Bajaj Allianz Third Party Car Insurance Price

Bajaj Allianz Third Party Car Insurance Price

What is Third-Party Car Insurance?

Third-party car insurance is a type of insurance that provides protection against a third-party’s legal liability arising from an accident in which a third-party was injured or suffered property damage. In other words, this type of insurance covers the insured person in the event of a third-party’s legal liability arising from an accident. This type of insurance is usually taken out when the car is used for commercial purposes or when the car is used to transport goods or passengers. It is also taken out when the car is leased or rented.

Benefits of Third-Party Car Insurance

Third-party car insurance is beneficial in many ways. It provides financial protection against legal liability arising out of an accident. It covers the costs of any damage or loss to the third-party’s property or person. In case of death or injury to the third-party, the insurance company pays for the medical costs. This type of insurance also covers the costs of legal defense if the insured person is sued by the third-party.

Why Bajaj Allianz Third Party Car Insurance?

Bajaj Allianz offers a comprehensive third-party car insurance policy that covers a wide range of risks. It provides coverage for legal liabilities arising out of accidents, damages to the third-party’s property, and death or injury to the third-party. The policy also provides coverage for medical expenses of the third-party. Additionally, the policy also covers legal defense costs in case of a lawsuit filed against the insured. It is also available with a number of add-on covers such as personal accident cover, engine protection cover, and zero depreciation cover. The policy also offers a number of discount options such as no claim bonus, multi-policy discount, and loyalty discount.

The Cost of Bajaj Allianz Third-Party Car Insurance

The cost of Bajaj Allianz Third-Party Car Insurance depends on a number of factors such as the type of vehicle, its age, its use (commercial or personal), the driver’s age, and the driver’s driving history. Generally, the cost of third-party car insurance is lower than comprehensive car insurance as it does not provide any coverage for the insured vehicle or its occupants. The third-party car insurance premium is decided by the insurance company after evaluating the risk involved. The premium can be further reduced by opting for a higher deductable and availing of the various discounts offered.

Conclusion

Bajaj Allianz Third-Party Car Insurance is an ideal option for individuals who are looking for a cost-effective way to insure their vehicles. It provides financial protection against legal liabilities arising out of accidents, damage to the third-party’s property, and death or injury to the third-party. The policy also offers a number of add-on covers and discounts that can be availed to further reduce the cost of the premium. It is important to compare policies from different insurance companies to find the best deal.

how to Motor third party Insurance in Bajaj Allianz General Insurance

Bajaj Allianz Car Insurance - Comparison, Reviews & Features

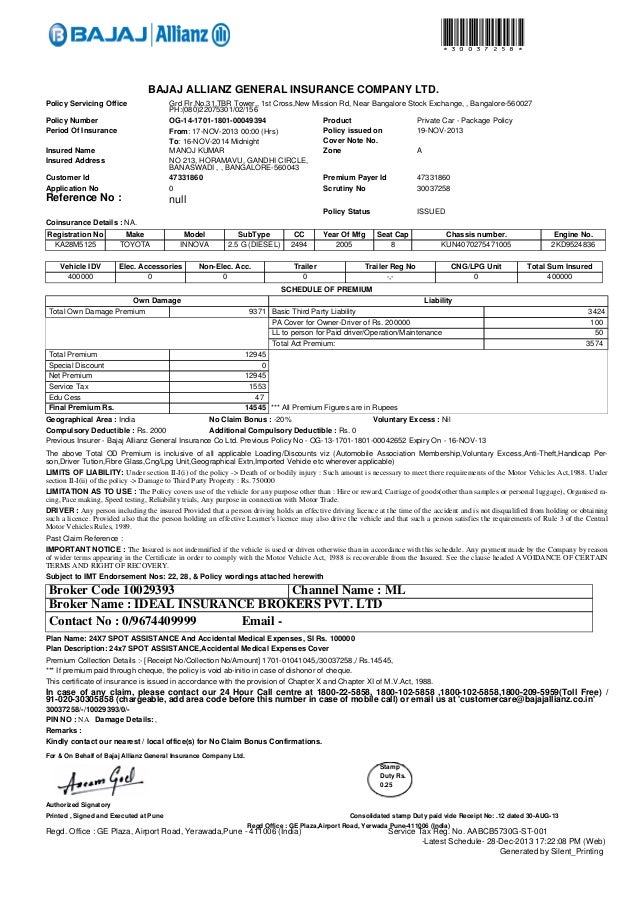

Og 14-1701-1801-00049394 (1)

Bajaj Allianz Recruitment Drive 2020 - Jobs4fresher.com - Latest Jobs

Bajaj Allianz launches weather-based crop insurance