Does A Named Driver Need Their Own Insurance

Does A Named Driver Need Their Own Insurance?

What Does 'Named Driver' Mean?

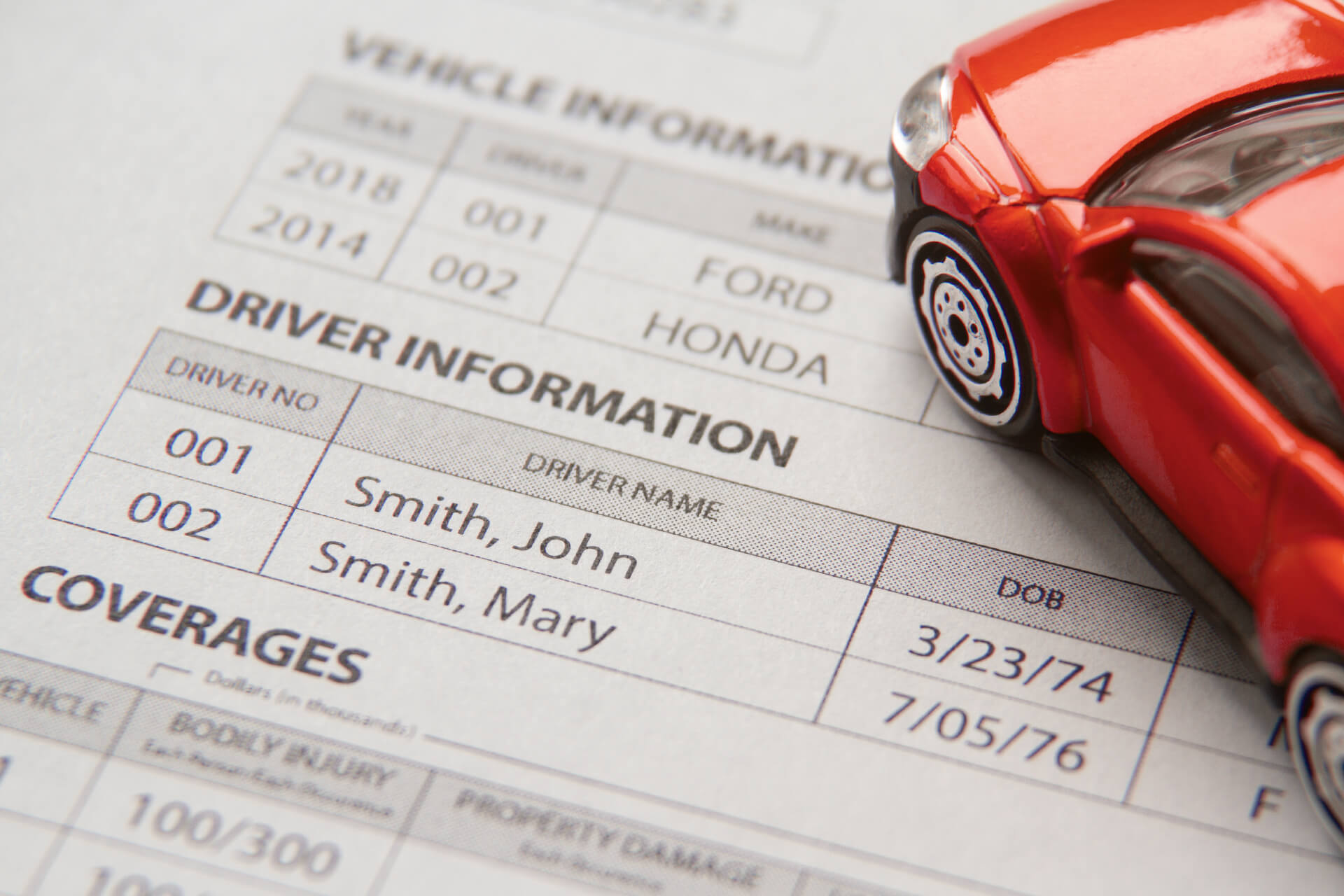

A named driver is a person who is allowed to drive a vehicle that is insured by another person. In most cases, the person who has taken out the insurance policy is the main driver of the vehicle, and the named driver is someone else who can legally drive the car.

A named driver can be a spouse, family member, or friend of the main driver. It is important to note that the named driver is not the owner of the vehicle, but a person who is allowed to drive it with the owner's permission.

Do Named Drivers Need Their Own Insurance?

The short answer is yes - a named driver needs their own insurance if they want to drive the vehicle regularly. This is because the main driver's insurance policy covers only them, and not the named driver.

If the named driver has an accident in the car, the main driver's insurance policy will not cover them. This means the named driver will have to pay for the damage out of their own pocket.

What Types of Insurance Are Available for Named Drivers?

Named drivers can take out their own insurance policy, just like the main driver. This is known as a named driver insurance policy. It is important to note that the policy will not cover the main driver, only the named driver.

The policy will usually include the same coverage as the main driver's policy, including liability, collision, and comprehensive coverage. The cost of the policy will depend on the type of coverage, the amount of coverage, and the named driver's driving record.

What Happens if a Named Driver Has an Accident?

If a named driver has an accident in the car, the main driver's insurance policy will not cover them. The named driver will be responsible for any damages they cause. They can either pay out of pocket or use their own insurance policy to cover the costs.

It is important to note that if the named driver has their own insurance policy, the insurer will take into account their driving record when determining the cost of the policy. This means that if the named driver has a poor driving record, the policy will be more expensive.

Do I Need to Inform My Insurer If I Add a Named Driver?

Yes - it is important to inform your insurer if you add a named driver to your policy. This is because the insurer needs to know the details of the named driver, such as their driving record, in order to determine the cost of the policy.

If you do not inform your insurer that you have added a named driver, they may not pay out if the named driver has an accident. This could leave you with a large bill that you will have to pay out of pocket.

Conclusion

In conclusion, a named driver needs their own insurance if they want to drive the vehicle regularly. This is because the main driver's insurance policy will not cover them in the event of an accident. It is important to inform your insurer if you add a named driver to your policy, as this will affect the cost of the policy.

Named driver car insurance in Singapore

What is Named Driver Experience, And How Do I Get It?

What does it mean to be a 'named driver' on a policy? | Churchill

Page for individual images • Quoteinspector.com

10 Ways to Avoid Invalidating Your Car Insurance - Number 8 | Regit