What Is The State Minimum For Car Insurance

What Is The State Minimum For Car Insurance?

Having car insurance is an important part of being a responsible driver. Depending on the state you live in, there may be minimum requirements when it comes to car insurance. These requirements are in place to ensure that all drivers on the road are covered in case of an accident. Knowing the state minimum for car insurance is the best way to make sure that you are always in compliance with the law.

What Is The State Minimum For Car Insurance?

The state minimum for car insurance is the least amount of coverage that you must have in order to legally drive your car in a particular state. Each state is different, so it is important to check with your state's Department of Motor Vehicles (DMV) for the specific requirements. Generally, the state minimum for car insurance includes liability coverage for bodily injury and property damage, uninsured motorist coverage, and personal injury protection (PIP).

Liability Coverage

Liability coverage is the most basic component of car insurance. This coverage pays for any costs associated with bodily injury or property damage caused by you while driving. The minimum requirements for liability coverage vary from state to state, but typically require coverage of at least $25,000 per person for bodily injury and $50,000 for all persons involved in an accident. In addition, states generally require that you have at least $10,000 in property damage coverage.

Uninsured Motorist Coverage

Uninsured motorist coverage is a type of insurance that covers you in the event that the other driver in an accident does not have insurance. This coverage is important in states where many drivers do not carry insurance. The minimum requirements for uninsured motorist coverage vary from state to state, but typically require coverage of at least $25,000 per person for bodily injury and $50,000 for all persons involved in an accident.

Personal Injury Protection (PIP)

Personal injury protection (PIP) is a type of insurance coverage that pays for medical expenses and lost wages in the event of an accident. PIP coverage is not required in all states, but many states have minimum requirements for PIP coverage. The minimum requirements for PIP coverage vary from state to state, but typically require coverage of at least $10,000 per person for medical expenses and lost wages.

Conclusion

Knowing the state minimum for car insurance is the best way to make sure that you are always in compliance with the law. Different states have different requirements when it comes to car insurance, so it is important to check with your state's Department of Motor Vehicles (DMV) for the specific requirements. Generally, the state minimum for car insurance includes liability coverage for bodily injury and property damage, uninsured motorist coverage, and personal injury protection (PIP).

A Guide to the BEST 9 Car Insurance Hacks No One Talks About | Cheap

What's the Cost of State Minimum Car Insurance? | Car Insurancee

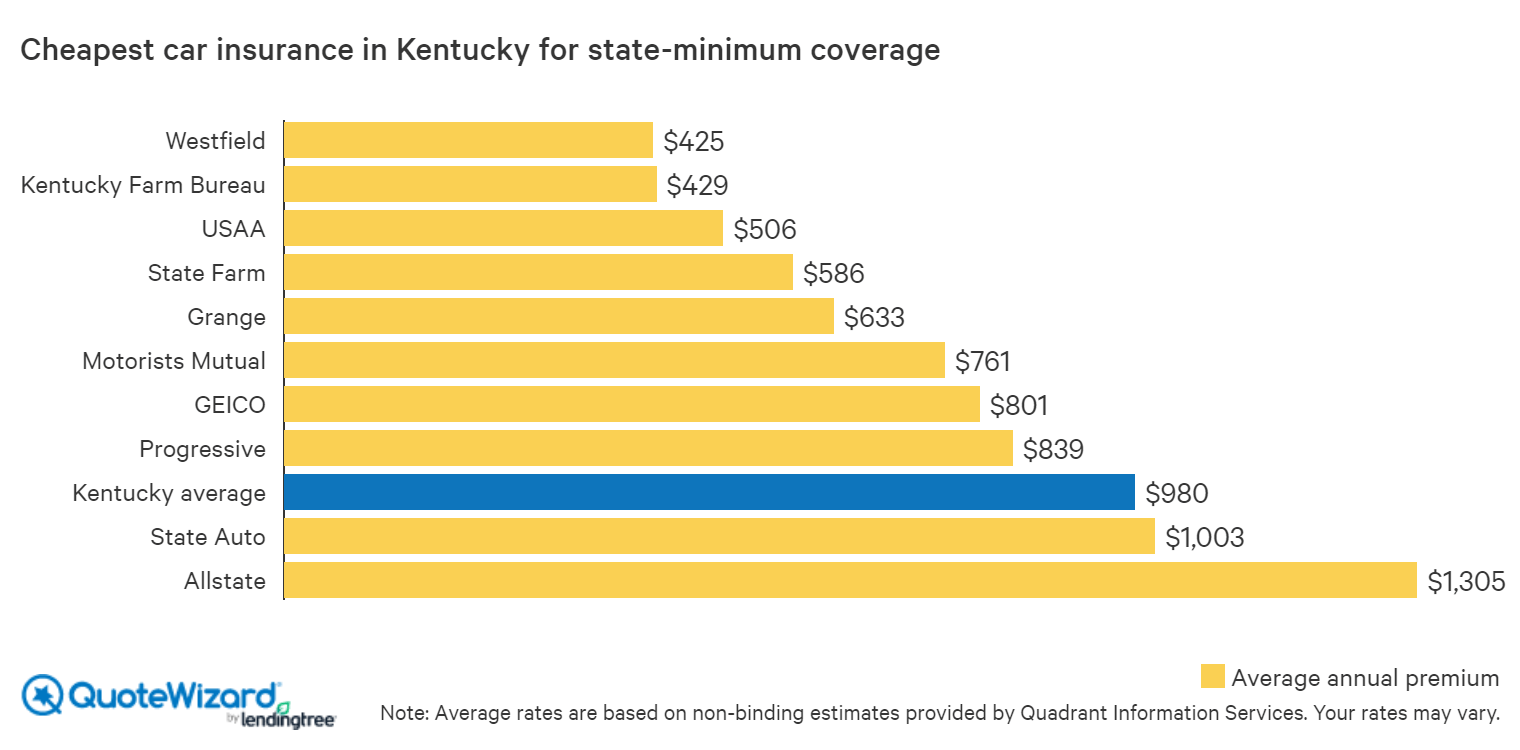

Find Cheap Car Insurance in Kentucky | QuoteWizard

What is state minimum auto insurance in Ohio? - Cowan & Hilgeman Law

Famous What Is The Minimum Auto Insurance Coverage In New Jersey 2022