How Much Does Root Car Insurance Cost

What Is Root Car Insurance?

Root Car Insurance is an innovative car insurance company that is revolutionizing the way people buy insurance. Root utilizes technology to enable customers to purchase auto insurance based on how they drive. Instead of a traditional policy, Root customers pay according to how they drive, with discounts based on their driving behavior. Root uses a mobile app to collect driving data and offer customized rates to its customers.

How Does Root Car Insurance Work?

Using the Root mobile app, customers are able to track and monitor their driving behavior in real-time. The app records data such as acceleration, braking, and speed, and generates a “Root Score” based on the customer’s driving. The Root Score is used to determine the customer’s insurance rate, as better drivers are rewarded with lower rates. Customers are able to monitor their driving and make changes to improve their Root Score and save money on their car insurance.

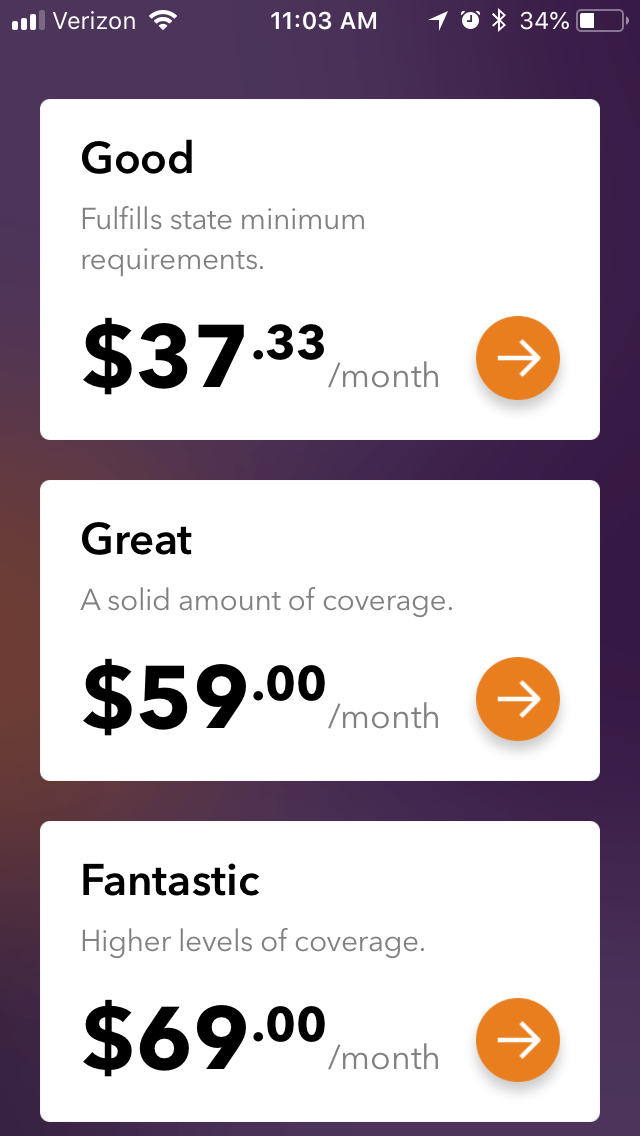

How Much Does Root Car Insurance Cost?

The cost of Root Car Insurance depends on a variety of factors, such as the customer’s driving behavior, location, and type of vehicle. Root calculates a personalized rate based on a customer’s Root Score and other factors. Generally, Root customers can expect to pay 10-30% less than the average car insurance rates in their state, but the exact rate depends on the customer’s individual situation.

Root Car Insurance Benefits

Root Car Insurance offers a variety of benefits for customers, such as discounts for good driving behavior, flexible payment options, and the ability to purchase additional coverage. Customers also have access to an online customer service portal where they can manage their policy and make payments. Additionally, Root customers are able to use the mobile app to track their driving, monitor their Root Score, and make changes to save money on their car insurance.

Should I Get Root Car Insurance?

Root Car Insurance is an innovative car insurance company that offers customers the ability to save money on their car insurance based on their driving behavior. Customers who are looking for a flexible and affordable car insurance option should consider Root Car Insurance. The mobile app allows customers to track their driving and make changes to save money on their car insurance, while the flexible payment options make it easy to manage the cost of their policy.

Conclusion

Root Car Insurance is an innovative car insurance company that is revolutionizing the way people buy insurance. Customers can save money on their car insurance by utilizing the Root mobile app to track their driving and generate a personalized Root Score. Root customers can expect to pay 10-30% less than the average car insurance rates in their state, and have access to a variety of benefits such as flexible payment options and discounts for good driving behavior. If you’re looking for a flexible and affordable car insurance option, Root Car Insurance is worth considering.

How Much Is Car Insurance? Average Car Insurance Cost 2020

Root Car Insurance 100% Recommended - How To Save Money On Car

Pin on lifestyle

Blog Archives - I TRIED ROOT CAR INSURANCE

20+ Root Car Insurance Quote - Best Day Quotes