Third Party Car Insurance Price In India

Third Party Car Insurance Price In India

Comparison of Different Car Insurance Companies

When it comes to shopping for car insurance, India has a wide variety of options. There are numerous companies offering different kinds of coverage, with varying levels of protection and price points. It is important to compare different companies and policies in order to make the best decision for your needs. To start, you will need to determine the type of coverage you require, as well as how much coverage you want.

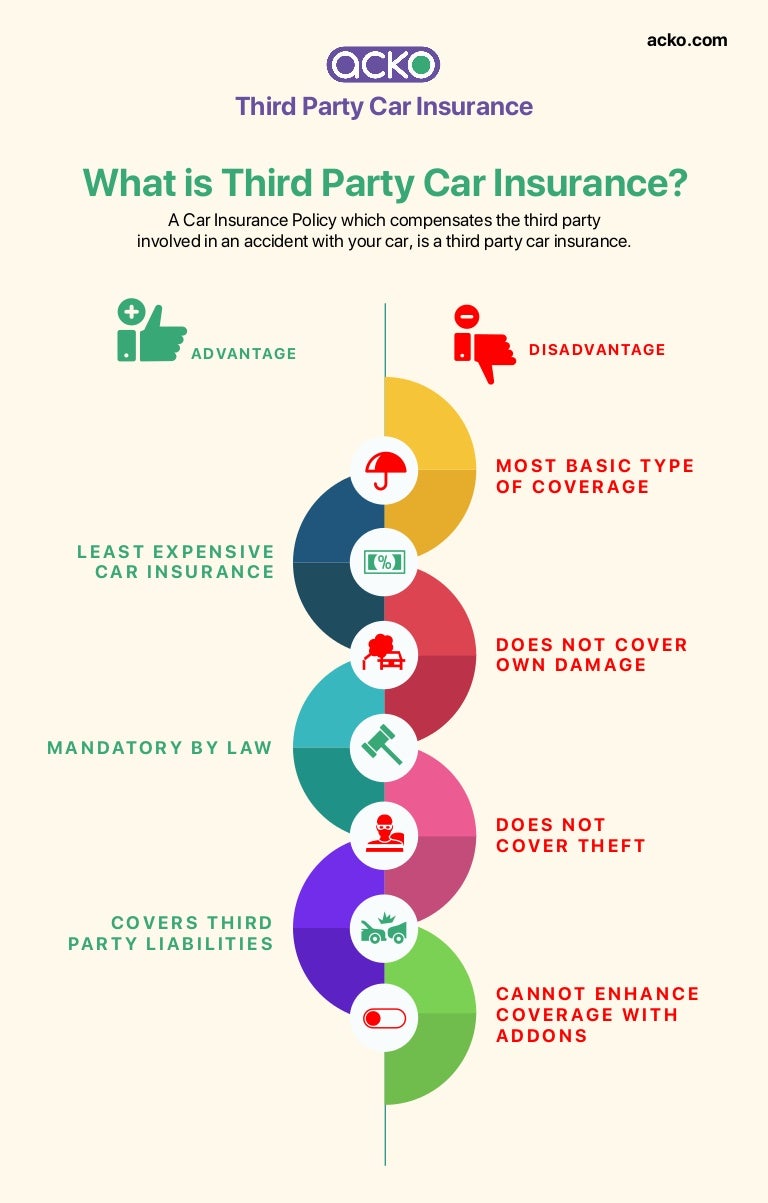

Third party car insurance is one of the most widely sold types of car insurance in India. This type of policy covers you for damage caused to another person or vehicle in the event of an accident, and covers the cost of legal fees and medical bills if you are found liable. It does not cover any damage to your own car. It is less expensive than comprehensive insurance, but it does not offer the same level of protection.

When it comes to pricing, there is a great deal of variability between different companies and policies. Depending on the type of coverage, the amount of coverage, and the area you live in, you could find that one company offers you a much better price than another. To get the best rate possible, it is important to compare different companies and policies.

Factors that Affect Third Party Car Insurance Price

A number of factors can affect the cost of third party car insurance, including the type of car you drive, your age, and your driving record. Many companies also offer discounts for certain types of drivers, such as those who have a clean driving record or those who have taken defensive driving courses. It is important to compare different policies in order to find the best rate.

In addition to the factors mentioned above, the area you live in can also affect the price of your third party car insurance. Rates in some areas may be higher due to a higher risk of accidents, while rates in other areas may be lower due to a lower risk of accidents. It is important to compare different policies in order to find the best rate for your area.

How to Save Money on Third Party Car Insurance

There are a few ways you can save money on third party car insurance. One way is to shop around and compare different policies and companies. You can also look into discounts for certain types of drivers, such as those with a clean driving record or those who have taken defensive driving courses. Additionally, you can look into bundling your car insurance with other types of insurance, such as home or life insurance, in order to get a better overall rate.

It is important to remember that third party car insurance is less expensive than comprehensive insurance, but it does not offer the same level of protection. It is important to compare different policies and companies in order to make the best decision for your needs. By shopping around, you can save money on third party car insurance and ensure that you are getting the best coverage at the best price.

