How To Insure A Learner Driver Cheap

How To Insure A Learner Driver Cheap

Introduction

Getting on the road can be a daunting experience for a new driver. With the cost of car insurance being one of the biggest financial obstacles, it is no wonder that many new drivers are looking for the cheapest way to insure their car. Unfortunately, finding cheap car insurance for learner drivers can be difficult. However, there are a few tips and tricks to help you get the best deal.

Shop Around

It is always important to shop around when looking for car insurance. There are many insurance companies out there, and they all offer different rates and policies. Comparing different policies can help you find the best deal for your needs. It is also important to compare different levels of coverage. For example, some policies may offer more coverage for a lower premium, while others may offer less coverage for a lower premium. Taking the time to compare different policies can help you find the best deal for your budget.

Increase Voluntary Excess

Voluntary excess is the amount of money that you agree to pay for any claim you make on your insurance policy. Increasing your voluntary excess can help to reduce the cost of your premium. However, it is important to make sure that you can afford to pay this amount if you make a claim. If you are not sure how much voluntary excess you should choose, you can speak to an insurance adviser to get more advice.

Choose A Low Insurance Group Car

When looking for car insurance, it is important to consider the insurance group of the car you are looking to insure. Insurance groups are used to determine the cost of car insurance, and cars in lower groups tend to be cheaper to insure. It is also important to consider the age and condition of the car. An older car with a higher mileage may be more expensive to insure than a newer car with a lower mileage.

Multi-Car Discounts

If you are looking to insure more than one car, many insurance companies offer multi-car discounts. These discounts can help to reduce the cost of insuring multiple cars, and can be a great way to save money. It is important to make sure you compare different policies before committing to a multi-car policy, as some may offer better discounts than others.

Black Box Insurance

Black box insurance is a type of insurance policy that uses a tracking device to monitor your driving. The device records things like speed, braking and cornering. This data is then used to determine your insurance premium. This type of insurance is generally cheaper for safe drivers, so it can be a great way to save money if you are a safe driver. However, it is important to make sure you understand how the policy works before committing to it.

Temporary Learner Driver Insurance | Cheap Learner Insurance | Tempcover

The Cheapest Way to Insure a Learner Driver | Bobatoo

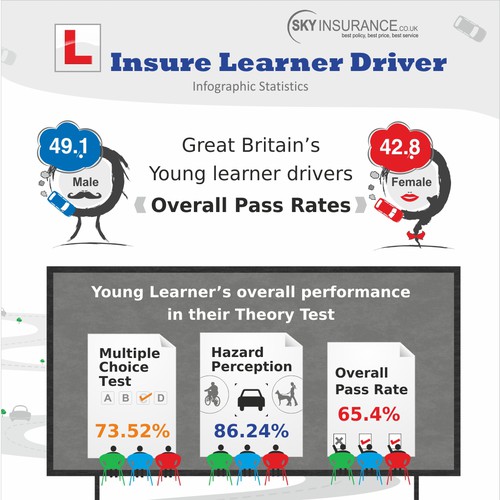

Create the next infographic for Sky Insurance - Insure Learner Driver

Learner Driver Insurance for Provisional Drivers | Dayinsure

The Ins and Outs of Learner Driver Car Insurance | totallymotor