Low Cost Sr22 Insurance Illinois

Thursday, August 1, 2024

Edit

Finding Low Cost Sr22 Insurance in Illinois

What Is SR22 Insurance?

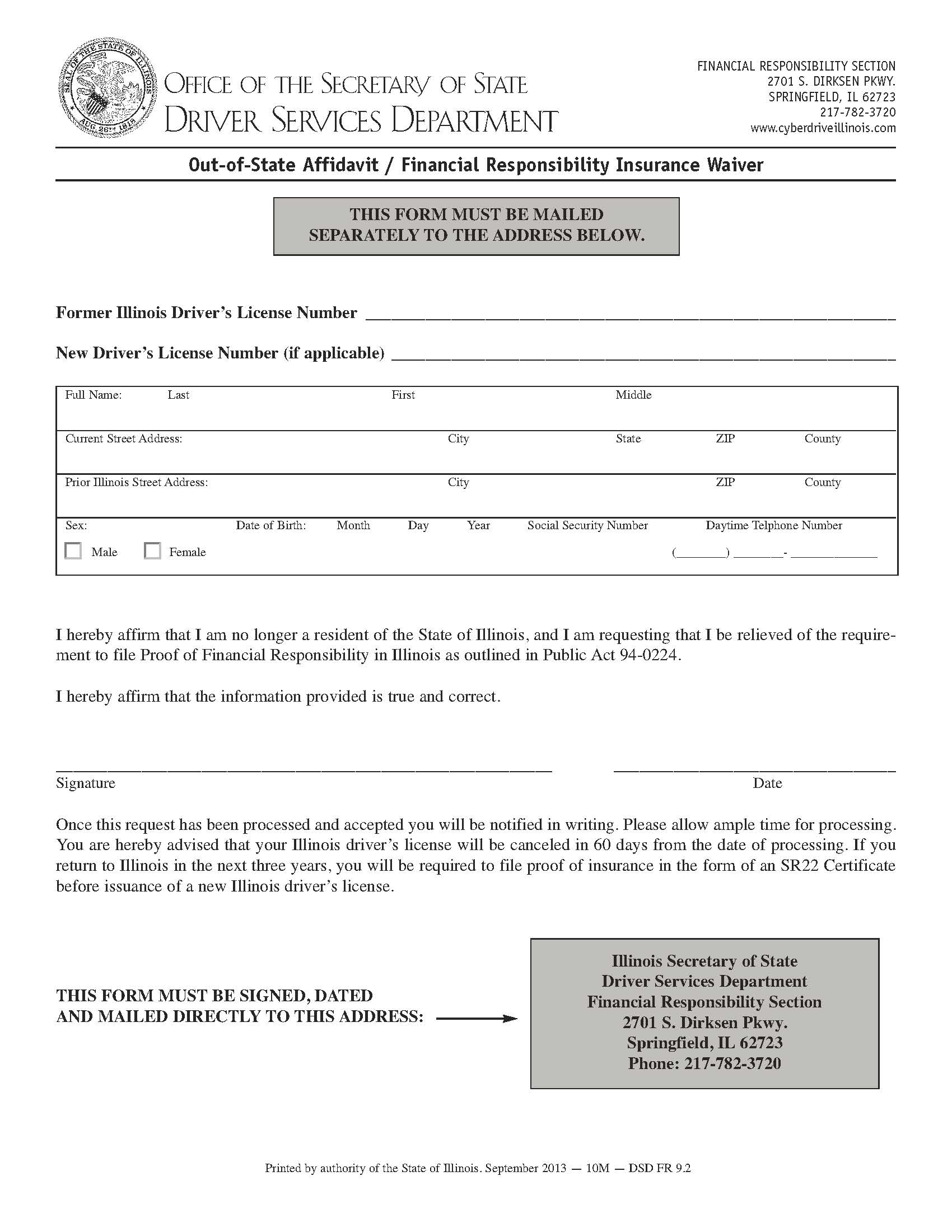

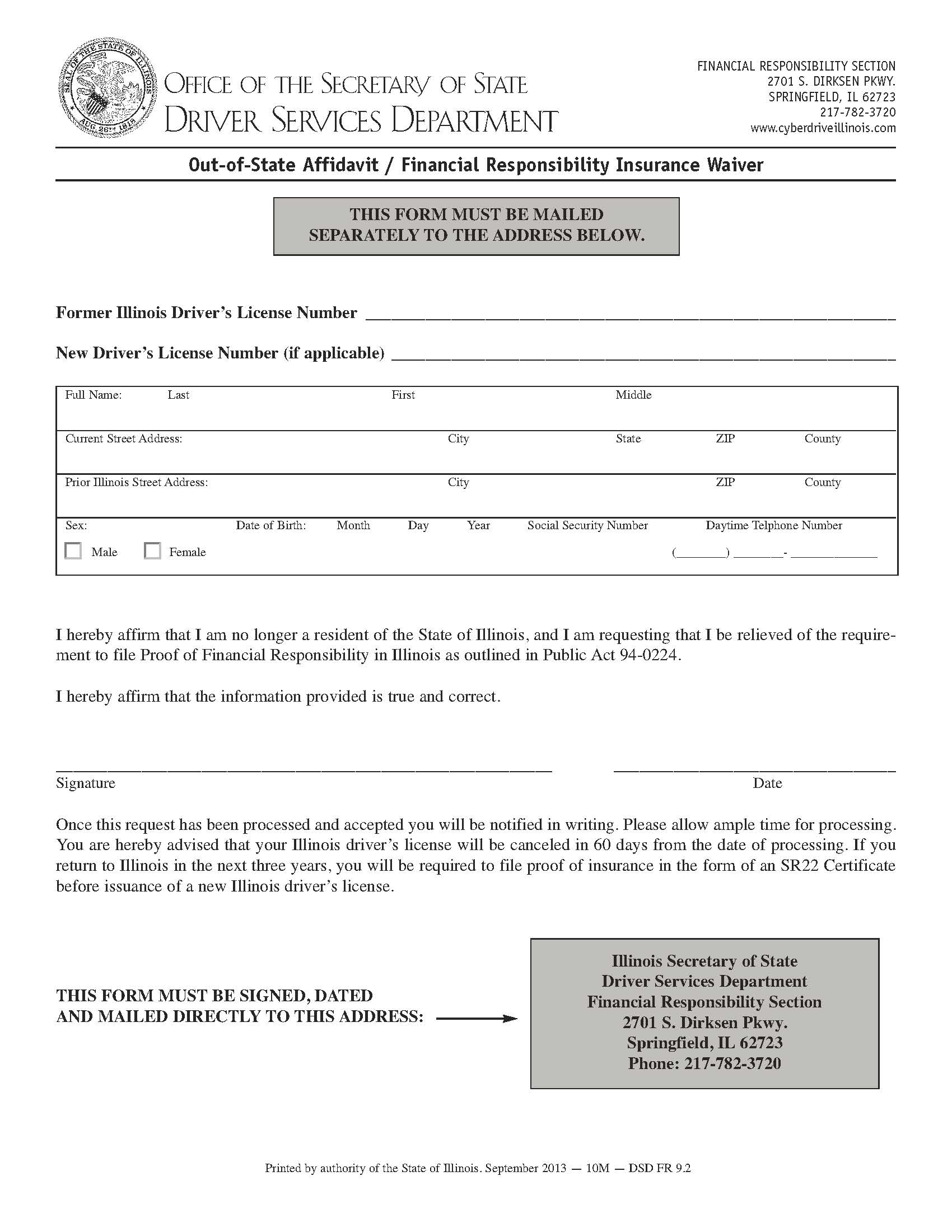

SR22 insurance is a type of car insurance required for people who have a DUI conviction or certain other traffic violations. It is legally required for most drivers in Illinois who have had their license suspended or revoked. SR22 insurance is a certificate of financial responsibility proving that a driver is carrying the state-mandated minimum amount of liability coverage. SR22 insurance must be purchased from an insurance company that is licensed to do business in Illinois and must be kept for three years.

Finding Low Cost SR22 Insurance in Illinois

Finding low cost SR22 insurance in Illinois can be a challenge. Insurance companies charge more for SR22 insurance because of the increased risk associated with drivers who have had their license suspended or revoked. It is important to shop around to find the best rate. Online comparison sites can be helpful in finding the best rate. Additionally, some insurance companies specialize in SR22 insurance and can provide discounted rates. It is important to compare multiple companies before making a decision.

Tips for Finding Low Cost SR22 Insurance in Illinois

There are some tips that can help drivers find low cost SR22 insurance in Illinois. The first tip is to maintain a clean driving record. A driver with a clean driving record is more likely to get a lower rate on SR22 insurance. The second tip is to look for discounts. Many insurance companies offer discounts for good driving, good grades, and other factors. The third tip is to look for companies that specialize in SR22 insurance. These companies usually offer lower rates than traditional insurance companies.