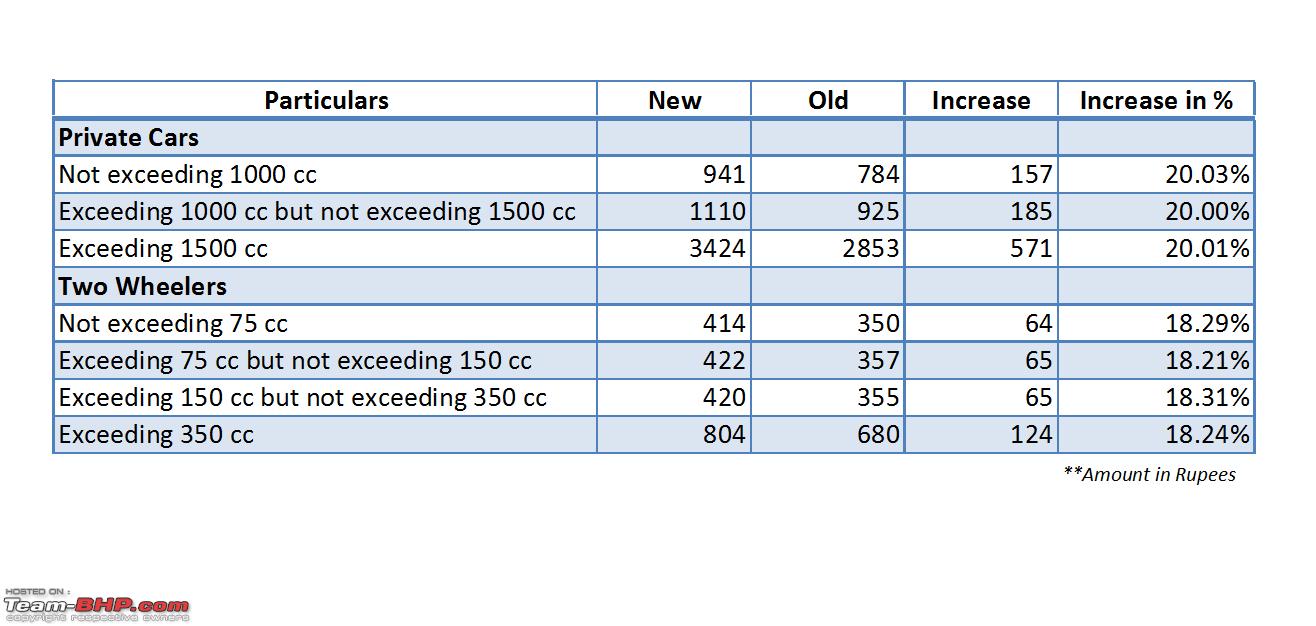

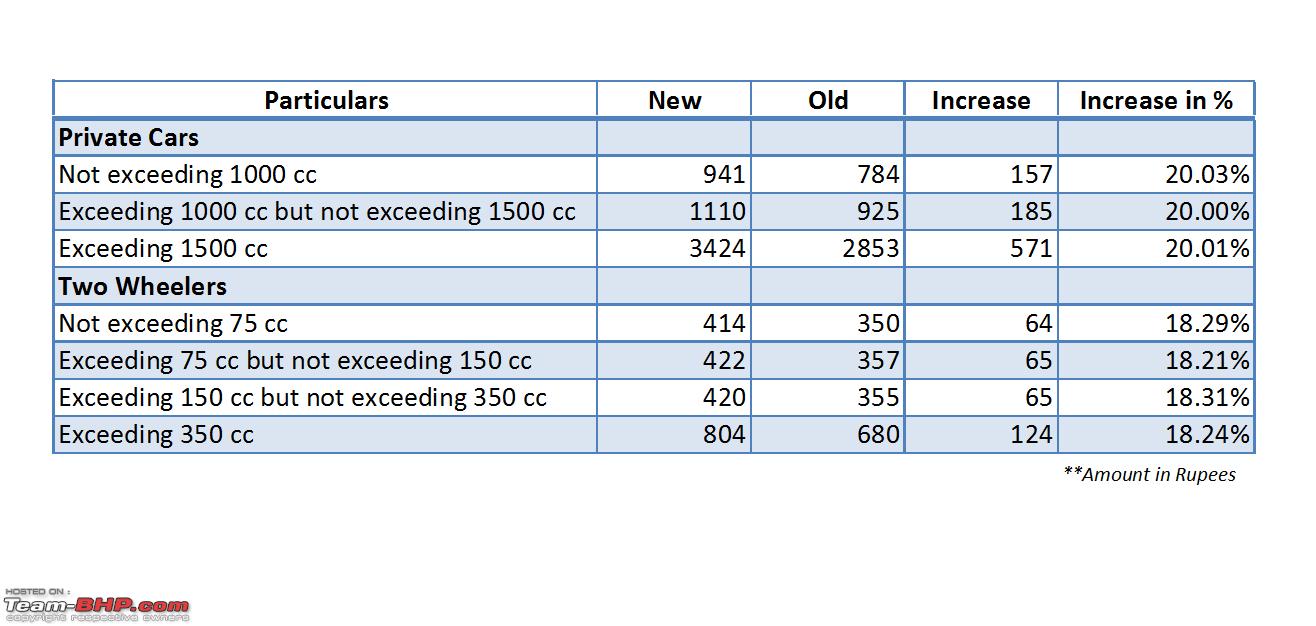

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Property Car Insurance | iSelect

What is third party insurance | Online insurance, Compare insurance

What is Third Party Insurance in 2020 | Third party, Insurance, Aadhar card

Third Party Car Insurance