Best Insurance For Tesla Model Y

Friday, August 23, 2024

Edit

Best Insurance for Tesla Model Y

What is Tesla Model Y?

The Tesla Model Y is an all-electric mid-size luxury crossover SUV made by Tesla, Inc. It was unveiled in March 2019 and first deliveries started in March 2020. The Model Y is an all-electric five-seater with two optional third-row seats, offering seven-passenger seating capacity. It has a range of up to 300 miles and a top speed of 150 mph. The Model Y is available in three variants, the Long Range, Performance, and Standard Range. All variants feature dual electric motors and all-wheel drive.

Why is Insurance for Tesla Model Y Important?

Insurance for Tesla Model Y is important because the cost of repairing or replacing a Tesla can be very expensive. Tesla's are equipped with the latest and greatest technology, and the cost of repairs or replacing any of these features can be very high. Insurance helps to protect you from these expensive repairs or replacement costs.

Insurance also helps to protect you from any liability that may occur while you're driving your Tesla Model Y. Liability can occur if you cause an accident or injury to someone else. Insurance can help protect you from these costs as well.

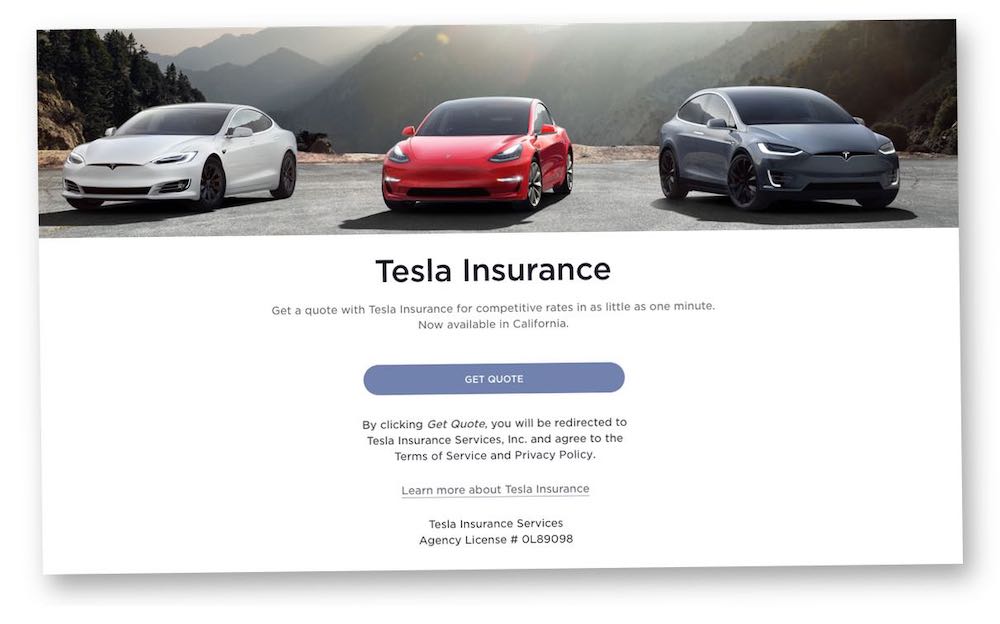

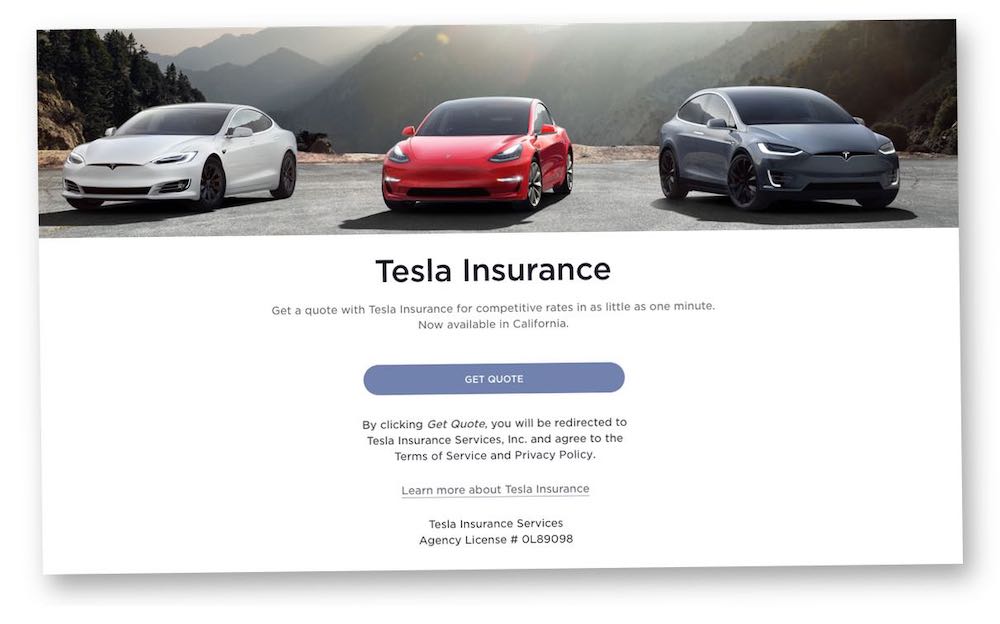

What Are the Best Insurance Options for Tesla Model Y?

There are several insurance providers that offer insurance for the Tesla Model Y. Each provider offers different coverage options, so it is important to compare different providers to find the best coverage for your needs.

One of the best options for Tesla Model Y insurance is Liberty Mutual. Liberty Mutual offers several coverage options including comprehensive and collision coverage, liability coverage, and roadside assistance. They also offer discounts for being a safe driver and for bundling multiple policies.

Geico is another great option for Tesla Model Y insurance. Geico offers comprehensive coverage, liability coverage, and roadside assistance. They also offer discounts for being a safe driver and for bundling multiple policies.

Progressive is another great option for Tesla Model Y insurance. Progressive offers comprehensive coverage, liability coverage, and roadside assistance. They also offer discounts for being a safe driver and for bundling multiple policies.

