month Car Insurance by Frank Thomas - issuu

6 Month Car Insurance Plans Malaysia : Best Ways To Make Your Car

6 Month Car Insurance Plans Malaysia / Malaysia Business Insurance

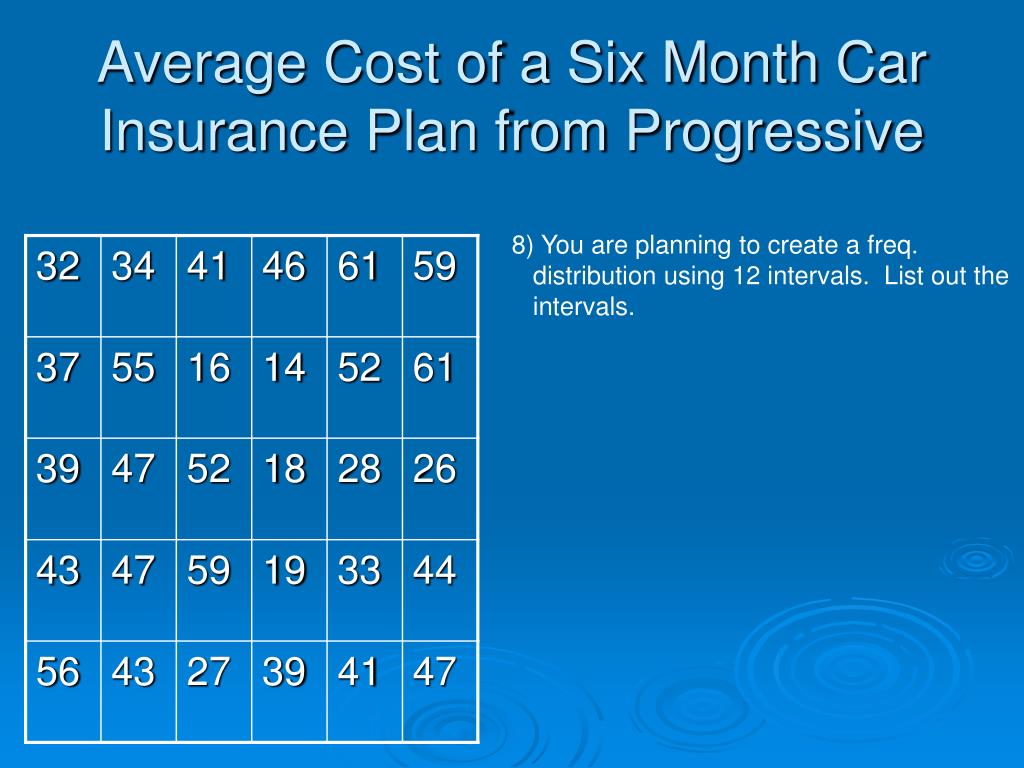

PPT - Advanced Math Topics PowerPoint Presentation, free download - ID

A 12-Month or 6-Month Car Insurance Policy: Which Should I Choose?