Non Owner Car Insurance Cost

Non Owner Car Insurance Cost - What You Need to Know

What Is Non Owner Car Insurance?

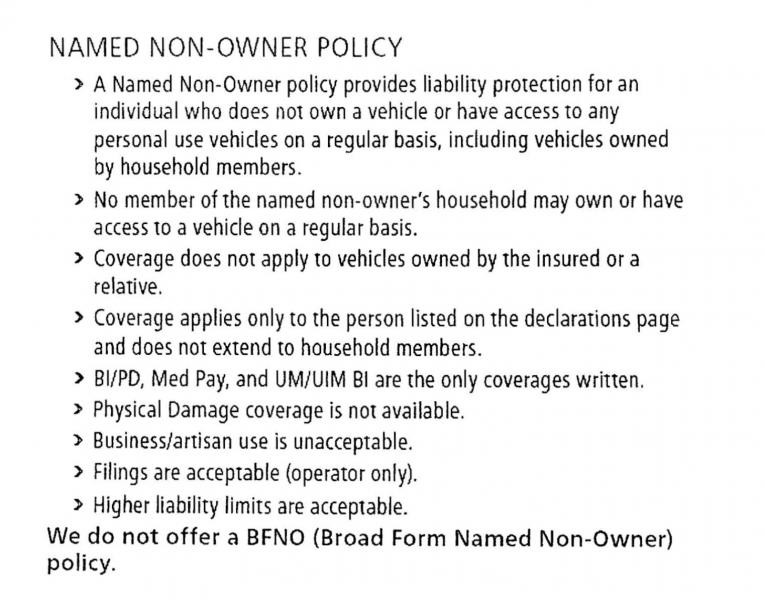

Non-owner car insurance is a type of auto policy that provides liability coverage for drivers who do not own a vehicle. It's normally used by people who have a license but don't own a car. It may also be used by people who need to meet a state's minimum liability requirements in order to get their license reinstated after a suspension. This type of policy does not provide physical damage coverage for the vehicle or any property that may be damaged in an accident. It only covers you for liability, meaning the cost of any damages or injuries you may cause to another person or property.

What Does Non Owner Car Insurance Cover?

Non-owner car insurance covers you for liability in the event that you are involved in an accident while driving someone else's car, or if you are renting a car and do not have a rental policy. It covers you in the event that you are sued for damages or injuries caused by an accident. It does not, however, provide physical damage coverage for the car or any property that may be damaged in an accident. This coverage is limited to liability only; it does not cover the cost of repairing or replacing the car or any other property that may be damaged in an accident.

How Much Does Non Owner Car Insurance Cost?

The cost of non-owner car insurance varies depending on a number of factors, including the type of coverage you select, the amount of coverage you need, and your driving record. Generally, non-owner car insurance is less expensive than a traditional car insurance policy because it does not cover physical damage. However, the cost of coverage will depend on the individual, so it's important to shop around and compare rates from different insurance companies.

Who Should Consider Getting Non Owner Car Insurance?

Non-owner car insurance is typically a good option for people who don't own a car but still need to meet a state's minimum liability requirements in order to get their license reinstated. It's also a good option for people who don't have access to a car but need to be able to drive someone else's car occasionally. Non-owner car insurance is not a good option for people who need physical damage coverage, as this type of policy does not cover the cost of repairs or replacement of the vehicle.

How Can I Get Non Owner Car Insurance?

The best way to get non-owner car insurance is to shop around and compare rates from different insurance companies. It's important to compare not only the cost of the policy, but also the coverage offered and the customer service of each company. It's also a good idea to read customer reviews to get an idea of how each company handles claims and customer service. Once you have found the policy that meets your needs, you can purchase it online or through an insurance agent.

Best Cheap Non-Owner Car Insurance - ValuePenguin

Best Cheap Non-Owner Car Insurance - ValuePenguin

If you don't have a car but drive someone else's, non-owner car

Non Owners Car Insurance Policy

Fascination About Cost Of Non-owner Sr-22 Insurance - Valuepenguin