What Factors Impact the Cost of Insurance for Tesla Model Y?

The cost of insurance for Tesla Model Y is impacted by several factors. These factors include the make, model, and year of the vehicle, the age and driving history of the driver, and the location where the vehicle will be driven. Additionally, insurance companies often offer discounts for bundling multiple policies, being a safe driver, and installing safety features on the vehicle.

The cost of insurance for the Tesla Model Y also varies by the type of coverage selected. Comprehensive and collision coverage typically have higher premiums than liability coverage. Additionally, some insurance companies may offer discounts for installing safety features on the vehicle such as anti-theft devices, blind spot monitoring, and automatic emergency braking.

How Can I Compare Insurance Rates for Tesla Model Y?

The best way to compare insurance rates for Tesla Model Y is to use an online comparison tool. These tools allow you to compare insurance rates from multiple providers in one place. Additionally, they can provide information on discounts available from each provider.

When comparing insurance rates, it is important to consider both the type of coverage offered and the cost of the policy. It is also important to read the policy carefully to ensure that all coverage needs are met. Additionally, it is important to compare the cost of the policy with the coverage offered.

Conclusion

Insurance for Tesla Model Y is important to protect yourself from expensive repairs and liability costs. There are several insurance providers that offer insurance for Tesla Model Y, and it is important to compare their coverage and costs to find the best option for your needs. The cost of insurance for Tesla Model Y is impacted by several factors, including the make, model, and year of the vehicle, the age and driving history of the driver, and the location where the vehicle will be driven. Comparing insurance rates using an online comparison tool is the best way to find the best coverage for your needs.

Tesla In-house Insurance Review vs 3 next-gen competitors (Updated

Tesla Model 3 Insurance Cost - Best Tesla Car Insurance Cost To Insure

Why Is Tesla Selling Insurance and What Does It Mean for Drivers? - Worth

Can Tesla Really Deliver On Its Promise Of Cheaper Car Insurance?

Best Auto Insurance For Tesla Model 3 - Khatoon Dehwar