How to Get Low Cost SR22 Insurance in Illinois

To get low cost SR22 insurance in Illinois, drivers must first purchase a policy from an insurance company that is licensed to do business in the state. It is important to compare multiple companies before making a decision. Online comparison sites can be helpful in finding the best rate. Additionally, some insurance companies specialize in SR22 insurance and can provide discounted rates. Once a policy is purchased, the driver must submit an SR22 certificate of financial responsibility to the Secretary of State. This must be done within 30 days of the policy purchase.

Maintaining Low Cost SR22 Insurance in Illinois

Once a driver has purchased low cost SR22 insurance in Illinois, it is important to maintain the policy for the duration of the period required by the state. Most states require SR22 insurance to be kept for three years. If the policy is canceled or lapses during this time, the driver will have their license suspended or revoked. Additionally, it is important to keep up with payments as any missed payments can cause the policy to be canceled.

Conclusion

Low cost SR22 insurance in Illinois can be difficult to find but it is important to shop around and compare multiple companies to find the best rate. Additionally, it is important to maintain the policy for the duration of the period required by the state and keep up with payments to avoid any lapses in coverage. By following these tips, drivers can find the best rate on SR22 insurance in Illinois.

SR22 Auto Insurance Illinois, Cheap Chicago SR22 Insurance | American Auto

How Much Does SR22 Cost in Illinois

Illinois SR22 Insurance Quotes - YouTube

What Is SR22 Insurance and How Do You Get it? – Car News

Pin on SR22 Insurance Illinois